Definition & Meaning

Form 8862, titled "Information To Claim Earned Income Credit After Disallowance," is vital for taxpayers in the United States who have previously had their Earned Income Credit (EIC) disallowed. This form must be completed to reclaim eligibility for the EIC, a tax credit that benefits low to moderate-income working individuals and families, particularly those with children. By filing this form, taxpayers provide essential information to the IRS, demonstrating compliance with necessary criteria to regain eligibility for the EIC.

- Purpose: The primary function is to inform the IRS that the taxpayer complies with the rules governing EIC eligibility.

- When to Use: Required when the EIC was previously denied or reduced, and the taxpayer wishes to claim it again.

Steps to Complete the 8862 on Tax USA 2009 Form

Completing Form 8862 involves several key steps. Ensuring accurate and thorough completion is essential to avoid processing delays or further disallowances.

- Personal Information: Begin with your personal details, including your name, Social Security number, and filing status.

- Reason for Previous Disallowance: Clearly explain why the EIC was previously denied or reduced, providing context and any changes that have occurred since.

- Qualifying Child Information: If applicable, provide information about your qualifying child or children, including their name, Social Security number, relationship to you, and living arrangements.

- Income and Filing Requirements: Confirm that your income falls within the required limits and that you meet all other filing criteria for the EIC.

- Certification: Sign and date the form to certify that all information provided is accurate to the best of your knowledge.

How to Obtain the 8862 on Tax USA 2009 Form

Accessing Form 8862 is straightforward, and there are several ways to obtain it:

- IRS Website: Download the form directly from the IRS website. Ensure you access the correct version for the 2009 tax year.

- Tax Preparation Software: Utilize tax software like TurboTax or H&R Block, which typically includes access to necessary tax forms.

- Local IRS Office: Visit your local IRS office to obtain a physical copy of the form.

IRS Guidelines

The IRS provides specific guidance for taxpayers completing Form 8862. Adhering to these guidelines ensures the form is processed correctly and efficiently:

- Documentation: Maintain records proving eligibility, such as income statements and documents for any qualifying children.

- Correcting Errors: If errors are found after submission, promptly file an amended return with accurate information.

- Following Instructions: Use the form instructions provided by the IRS to ensure every section is completed accurately and fully.

Filing Deadlines / Important Dates

While the deadline for submitting Form 8862 aligns with general tax filing deadlines, there are crucial time frames to consider:

- Annual Deadline: Aligns with the federal tax filing deadline, typically April 15.

- Extension Date: If you file for an extension, note the extended deadline, generally October 15.

- Reevaluation Period: After filing, the IRS may require additional time to process and review the form, impacting the timing of your EIC receipt.

Required Documents

To ensure the IRS accepts Form 8862, compile necessary documentation:

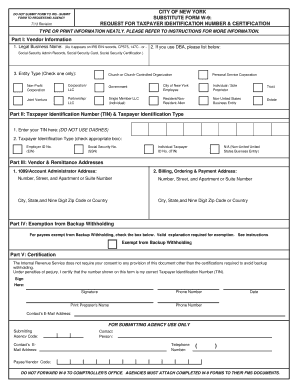

- Proof of Income: Such as W-2s or 1099s that reflect earned income levels.

- Qualifying Child Records: Birth certificates, school records, and residency verification for any children claimed.

- Previous EIC Notices: Any prior correspondence from the IRS about EIC denial or disallowance.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer situations might influence how Form 8862 is completed:

- Self-Employed: Must accurately report all business income and expenses to verify earned income levels.

- Retired: Typically, not eligible unless there is earned income within the qualifying thresholds.

- Students: May qualify if separate sources of qualifying income are apparent, beyond educational benefits.

Form Submission Methods (Online / Mail / In-Person)

Submitting Form 8862 can be done via several methods, each with unique benefits:

- Online: E-file through tax software that supports IRS form submissions for fast and efficient results.

- Mail: Print the completed form and necessary documents, mailing them to the IRS. Use certified mail to confirm receipt.

- In-Person: Visit an IRS office to submit the form and seek direct assistance if needed.

By following these detailed guidelines and understanding how to accurately complete Form 8862, taxpayers can effectively navigate the intricacies of reclaiming their Earned Income Credit. Comprehensive preparation and submission will lead to successful processing and resolution.