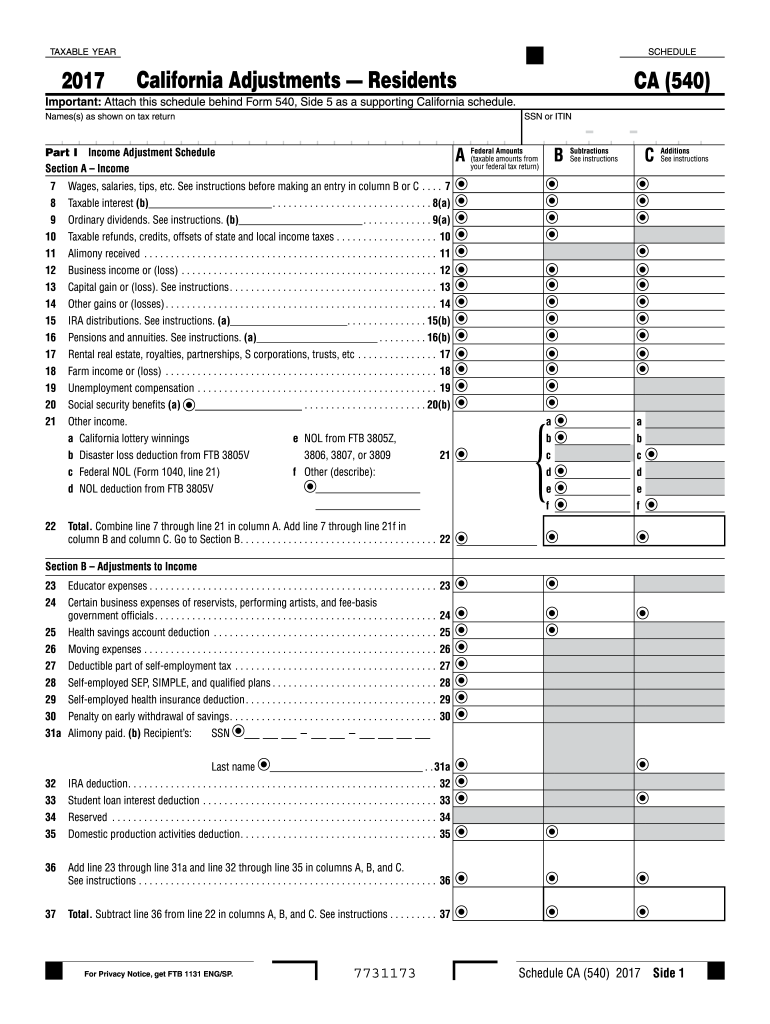

Definition and Purpose of the California 540 Form

The California 540 Form is an essential tax document used by California residents to report their state income tax. Specifically for 2017, this form requires residents to detail their adjusted gross income, itemized deductions, and any additional taxes or credits that influence their overall tax obligation in accordance with state regulations. Understanding the form's purpose is crucial, as it facilitates accurate tax calculations and ensures compliance with California tax laws, minimizing potential disputes with the Franchise Tax Board.

How to Use the California Form

To effectively utilize the 2017 California 540 Form, taxpayers need to accurately document their financial information. The form requires entering various types of income, subtractions, and state-specific adjustments. Taxpayers must also report any deductions previously itemized on federal returns, adapting them to meet California's specific tax criteria. Ensuring accurate math and complete documentation will help avoid errors that could delay tax processing or result in further inquiry.

- Gather all necessary income statements, deductions records, and tax credit documentation.

- Carefully follow the form's instructions for each section to report income accurately and adjust it as per California regulations.

Steps to Complete the California Form

-

Determine Filing Status:

- Select the appropriate filing status. This influences tax rates and available deductions.

-

Report Income:

- Enter all income sources, including wages, interest, and dividends, and adjust per California guidelines.

-

Account for Adjustments and Deductions:

- Deduct applicable expenses and make necessary adjustments based on California's rules, such as the standard or itemized deductions.

-

Calculate Tax and Credits:

- Use the provided tables and guidelines to calculate your tax and account for credits like the California Earned Income Tax Credit (CalEITC).

-

Provide Personal Information:

- Verify all personal details, SSN, and mailing address to ensure accuracy.

-

Review and Sign:

- Double-check all entries for accuracy, sign the form, and include payment if taxes are owed.

Key Elements of the California Form

- Personal Information Section: Requires full name, Social Security Number, and filing status.

- Income Statement: Detailed section for different income sources, requiring California-specific adjustments.

- Credits and Deductions: Special provisions for various tax credits and allowable deductions.

- Tax Computation: Instructions and tables to compute total tax due, incorporating California's tax brackets.

- Signature Line: Section where the taxpayer affirms the accuracy of the information provided.

Important Terms Related to the California Form

- Adjusted Gross Income (AGI): A person's total gross income minus specific deductions. Essential for determining state tax liability.

- Itemized Deductions: Expenses that can be deducted from AGI to reduce taxable income, such as medical expenses, mortgage interest, and charitable contributions.

- Tax Credits: Reductions in tax liability that differ from deductions insofar as they directly cut the amount of taxes owed, rather than reducing taxable income.

- Franchise Tax Board (FTB): The state entity responsible for administering personal income tax in California.

Legal Use of the California Form

Filing the California 540 Form in a legal and accurate manner ensures compliance with the state’s tax obligations. Improper use or deliberate misinformation may lead to legal consequences, including fines or additional audits by the Franchise Tax Board. Taxpayers must be cognizant of the legal implications of false reporting and the importance of maintaining thorough and accurate records to substantiate all claims on the form.

Who Typically Uses the California Form

- Residents: California residents are required to file this form to report their state income tax obligations.

- Individuals with State Income: Anyone who has earned income from California sources, regardless of residency, may need to utilize this form.

Various taxpayer scenarios—self-employed individuals, retirees, part-year residents, and students—might have unique considerations when completing the form, highlighting the need for personalized assessment of each tax case.

State-Specific Rules for the California Form

California taxpayers must adhere to specific regulations that may differ from federal tax laws. These include California's distinct treatment of certain income types, the requirement to adjust federal itemized deductions to match state provisions, and the application of particular state tax credits. Understanding these distinctions ensures compliance and maximizes potential tax benefits under California's tax system.

Filing Deadlines and Important Dates

The typical deadline for filing the California 540 Form is April 15 of the year following the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also note that extensions to file are available but do not extend the deadline for payment of taxes owed. Penalties may apply if taxes are underpaid by the original due date, even if an extension to file is granted.