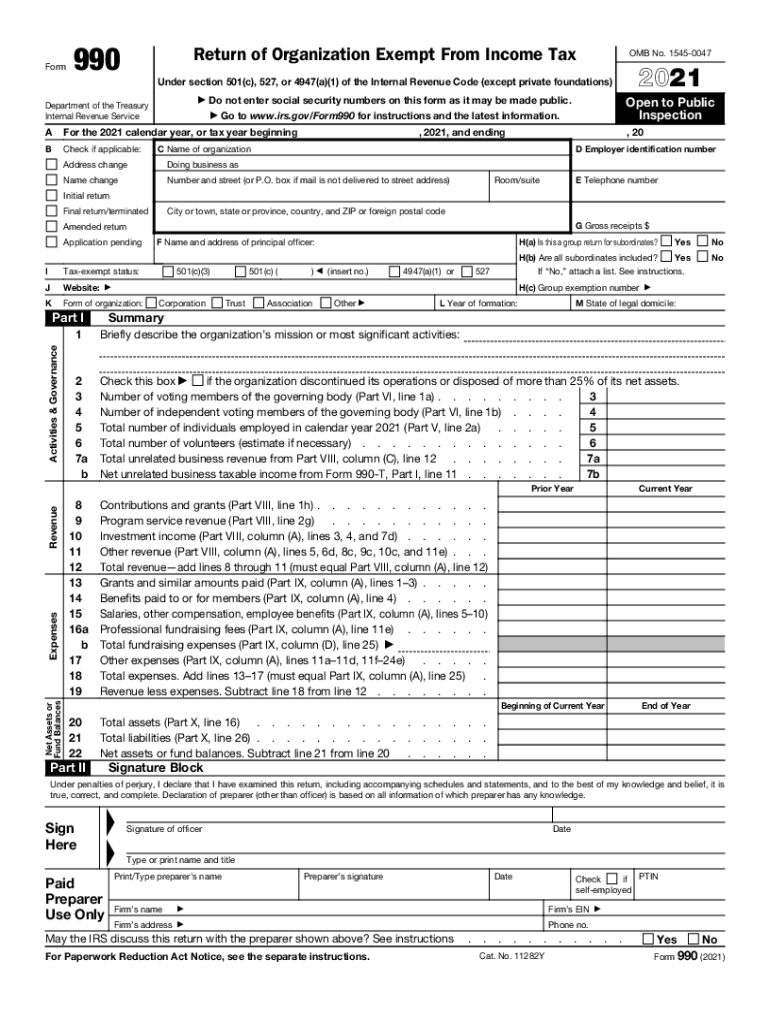

Understanding Form 990

Form 990 is an informational tax return required in the United States for certain exempt organizations. It provides detailed insights into the financial health and operations of entities under sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. Organizations report on their revenue, expenses, net assets, and governance policies to maintain transparency and comply with IRS regulations. Understanding this form helps in assessing an organization's adherence to tax exemption eligibility criteria.

Importance and Utility of Form 990

Organizations must file Form 990 to maintain tax-exempt status and demonstrate fiscal responsibility. It is essential for public transparency, as stakeholders, including donors and regulators, use this form to assess an organization's financial health and operational integrity. The form discloses valuable details, like executive compensation and program accomplishments, which can influence public perception and trust.

How to Obtain Form 990

To obtain Form 990, organizations can access it through the IRS's official website, where it is available for download as a PDF. Additionally, tax software programs may provide integrated access to the form, streamlining the filing process. Some organizations also maintain archived forms on their websites for internal records or public access.

Steps to Complete Form 990

- Gather Required Information: Collect financial statements, governance policies, and operational data from the past fiscal year.

- Fill Out Part I: Provide a summary of the organization's key financials, activities, and net assets.

- Detail Revenue and Expenses: Complete Sections VIII and IX to reflect detailed income and expenditure reports.

- Report Governance: Disclose board member details, policies, and management practices in Section VI.

- Additional Schedules: Attach any necessary schedules based on the nature of the organization's activities.

- Review and Submit: Conduct a thorough audit of the completed form for accuracy before filing electronically or via mail.

Key Elements of Form 990

-

Revenue Reporting: Capture all forms of income, distinguishing between contributions, grants, program service revenue, and investment income.

-

Expense Categorization: Track operational costs, including program services, management, and fundraising expenses, to promote fiscal transparency.

-

Governance Disclosure: Outline the governance structure, including board members, key policies, and disclosure practices, to comply with IRS scrutiny.

-

Program Service Accomplishments: Document the major achievements and services offered by the organization to validate its mission fulfillment.

IRS Guidelines for Form 990

The IRS publishes comprehensive instructions detailing how to file Form 990, including definitions of terms, line-by-line guidelines, and explanations for each section. These instructions help organizations accurately complete the form, ensuring compliance with federal laws. Staying updated with IRS changes is crucial for correctly filing each year.

Filing Deadlines and Important Dates

Form 990 is due on the 15th day of the fifth month after the end of an organization's fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15. Extensions can be requested if more time is needed to file, but they must be submitted before this deadline.

Penalties for Non-Compliance

Failing to file Form 990 or filing an incomplete form can lead to significant penalties. Organizations may be charged daily fines until compliance is achieved, potentially losing tax-exempt status for persistent negligence. Keeping accurate records and filing on time is imperative to avoid these repercussions.

Digital vs. Paper Submission of Form 990

While paper filing is still an option, organizations are encouraged to file Form 990 electronically. Digital submissions are processed faster, reduce errors, and offer a streamlined experience. The IRS provides options for electronic filing through approved e-file providers, enhancing security and efficiency.

Software Compatibility for Form 990 Filing

Several tax preparation software platforms, such as TurboTax and QuickBooks, are compatible with Form 990. These tools help automate the process, providing calculation assistance and error-checking features that reduce the risk of filing inaccuracies. Integration with accounting systems can simplify data transfer and ensure consistency across financial records.

State-Specific Rules for Form 990

While Form 990 is a federal requirement, some states have additional filing requirements or utilize the information in state-specific filings. Understanding state-specific mandates ensures compliance with both federal and state regulations. Organizations should investigate the particular stipulations in their state to align with all applicable laws.

Versions and Alternatives to Form 990

Depending on an organization's size and type, variants of Form 990 — such as Form 990-EZ or Form 990-N — might be appropriate. Smaller organizations or those with limited financial activity may benefit from these simpler forms. These shorter versions still fulfill IRS requirements but require less detailed reporting.