Understanding Form 6765: Credit for Increasing Research Activities

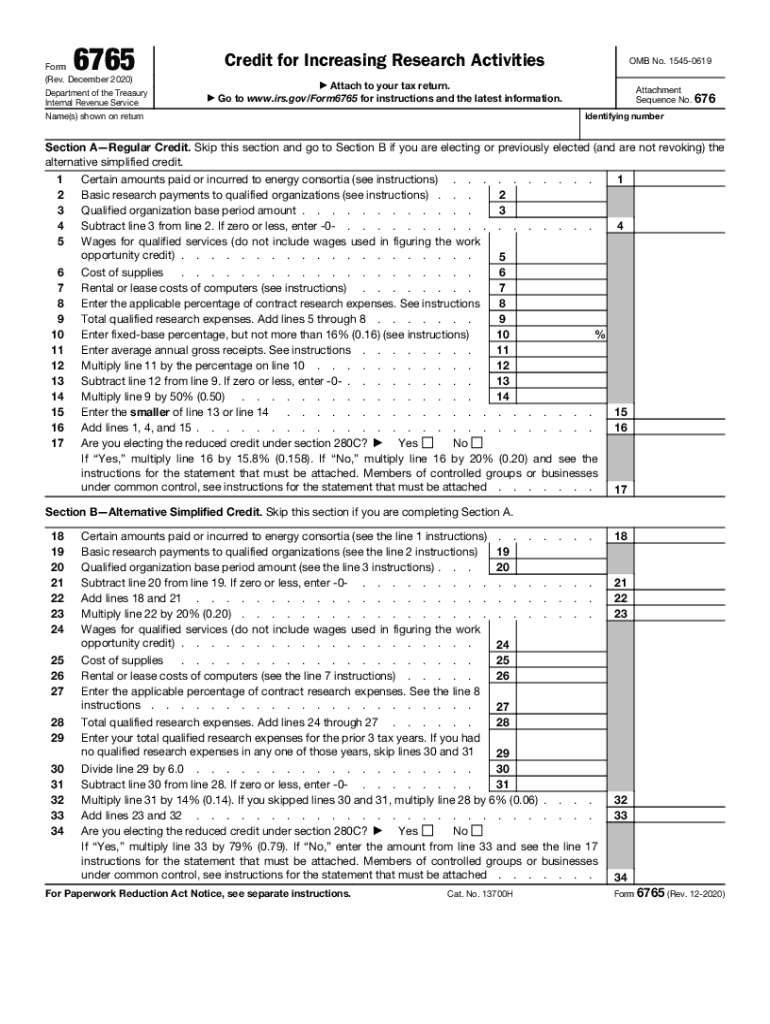

Form 6765, issued by the Internal Revenue Service, is essential for businesses seeking to claim the Credit for Increasing Research Activities. It serves as a means to calculate and apply for tax credits associated with research and development (R&D) expenses. This form is divided into two main calculation sections: the Regular Credit and the Alternative Simplified Credit. Understanding the specifics of each section and how they apply to your business is crucial for accurately completing the form and maximizing potential tax benefits.

Steps to Complete Form 6765

Filling out Form 6765 involves a series of precise steps that ensure correct calculation and application of the research credit. First, gather all necessary financial documentation related to your research expenditures, including qualified research expenses and gross receipts. Section A of the form is designated for calculating the Regular Credit, where you'll input figures such as qualified research expenses and average annual gross receipts. Section B, the Alternative Simplified Credit, offers a different approach, applying various percentages to expenses from eligible years. Pay close attention to instructions regarding which section to use based on your unique criteria.

Acquiring Form 6765 and Submission Methods

Obtaining Form 6765 can be done directly through the IRS website, where it is available as a PDF download. The form can be completed digitally or printed for manual completion. Submission options vary: you can file it as part of your annual income tax return package either electronically or via mail. If you choose electronic submission, it may be advantageous to use IRS-approved tax software like TurboTax or QuickBooks, which often include enhanced features for form handling and submission tracking.

IRS Guidelines and Important Deadlines

The IRS provides detailed guidelines on completing and filing Form 6765. It is important to adhere to these instructions to avoid filing errors that could delay the processing of your credit. Be mindful of annual tax filing deadlines, as Form 6765 is submitted along with your regular tax return. Missing the filing deadline could result in the loss of potentially substantial tax credits. Always check for updates to IRS guidelines, as requirements and deadlines may change annually.

Who Typically Uses Form 6765

Form 6765 is predominately used by businesses, particularly those heavily investing in R&D activities. This encompasses a wide range of industries, from pharmaceuticals to technology firms, that meet specific eligibility criteria regarding research expenditures. Companies must verify that their research activities align with the IRS's four-part test, which examines factors like permitted purpose and elimination of uncertainty. Understanding which business actions qualify is essential to determine the applicability of Form 6765 to your situation.

Key Elements of Form 6765

Form 6765 consists of critical elements that require careful attention. Key areas include:

-

Qualified Research Expenses (QREs): Central to the credit calculation, these expenses must directly tie to business research activities.

-

Research Credit Calculation: Different methodologies apply, including the fixed-base percentage for the Regular Credit and a simpler calculation for the Alternative Simplified Credit.

-

Payroll Tax Credit Election: Small businesses may elect to apply a portion of their research credit against their payroll tax liability instead of income tax, adding valuable flexibility.

Important Terms and Compliance Requirements

Several terms and compliance requirements are pivotal when dealing with Form 6765, including:

-

Qualified Research: Must meet IRS-defined criteria that encompass activities involving hard sciences.

-

Base Amount: Refers to a specific period's expenditure that assists in calculating the credit.

-

Tax Compliance: Regular audit trails and supporting documentation are imperative to substantiate claims.

Businesses should maintain comprehensive records to support their claims, understanding that the IRS may require proof of compliance during audits or reviews.

Real-World Examples and Practical Scenarios

Consider a technology startup investing heavily in developing new software. This company can leverage Form 6765 to reduce taxable income by effectively translating successful research efforts into monetary credit. Similarly, a pharmaceutical company working on drug innovation can use this form to claim credits for clinical trial expenses. Thus, ensuring eligibility through the IRS's four-part test and maintaining accurate documentation is crucial.

Software Compatibility and Integration

Using compatible software such as TurboTax or QuickBooks enhances the process of completing Form 6765. These tools simplify the entry and calculation of complex data, automate tax form updates as per the latest IRS guidelines, and ensure error-free submission. Moreover, they provide seamless integration with accounting systems, making it easier to track and manage R&D activities and expenses.

By comprehending the intricate details of Form 6765, businesses can effectively leverage potential R&D tax credits, providing substantial financial benefits and encouraging ongoing innovation within their operations.