Definition & Meaning of the W-3PR 2016 Form

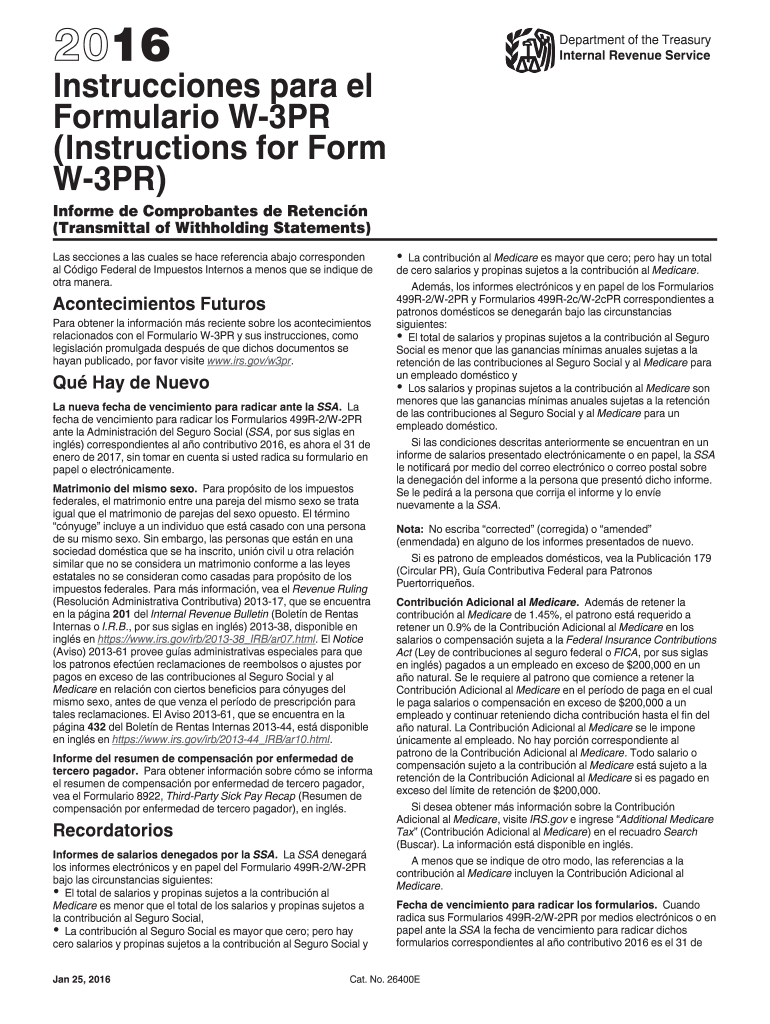

The W-3PR 2016 form is a summary transmittal form used by employers in Puerto Rico to report wage and withholding information to the Social Security Administration (SSA) for the tax year 2016. It is necessary for employers who also file the Form 499R-2/W-2PR, which contains the individual wage data of employees. The W-3PR consolidates information, making it easier for the SSA to process wage and tax information efficiently. Understanding this form is crucial for compliance with federal tax laws, as it plays a vital role in documenting employee compensation and withholding taxes.

- The form includes various data points, such as total wages paid, total federal income tax withheld, and total social security tax withheld. It serves as a summary document of all the individual employee W-2 forms submitted for that reporting year.

- Employers must ensure that the information reported on the W-3PR correlates accurately with the individual W-2 forms submitted, as discrepancies could lead to penalties or delays in processing.

How to Use the W-3PR 2016 Form

Using the W-3PR 2016 form involves several key steps aimed at ensuring accurate reporting of wage and tax data to the SSA. Accurate completion of the form is essential for compliance and to avoid potential penalties.

- Gather Necessary Information: Before completing the W-3PR, collect all relevant wage and withholding data from the individual W-2 forms issued to employees.

- Complete the Form: Fill in the required fields, which include:

- Employer information (name, address, and Employer Identification Number).

- Total number of W-2 forms submitted.

- Totals for wages, federal taxes withheld, and social security payments.

- Double-Check for Accuracy: Verify that all figures align with the corresponding W-2 forms. Ensuring accuracy is key to preventing issues with the SSA.

- Submission: Submit the W-3PR form alongside the W-2 forms to the SSA, adhering to filing deadlines.

Steps to Complete the W-3PR 2016 Form

Completing the W-3PR form requires careful attention to detail and adherence to guidelines provided by the SSA.

- Obtain the Form: The W-3PR can be obtained online or through the IRS website.

- Input Employer Information: Fill in your business details at the top of the form.

- Include the name, address, and Employer Identification Number (EIN).

- Enter Total Wage Data:

- Total number of W-2 forms.

- Total wages paid during the year.

- Total federal income tax withheld.

- Total social security tax withheld.

- Submit the Form: After reviewing the form for accuracy, submit it along with W-2 forms either electronically if permitted or via mail to the appropriate SSA address.

Filing Deadlines / Important Dates for the W-3PR 2016 Form

Filing deadlines are critical for compliance and avoiding penalties. For the 2016 tax year, employers need to adhere to the following key dates:

- January 31, 2017: The final date for submitting Form W-3PR and accompanying W-2 forms to the SSA.

- Employers must ensure that all forms are completed and postmarked by this deadline to avoid late penalties.

It is advisable for employers to begin preparing their forms well ahead of the deadline to ensure ample time for corrections and verifications.

Important Terms Related to the W-3PR 2016 Form

Being familiar with relevant terminology related to the W-3PR is beneficial for understanding the form and its context in the broader tax landscape.

- W-2 Form: A form used to report wages, tips, and other compensation paid to employees.

- Employer Identification Number (EIN): A unique number assigned to a business entity for tax purposes.

- Social Security Administration (SSA): The agency responsible for administering social security programs and overseeing the reporting of wage information.

- Withholding Tax: Taxes withheld from employees’ earnings to pay federal income tax obligations.

Understanding these terms aids employers in comprehensively completing the W-3PR form.

Legally Binding Nature of the W-3PR 2016 Form

The W-3PR form, along with its related W-2 forms, is a legally binding document required for compliance with federal tax laws. This form must accurately reflect the wages paid and taxes withheld for each employee, ensuring that federal requirements are met. Failure to submit accurate forms can result in penalties, interest charges, and complications with the SSA regarding employees’ social security credits.

- Employers are held accountable for the information reported, meaning rigorous checks and audits are often necessary to ensure compliance.

- The information on the W-3PR may also be used by the IRS during audits, emphasizing the importance of accuracy.

Examples of Using the W-3PR 2016 Form

Practical applications of the W-3PR can provide insight into its use in real-world scenarios. Here are several examples:

- Example 1: A retail company with multiple employees must file a W-3PR after issuing W-2 forms, summarizing total wages and withholding. Accurate completion is required to maintain compliance and ensure employees receive proper credit for their earnings.

- Example 2: A small business that neglected to submit the W-3PR form on time faces penalties during an SSA audit. This circumstance underlines the significance of adherence to filing deadlines.

These examples illustrate the critical nature of the W-3PR in maintaining proper employment records and ensuring compliance with federal tax law.