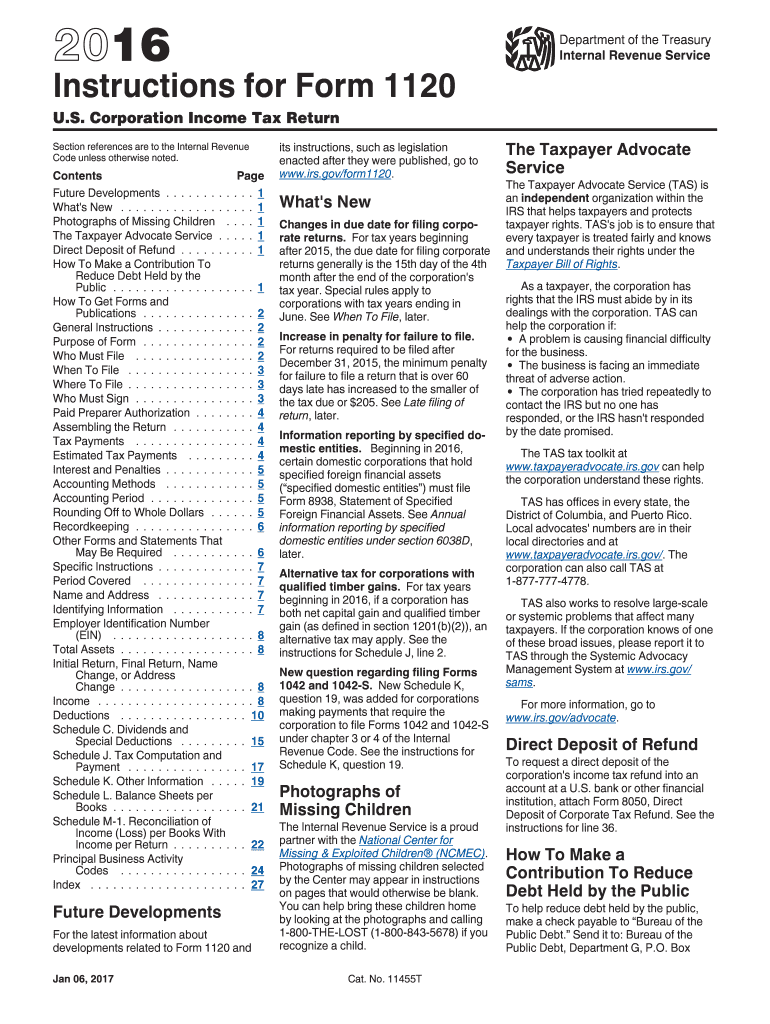

Definition & Purpose of IRS Form 1120 Instructions 2016

IRS Form 1120 is a crucial document used by corporations operating in the United States to report their income, gains, losses, deductions, credits, and to compute their income tax liability for the 2016 tax year. The instructions for this form provide comprehensive guidance on how to accurately complete and file the U.S. Corporation Income Tax Return. This form must be filed by C corporations, as well as other associations that elect to be taxed as corporations. Understanding the instructions ensures compliance with tax laws and helps corporations avoid penalties for inaccuracies or late submissions.

Steps to Complete the IRS Form 1120 Instructions 2016

-

Gather Required Information: Before beginning, collect all necessary financial records, including income statements, balance sheets, and details of any deductions or credits.

-

Complete Basic Information: Enter the corporation's name, address, Employer Identification Number (EIN), and the tax year covered.

-

Report Income: List all sources of income, including gross receipts, sales, and other revenue streams, while ensuring alignment with documented financial records.

-

Claim Deductions: Identify and report allowable business deductions such as salaries, rent, and employee benefits. Ensure conformity with the Internal Revenue Code.

-

Compute Taxable Income: Calculate taxable income by deducting total expenses from total income received during the year.

-

Determine Tax Liability: Use current tax rates and applicable credits to compute the corporation's tax obligation.

-

Review and Submit: Double-check all information for accuracy, then file the completed form by the due date, typically the 15th day of the 4th month after the end of the corporation’s tax year.

Filing Deadlines and Important Dates

Corporate tax returns using Form 1120 are generally due on April 15th of the year following the close of the tax year for calendar year corporations. For fiscal year filers, the deadline is the 15th day of the 4th month following the fiscal year-end. Extensions can be obtained by filing Form 7004, allowing an additional six months to file the return, but not to pay taxes due. Corporations must ensure timely filing to avoid late-filing penalties.

Penalties for Non-Compliance

Failing to file Form 1120 or filing inaccurately may result in significant penalties. The IRS can impose a penalty for late filing, calculated as 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Additional penalties exist for unpaid taxes, underpayment of estimated taxes, and inaccuracies. Corporations must ensure they understand the filing requirements and submit accurate forms to minimize potential penalties.

How to Obtain the IRS Form 1120 Instructions 2016

The IRS Form 1120 Instructions for the 2016 tax year can be accessed through the IRS website, allowing corporations to download and print copies directly. Additionally, the IRS provides options to order paper copies for free delivery. Tax software like TurboTax or QuickBooks can also offer integrated instructions, providing a guided experience for digital filing. By obtaining and following the instructions, corporations can ensure accurate completion of the form.

Important Terms Related to IRS Form 1120 Instructions 2016

- Gross Receipts: Total revenue generated by the corporation from all sources before any deductions.

- Deductions: Expenditures subtracted from gross income to determine taxable income; including operational costs and business expenses.

- Tax Credits: Reductions in tax liability allowing corporations to lower the total amount of tax owed.

- Fiscal Year: Any accounting period of 12 months ending on the last day of any month, except December.

- Estimated Tax: The estimated amount of tax a corporation is expected to pay to cover its tax liability.

Eligibility Criteria for Filing IRS Form 1120

Corporations organized under U.S. law and operating within the United States are required to file Form 1120. This includes both domestic and foreign corporations that conduct business within the U.S. or receive income from U.S. sources. Exempt from filing are non-profit organizations and entities not recognized as corporations under federal tax law. Corporations should assess their operations and consult the eligibility criteria to confirm their requirement to file Form 1120.

Digital vs. Paper Version of IRS Form 1120

Corporations may choose to submit IRS Form 1120 either digitally or via mail. Digital submission is facilitated through approved tax filing software that directly transmits data to the IRS. Paper submissions require mailing the completed form to the designated IRS service center based on the corporation’s location. Electronic filing offers benefits such as timely submission acknowledgment and reduced processing time, promoting efficiency and accuracy in tax filing.