Definition and Meaning of W3PR Form 2018

The W3PR form 2018 is a crucial document used primarily in Puerto Rico for reporting annual wages and tax information to the Social Security Administration (SSA). It serves as a summary of the Forms 499R-2/W-2PR submitted by employers to report the income of employees. This form consolidates data from multiple W-2s submitted by an employer, providing a clear overview necessary for SSA's processing and tax collection purposes. The W3PR form ensures compliance with both federal and local tax laws, facilitating accurate recording of earnings and taxes withheld for reporting employees.

How to Obtain the W3PR Form 2018

To obtain the W3PR form 2018, employers can access it through several avenues:

- Online Resources: The form is available on the official IRS website and the Puerto Rico Department of Treasury’s portal. These platforms provide reliable downloads and the latest updates regarding form requirements.

- Local Offices: Employers may visit local IRS or Treasury offices to request paper copies of the form.

- Tax Software: Many tax preparation software programs incorporating payroll and compliance features include the W3PR form as part of their services, allowing for smooth preparation and filing.

Ensuring you have the correct version is vital, as forms may have slight variations based on the reporting year.

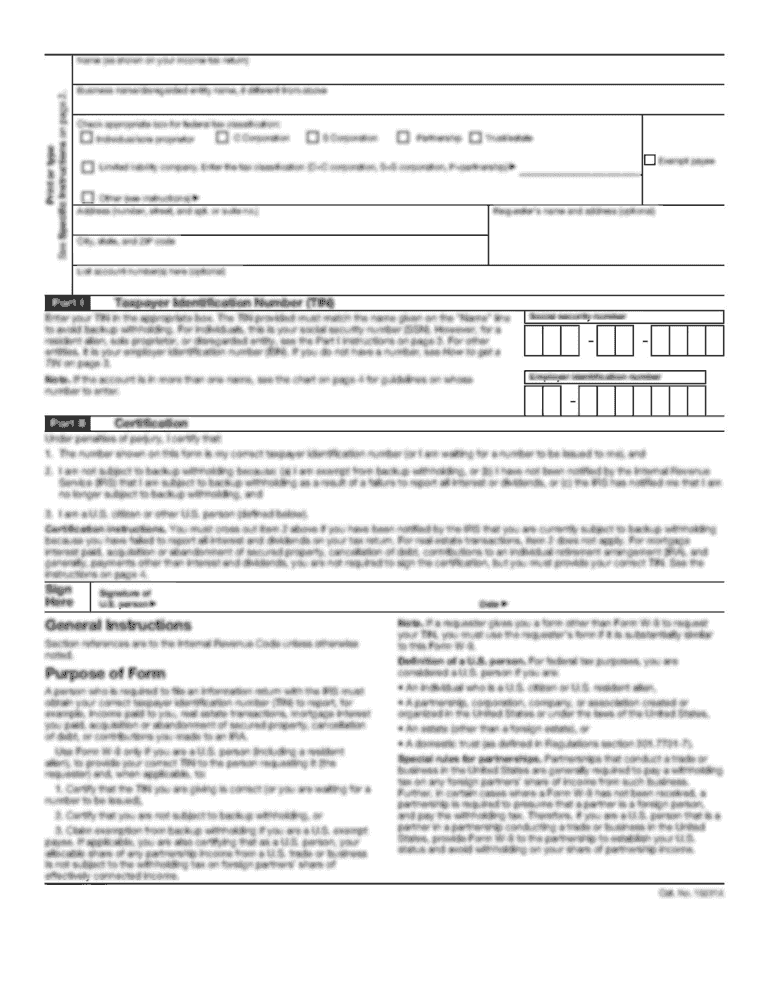

Steps to Complete the W3PR Form 2018

Completing the W3PR form 2018 involves a series of detailed steps to ensure accuracy and compliance:

- Gather Information: Collect necessary data from the individual Forms 499R-2/W-2PR issued to employees. This includes total wages, tips, and other compensation information.

- Fill in Employer Information: Enter the employer's name, address, and identification number as mandated. Make sure all details are correct to avoid processing delays.

- Report Wage Information: Summarize the total wages paid and taxes withheld for all employees. This section typically requires careful attention to ensure totals match those reported on individual W-2s.

- Calculate and Verify Totals: Confirm that the totals align with what has been reported to the IRS on the employee forms. Discrepancies can lead to issues with IRS compliance.

- Signature and Submission: After completion, the form must be signed by an authorized individual before being submitted.

Attention to detail during each step is crucial to ensure all reporting requirements are met.

Important Terms Related to W3PR Form 2018

Understanding key terms associated with the W3PR form 2018 is essential for effective submission and compliance. Here are some crucial terms:

- Forms 499R-2/W-2PR: The individual wage and tax statements that detail the earnings and taxes withheld for each employee.

- Filing Period: This refers to the specific tax year the form is reporting on, which is essential for timely submissions to the SSA.

- Tax Identification Number (TIN): A unique number assigned to employers for identification purposes in tax submissions.

- Social Security Administration (SSA): The governmental agency responsible for administering social security programs, including the collection of earnings data reported in the W3PR form.

An understanding of these terms streamlines the process of filling out and understanding the implications of the W3PR form.

Filing Deadlines and Important Dates

Timely filing of the W3PR form is crucial to avoid penalties. Key deadlines for the W3PR form 2018 include:

- Due Date: The W3PR must be filed with the SSA by January 31 following the end of the tax year. For example, for the 2018 tax year, the due date would be January 31, 2019.

- Submission of Copies: Employers must also provide copies of the relevant Forms 499R-2/W-2PR to employees by the same deadline.

- Extensions: If additional time is needed, employers should apply for extensions as mandated by the IRS to avoid penalties.

Missing these deadlines can result in late fees and complications with tax reporting.

Penalties for Non-Compliance with W3PR Form 2018

Non-compliance with the requirements to file the W3PR form 2018 can lead to significant penalties. These penalties include:

- Late Filing Penalties: Businesses may incur penalties for not filing the form by the due date, which can accrue over time.

- Incorrect Information: Providing false or misleading information can result in both civil and potential criminal penalties.

- Impact on Employees: Non-compliance can hinder employees’ access to social security benefits, creating further complications.

Employers should prioritize accurate and timely submissions to avoid such repercussions.

Examples of Using the W3PR Form 2018

Practical application of the W3PR form 2018 can resonate under various scenarios. Here are a few examples:

- Annual Employee Reporting: A restaurant owner uses the W3PR to file wage information for seasonal employees who worked throughout the year, ensuring compliance and accurate tax reporting.

- Business Acquisition: When a company acquires another business, the new entity must accurately merge the payroll information, necessitating enhanced scrutiny of both the W3PR and W-2 forms for continuity.

- Audits: In preparation for an IRS audit, a business owner reviews the W3PR submitted for discrepancies after receiving inquiries about their employees' reported wages.

Such illustrative cases demonstrate the utility of the W3PR form in varied professional settings.

Electronic Filing vs. Paper Version of the W3PR Form 2018

Employers have the option of filing the W3PR form 2018 electronically or using a paper version. Each method has its own set of advantages and requirements:

-

Electronic Filing:

- Typically faster, allowing for immediate submissions and confirmation of receipt.

- Reduces the chances of errors associated with handwritten submissions.

- May require registration with the SSA for electronic submissions.

-

Paper Filing:

- Often used by businesses with smaller volumes of employees, who may find physical forms easier to manage.

- Requires careful checks to ensure no errors in writing and calculations.

Choosing between these options will depend on the employer's resources, capabilities, and preferences for managing their documentation process either digitally or through traditional means.