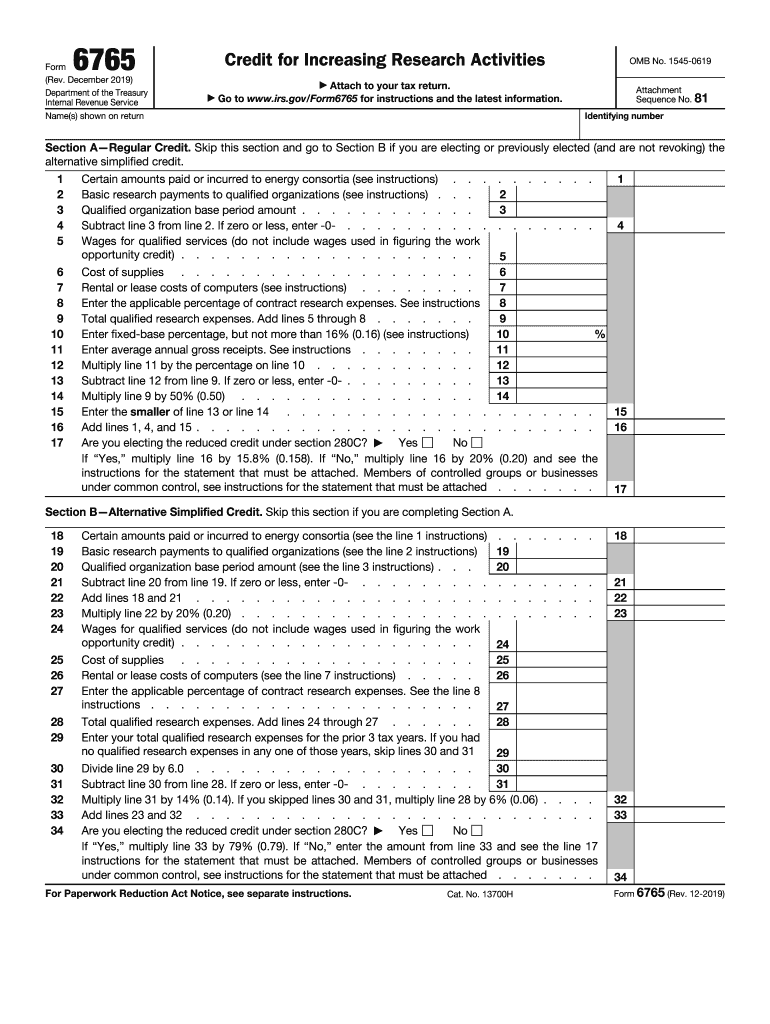

Definition and Purpose of IRS Tax Form 6765

IRS Tax Form 6765 is utilized by businesses to apply for the Credit for Increasing Research Activities, commonly known as the Research and Development (R&D) Tax Credit. This form provides a financial incentive for companies engaging in eligible research activities, encouraging innovation and technological advancement within the United States. The primary focus is on acknowledging and supporting extensive research efforts through tax credits, helping companies offset the expenses associated with qualifying research and development.

Sections of Form 6765

-

Section A: Regular Credit

This section involves calculating the traditional R&D credit using a fixed-base percentage and gross receipts. Companies must identify their qualified research expenses, including in-house research wages and supply costs, over a defined period. -

Section B: Alternative Simplified Credit (ASC)

The ASC offers an alternative method to calculate the credit, designed for businesses that may not qualify under the traditional method. It simplifies the calculation by using a percentage of prior-year research expenses, enabling more companies to access the tax credit.

How to Obtain IRS Tax Form 6765

Businesses can acquire Form 6765 through various channels. It is accessible on the official IRS website, where it can be downloaded and printed. Additionally, tax preparation software often includes this form, allowing businesses to fill it out digitally. Obtaining the form does not incur any charges, as the IRS provides it as part of public tax resources. For those using professional accounting services, accountants usually handle all necessary documentation and form completion.

Electronic Access

- Official IRS Website: Navigate to the Forms and Publications section to find downloadable PDF versions.

- Tax Software: Integral in platforms like TurboTax and QuickBooks, facilitating seamless digital submission.

