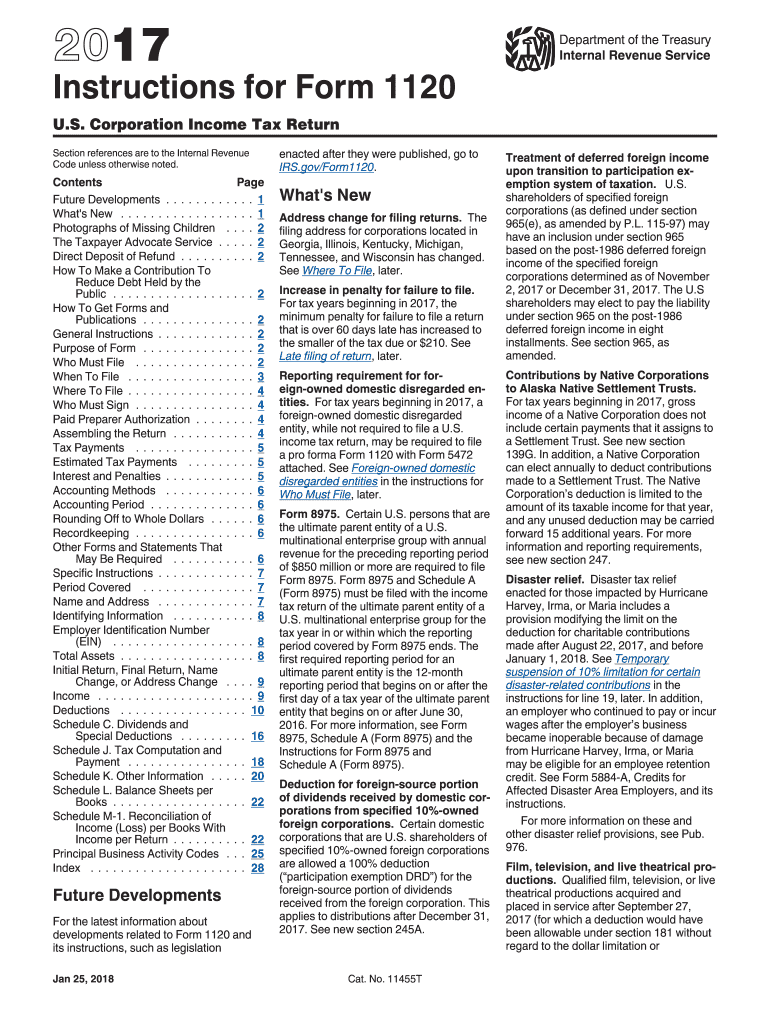

Definition and Purpose of IRS Form 1120 Instructions 2017

The IRS Form 1120 is the U.S. Corporation Income Tax Return. The instructions for this form serve as a crucial guide to completing the return accurately for the tax year 2017. These guidelines detail who is required to file the form, what information must be included, and how to compute taxes owed. Corporations, including those undergoing liquidation, generally need to utilize Form 1120 unless they qualify to use specialized corporate forms like 1120S for S corporations.

Key Elements of the Instructions

- Filing Requirements: The instructions clarify which corporations must file this form, including C corporations, and detail specific scenarios where alternative forms are applicable.

- Structure of the Form: It includes sections on income, deductions, tax computation, credits, and payment schedules, all of which must be filled out to comply with federal requirements.

- Recent Tax Law Changes: Updates to corporate tax laws that occurred in 2017, affecting how taxes are assessed and filed, are highlighted to ensure compliance.

Steps to Complete IRS Form 1120

Filing Form 1120 entails a step-by-step process to ensure accuracy and compliance with IRS regulations.

- Gather Information: Obtain financial records, including detailed income statements, balance sheets, and records of deductions.

- Fill Out Income Section: Accurately report the corporation's total income, which includes gross receipts and sales.

- Deduct Expenses: Record allowable business expenses which can include costs like salaries and wages, rent, and interest on business loans.

- Calculate Tax: Use the IRS instructions to compute taxable income and the resulting tax liability for the corporation.

- Review and Sign: Ensure all information is correct and complete, then have an authorized officer of the corporation sign the form.

- Submit the Form: File the form by the 15th day of the fourth month following the end of the corporation's tax year.

Filing Deadlines and Important Dates

The deadline for Form 1120 is typically the 15th day of the fourth month after the end of the corporation's tax year. For those whose fiscal year coincides with the calendar year, the due date is April 15. Extensions can be requested to avoid late filing penalties but must be submitted before the original due date.

Penalties for Non-Compliance

- Late Filing: Penalties can be considerable for late submission, generally calculated as 5% of the unpaid tax for each month the return is late.

- Inaccuracy Penalties: Providing inaccurate or incomplete information may lead to additional fines or audits by the IRS.

Eligibility Criteria

Corporations that conduct business, process income, and have taxable obligations in the U.S. are required to file Form 1120. This includes most C corporations. Determining eligibility includes evaluating whether the corporation meets specific thresholds in income and employee numbers.

Business Entity Types

- C Corporations: All primary users of Form 1120, responsible for corporate income tax based on earned profits.

- Foreign Corporations: If effectively connected with U.S. trade, these can also be required to file based on certain income thresholds.

- Inactive Corporations: Even corporations with no assets or income during the tax year must file to maintain compliance.

Obtaining IRS Form 1120 Instructions 2017

- Online Availability: The instructions are available for download directly from the IRS website, ensuring that corporations can access the latest information.

- Paper Copies: Taxpayers can request paper copies through the IRS by mail for those who prefer or need a physical document for reference.

Software Compatibility

For electronic filing, software compatibility is vital. Many tax preparation platforms, including TurboTax and QuickBooks, support Form 1120 filings, offering guided assistance to reduce errors and streamline the e-filing process.

State-Specific Rules

While Form 1120 is a federal requirement, corporations should also account for state-specific tax obligations. This may include additional filings or adjustments for state-specific deductions and credits.

Examples of State Variations

- California: Corporations must also submit a Franchise Tax Board return.

- New York: Requires combined reporting for unitary businesses.

Form Submission Methods

Corporations have multiple methods for submitting IRS Form 1120:

- Electronic Filing: Offers speed and confirmation of receipt, using IRS-approved software.

- Mailing: Sending physical copies to designated IRS service centers, ensuring forms are postmarked by the due date.

These instructions provide comprehensive support to navigate the complexities of corporate tax requirements, ensuring that all financial obligations are met in a timely and accurate manner.