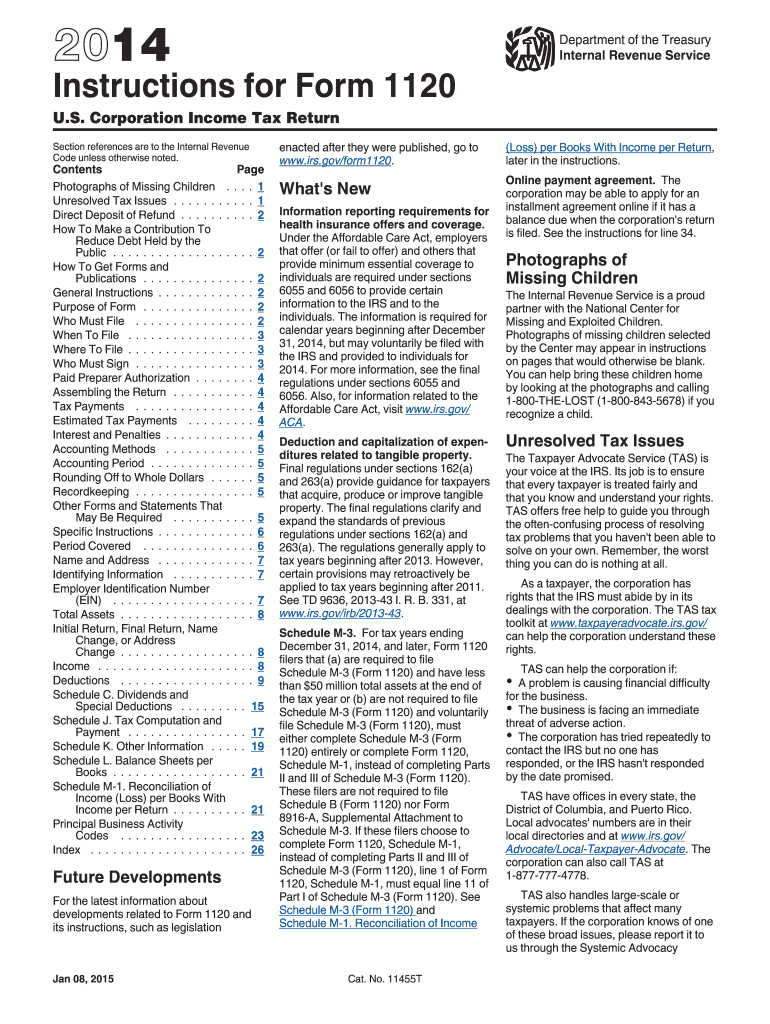

Definition & Purpose of the 2014 Form 1120

The 2014 Form 1120 is known as the U.S. Corporation Income Tax Return, which is utilized by corporations to report their income, gains, losses, deductions, credits, and to determine their income tax liability for the tax year 2014. This form is mandated by the IRS for C corporations, ensuring compliance and accurate reporting of corporate financial activities. Additionally, it serves as a legal document evidencing the corporation's tax obligations.

Obtaining the 2014 Form 1120

There are several ways corporations can acquire the 2014 Form 1120. It is available directly from the Internal Revenue Service's official website, where it can be downloaded and printed. Additionally, tax preparation software like TurboTax and QuickBooks provide the form as part of their package, assisting in seamless tax filing. For those preferring paper copies, it can sometimes be sourced from local IRS offices or requested by mail.

Key Steps to Complete the 2014 Form 1120

- Gather Required Information: Include details such as the corporation's name, EIN, address, and date of incorporation.

- Calculate Income and Deductions: Detail gross receipts, the cost of goods sold, total income, and applicable deductions.

- Determine Tax Liability: Compute the tax using IRS tables and document any credits that reduce this liability.

- Complete Schedules: Fill out relevant schedules, like Schedule C for dividends or Schedule J for tax computation.

- Signature: An authorized officer of the corporation must sign the return to validate it.

Important Terms Related to Form 1120

- EIN (Employer Identification Number): A unique number assigned to corporations for tax reporting purposes.

- Gross Receipts: The total income received by the corporation before any expenses are deducted.

- Dividends Received Deduction: A tax deduction that allows corporations to partially deduct dividends received from other taxable domestic corporations.

- Taxable Income: The income subject to tax after deductions and exemptions.

Filing Deadlines & Important Dates

The 2014 Form 1120 must be filed by the 15th day of the third month after the end of the corporation's tax year, typically March 15 for calendar-year taxpayers. Extensions can be requested using Form 7004, granting an additional six months to file.

Submission Methods for the 2014 Form 1120

Corporations have multiple submission options for the 2014 Form 1120. It can be filed electronically using IRS-accepted software, providing a secure, efficient method. Alternatively, a paper version can be mailed to the IRS. Some payment types and submissions might also be eligible for in-person filing at designated IRS locations.

Common Taxpayer Scenarios

Corporations of varying sizes and types, including subsidiaries of foreign entities, typically utilize Form 1120. Small to medium businesses might face different reporting challenges compared to large corporations, particularly those with intricate tax issues like foreign tax credits, sizable inventories, or complex dividend structures.

State-Specific Rules for Form 1120

While federal guidelines for Form 1120 are standardized, each state may impose additional requirements or stipulations, particularly for state corporate income tax purposes. Corporations should consult with local tax laws or a tax professional to ensure compliance with both federal and state-specific filing and tax obligations.

Penalties for Non-Compliance

Failing to file Form 1120 by the deadline can lead to penalties, with the IRS imposing a set fee per month based on the unpaid tax amount if the corporation neglects its filing duties. It’s critical to understand that consistent failure to comply can result in increased penalties, with interest accruing on any outstanding taxes, further impacting the corporation's financial standing.