Definition and Purpose of the Forn W-3PR 2014 Form

The Forn W-3PR 2014 form serves as a summary of withholding information which is to be transmitted to the Social Security Administration (SSA) in Puerto Rico. It is specifically designed for employers who have employees under Puerto Rican taxation. This form consolidates data from individual W-2 forms, allowing the SSA to accurately record Social Security earnings and taxes withheld from Puerto Rican employees. Employers must submit this form in conjunction with Form 499R-2/W-2PR, which details the individual wages and withholding for each employee.

Key functions of the Forn W-3PR include:

- It compiles total wages, tips, and other compensation paid to employees.

- It summarizes the amounts withheld for Social Security and Medicare taxes.

- It highlights any contributions made towards additional Medicare tax.

This form plays a crucial role in ensuring that the data reported on individual withholding statements is organized and accurate.

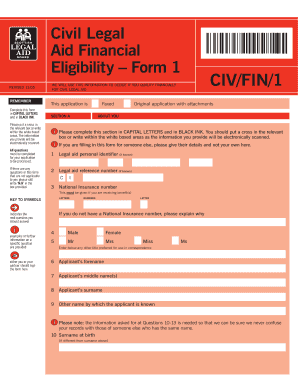

Steps to Complete the Forn W-3PR 2014 Form

Completing the Forn W-3PR involves a multi-step process that requires careful attention to detail to avoid mistakes.

-

Gather Employee Information: Collect all W-2 forms for employees, ensuring that each form is filled out accurately. Each W-2 should include the employee's Social Security number and the respective amounts of wages and taxes withheld.

-

Complete Header Information: Fill in the top section of the Forn W-3PR, which includes:

- Employer's name and address.

- Employer identification number (EIN).

- The total number of W-2 forms being submitted.

-

Summarize Employee Wages and Taxes: In the corresponding sections, input the total wages subject to taxation, the total amount withheld for Social Security and Medicare, and any other relevant amounts.

-

Certification Statement: Sign and date the form, confirming that the information reported is correct to the best of your knowledge.

-

Submission: Ensure that you submit the completed form along with the individual W-2 forms to the SSA by the specified deadline.

These steps facilitate accurate reporting and compliance with tax obligations.

Filing Deadlines and Important Dates for the Forn W-3PR 2014 Form

Understanding the filing deadlines associated with the Forn W-3PR is crucial for compliance. For the 2014 tax year, the following deadlines apply:

-

Filing Deadline: Employers must submit the Forn W-3PR along with the W-2 forms by January 31 of the following year. This ensures that all withholding data is reported in a timely manner.

-

Extended Deadline for Electronic Filing: Employers opting to file electronically may have until February 28 to complete the submission.

Additionally, it is important to stay informed about any changes in these deadlines that may be announced by the SSA or the Puerto Rico Department of Treasury.

Key Elements Included in the Forn W-3PR 2014 Form

The Forn W-3PR contains several key elements that are essential for effective reporting and compliance:

-

Basic Employer Information: This section includes identifying details about the employer, such as name, address, and EIN.

-

Total Wages and Taxes: A breakdown of total wages, tips, and other compensation, alongside total Social Security and Medicare taxes withheld, is provided.

-

Signature Section: An area for the employer’s authorized representative to certify the accuracy of the information included in the submission.

-

Instructional Remarks: The form includes specific instructions that aid employers in correctly filling out the form and reporting information accurately.

These elements work together to ensure that the SSA has all necessary information to process employee earnings and tax contributions.

Common Pitfalls in Using the Forn W-3PR 2014 Form

Employers may encounter common pitfalls when using the Forn W-3PR, which can lead to filing complications or penalties:

-

Inaccurate Employee Information: Small errors in Social Security numbers or wage amounts on W-2s may create discrepancies in the total reported on the Forn W-3PR.

-

Missing Signatures and Dates: Failure to sign and date the certification statement can result in delays or rejections of the form.

-

Incorrect Filing Method: Not adhering to the proper submission method (electronic vs. paper) or timelines can lead to non-compliance.

To mitigate these issues, employers should implement a checklist review process before submission, ensuring that all information is accurate and complete.