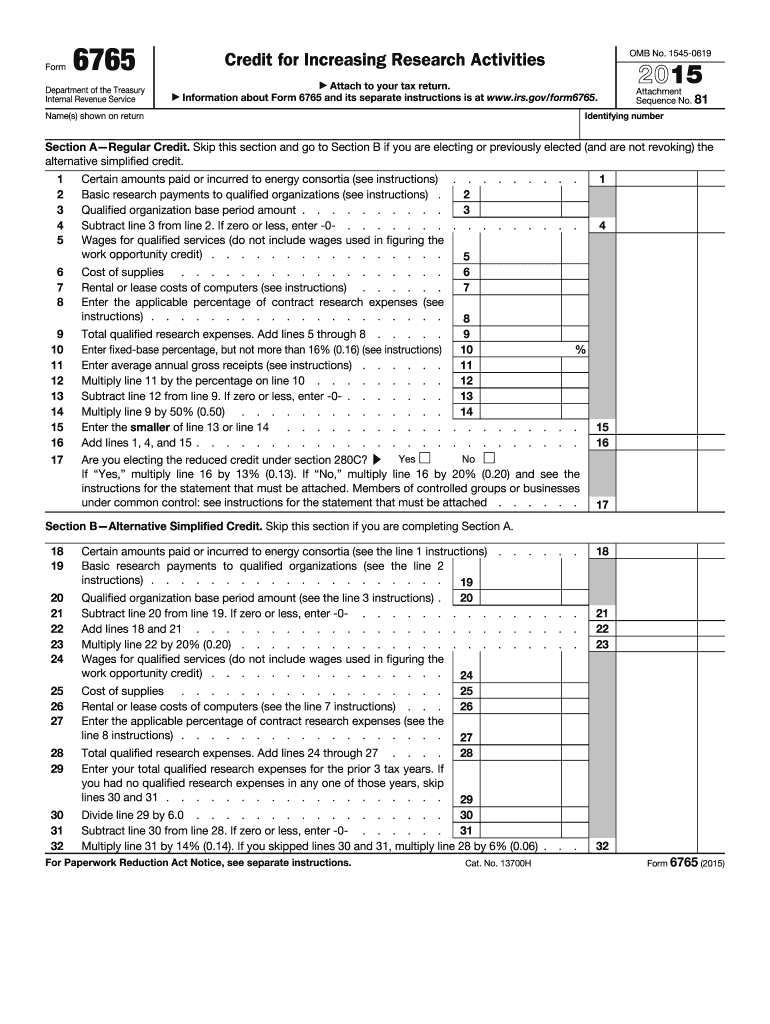

Definition & Meaning of the 2015 Form 6765

The 2015 Form 6765, officially known as the "Credit for Increasing Research Activities," is a crucial document provided by the Internal Revenue Service (IRS). It is used by businesses to claim tax credits for qualified research expenses, which include costs incurred in the pursuit of new or improved business components—products, processes, techniques, formulas, or inventions. The purpose of the form is to foster innovation and economic growth by providing financial relief to those engaging in research and development (R&D) activities.

Steps to Complete the 2015 Form 6765

Completing the 2015 Form 6765 requires careful attention to detail and an understanding of eligible expenses and credits. Follow these steps for accurate submission:

- Begin by compiling all documentation related to your research activities, including expenditure records and project descriptions.

- Enter all relevant taxpayer information, ensuring accuracy in details like names and identification numbers.

- Calculate the Regular Research Credit by detailing qualified research expenses from current and previous years.

- Alternatively, compute the Alternative Simplified Credit if it results in a more favorable outcome.

- Verify and double-check all figures to confirm their accuracy.

- Attach the completed Form 6765 to your corporate tax return before the submission deadline.

Key Elements of the 2015 Form 6765

- Qualified Research Expenses (QREs): These include wages, supplies, and contract research costs directly related to research activities.

- Regular Credit Calculation: This section involves a complex formula based on the fixed-base percentage and annual gross receipts.

- Alternative Simplified Credit (ASC): A simplified method that allows taxpayers to calculate their research credit, requiring less historical data.

Eligibility Criteria for Using the 2015 Form 6765

Businesses must meet specific criteria to be eligible for the research credit via Form 6765:

- Engagement in Qualified Research: Activities must aim to advance technological development through systematic experimentation.

- Use of Principles of Hard Sciences: Research should involve credible scientific methods or engineering principles.

- Exclusion of General Business or Commercial Activities: Routine data collection and market testing do not qualify.

IRS Guidelines on the 2015 Form 6765

The IRS provides detailed guidelines outlining what constitutes qualified research activities:

- Technological in Nature: Activities must rely on hard sciences like engineering or biology.

- Targeting New or Improved Functions: Projects should aim to enhance performance, reliability, or quality.

- Documentation: Rigorously documented processes substantiating each stage of research are essential.

Who Typically Uses the 2015 Form 6765

Form 6765 is primarily utilized by businesses engaged in R&D, regardless of size, intending to reduce taxable income through federal tax credits. Typical users include:

- Technology Firms: Innovating new software or hardware.

- Manufacturing Companies: Developing new production methodologies.

- Pharmaceutical Enterprises: Engaging in drug and medical research.

Software Compatibility for Filing the 2015 Form 6765

Modern tax preparation software such as TurboTax and QuickBooks supports the integration and filing of Form 6765, ensuring:

- Ease of Calculation: Automatic computation of credits minimizes errors.

- Data Importing: Seamless import of financial records for accurate entries.

- Built-in Compliance Checks: Alerts for missing or contradictory information improve submission accuracy.

Examples of Using the 2015 Form 6765

Real-world examples demonstrate the diverse applications of Form 6765:

- Tech Startup: A company developing a new app claimed R&D credits for prototype development expenses.

- Biotech Laboratory: Enlisted the alternative simplified credit while researching a groundbreaking diagnostic tool.

- Manufacturing Innovator: Received credits for optimizing a new assembly line approach boosting efficiency.

Incorporating detailed documentation and adhering to IRS guidelines can optimize the benefits gained from the 2015 Form 6765, providing significant tax relief for qualifying businesses.