Understanding the California Instructions for the 540 Form Printable

The California Instructions for the 540 form are essential for individuals filing their state income taxes. Designed for use by California residents, these instructions guide taxpayers through the specifics of filing their Form 540, ensuring compliance with state regulations. The instructions highlight key elements necessary for accurately completing the form and comprehensively cover the requirements for individual tax situations.

Steps to Complete the California 540 Form

Completing the California 540 form requires careful attention to detail. This form is used to report personal income and calculate state taxes owed. Below is a step-by-step guide outlining how to fill it out:

- Gather Required Information: Collect necessary documents such as W-2 forms, 1099s, and records of other income. Documentation regarding deductions, credits, and adjustments must also be ready.

- Identify Filing Status: Determine the correct filing status—options include single, married filing jointly, married filing separately, and head of household.

- Calculate Total Income: Summarize all income sources reported on various tax documents. Include wages, interest, dividends, and any other income sources.

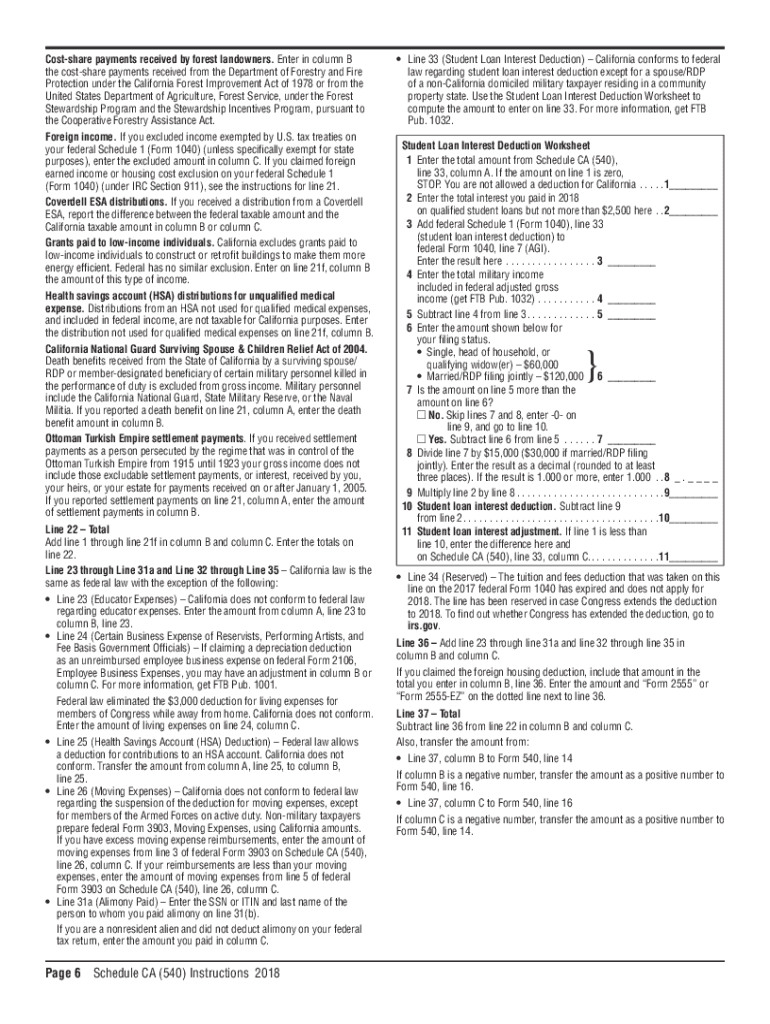

- Adjust for Deductions: Identify applicable deductions to adjust your total income. California may not conform to federal provisions, so be mindful of state-specific deductions such as the standard deduction or itemized deductions on Schedule CA (540).

- Determine Tax Liability: Utilize the tax tables provided with the instructions to find your tax liability based on taxable income.

- Claim Any Tax Credits: After calculating your tax liability, apply any eligible tax credits to lower your final tax amount owed.

- Review and Submit: Carefully review the completed form for accuracy before submitting. The tax form can be submitted online, by mail, or in person.

Who Typically Uses the California 540 Form Printable

The California 540 form is primarily utilized by residents of California who need to file their state income tax returns. This includes:

- Individuals with Income: Anyone earning income in California, such as wages or self-employment income.

- Married Couples: Married individuals filing jointly to report combined income or separately for individual tax situations.

- Heads of Household: Single parents or caregivers filing under this status to benefit from specific tax advantages.

- Registered Domestic Partners: Couples who may fall under specific tax considerations due to their relationship structure.

Important Terms Related to the California 540 Instructions

Understanding the terminology linked to the California 540 form is crucial for proper navigation. Key terms include:

- Adjusted Gross Income (AGI): The calculated income after deductions for specific expenses, critical in determining tax liability.

- Deductions: Specific amounts that taxpayers can subtract from their gross income to reduce taxable income.

- Tax Credits: Direct reductions of tax liability that lower the total tax owed after calculating the tax due.

- Filing Status: Determines the rate at which taxpayers are taxed and eligibility for certain tax benefits.

Common Scenarios for Filing the California 540 Form

Different taxpayers face various scenarios when completing the California 540 form. Consider these examples:

- Self-Employed Individuals: A freelance graphic designer must report all income and can claim deductions for business-related expenses like software and equipment.

- Retired Persons: A retiree using retirement income must take care to report pensions or Social Security accurately while claiming any applicable exemptions.

- Students: College students with part-time jobs must ensure they are reporting their income correctly and can often claim additional tax credits for education expenses.

Understanding the California instructions for the 540 form helps facilitate accurate and lawful tax filings, benefiting taxpayers through informed choices about their returns.