Steps to Complete IRS Tax Form 6765

Completing Form 6765 requires precise documentation of research expenses and adherence to IRS instructions. Below is a structured approach to efficiently fill out the form:

-

Gather Relevant Financial Documents

Collect all financial records related to research expenses, including payroll records and invoices for supplies and contract research. -

Calculate Qualified Research Expenses (QREs)

Identify eligible expenses, covering wages, supplies, and contract research costs associated with qualified research activities. -

Determine the Calculation Method

Choose between the Regular Credit method and the Alternative Simplified Credit, based on which provides a higher or more accessible credit. -

Fill Out Section A or B

Enter data into the appropriate section. Ensure accuracy in figures and adherence to specified percentages for your selected method. -

Complete the Form

Double-check all entries, ensuring that calculations align with supporting documents. Accuracy is crucial to avoid discrepancies during IRS reviews. -

Attach Supporting Documentation

Provide detailed records and explanations as required. Documentation supports the figures and claims made, easing audit processes if flagged. -

Submit the Form

File with your business tax return by attaching Form 6765 to Form 1040, 1040-SR, or 1120, depending on the business structure.

Who Typically Uses IRS Tax Form 6765

Form 6765 is primarily used by businesses involved in research and development operations. It spans various sectors, including technology, pharmaceuticals, engineering, and manufacturing. Both large corporations and eligible small businesses—such as LLCs, C-corporations, and partnerships—stand to benefit significantly from this credit, as it helps to reduce the financial burden of innovation-driven expenditures.

Key Users

- Corporations and LLCs: Major entities within the tech and manufacturing industries often have substantial qualifying R&D activities.

- Small and Medium Enterprises (SMEs): These businesses, eager to innovate but with tighter budgets, find substantial relief through the credit.

Important Terms Related to IRS Tax Form 6765

Understanding relevant terminology is vital for correctly completing the form and maximizing potential benefits:

- Qualified Research Expenses (QREs): Costs directly tied to research activities that meet IRS criteria.

- Base Amount: A historical threshold calculated as a percentage of a company’s average annual gross receipts.

- Fixed-Base Percentage: A historical percentage used in the Regular Credit method, drawn from previous years’ research intensity.

- Credit for Increasing Research Activities: The formal title of the R&D tax credit, reinforcing its role in promoting economic research investment.

Definitions Explained

- In-house Research: Development conducted within corporate resources versus outsourced.

- Contract Research: Externally commissioned R&D paid to independent contractors or third-party organizations.

Filing Deadlines and Important Dates

Timely filing is crucial to ensure eligibility for the tax credit:

- Fiscal Year-End: Aligns with your tax return, generally March 15 for corporations or April 15 for sole proprietorships and LLCs.

- Extensions: Possible through standard IRS extension requests, applicable to both individual and corporate tax returns.

- Amendments: Amend a prior return using Form 6765, typically within three years of the original filing date, to retroactively claim missed credits.

Legal Use of IRS Tax Form 6765

Compliance with regulations and understanding the legal application of Form 6765 is vital. The IRS has set clear guidelines and requirements to determine eligibility for credits, ensuring companies adhere to tax code provisions while claiming the credit. The form underpins lawful claims to the R&D credit, a crucial process for businesses engaged in innovation-driven activities.

Compliance Guidelines

- IRS Documentation: Maintain rigorous records to support credit applications.

- Audit Preparedness: Ensure that all claims can withstand IRS scrutiny, given audits are a common occurrence for credit claims.

Tax Law Alignment

- ESIGN Act Compliance: All electronically submitted forms must adhere to legal standards to uphold electronic signature validity.

Examples of Using IRS Tax Form 6765

Illustrating practical examples can elucidate the application of Form 6765:

- Tech Start-up: A new software company develops an advanced algorithm, incurring expenses on development staff wages and software supplies, claiming these as QREs under ASC.

- Biotech Firm: Investing in laboratory research to create a new medication, applying wages of research scientists and lab supplies toward the credit using the Regular Credit method.

- Manufacturing Entity: Innovating a new production process, leveraging contract engineering services as part of its QRE calculations, fitting the Form 6765 framework.

These case studies demonstrate the broad applicability of the form across varied industries, underlining its role in bolstering U.S. business innovation endeavors.