Definition & Meaning

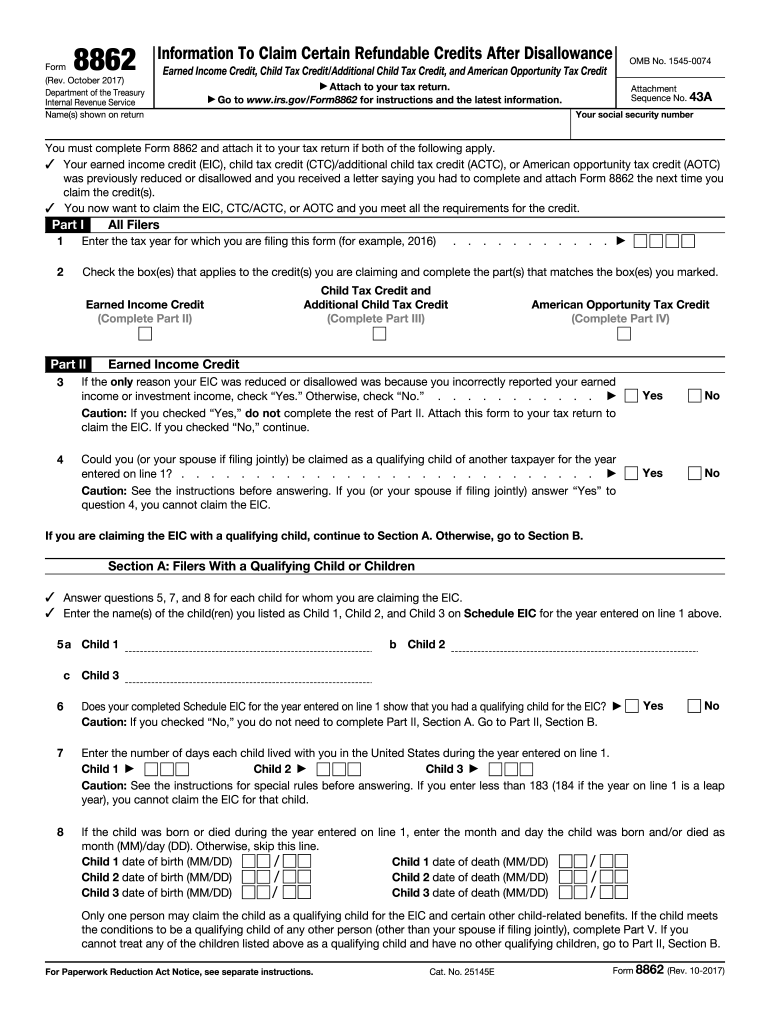

Form 8862, introduced for the 2012 tax year, is critical for taxpayers wanting to claim the Earned Income Credit (EIC) after a previous disallowance. This form requires thorough documentation of the taxpayer's residency status and information about qualifying children during the tax year. The IRS mandates Form 8862 to ensure taxpayers meet eligibility requirements for the EIC based on specific criteria and to prevent incorrect filings in subsequent years. The form serves as a corrective measure, helping taxpayers regain eligibility after disallowance by demonstrating compliance with IRS regulations.

How to Obtain Form 8

Obtaining Form 8862 for the 2012 tax year can be achieved through multiple channels. It is accessible on the official IRS website, where taxpayers can download the PDF version for manual completion. Alternatively, taxpayers can request a physical copy by contacting the IRS directly, either through phone or mail. For those utilizing tax preparation software, Form 8862 is typically integrated into these platforms, allowing users to fill it out digitally as part of their electronic tax submission process.

Steps to Complete Form 8

-

Provide Personal Information: Enter your name, social security number, and address. Ensuring accuracy in this section is crucial to avoid delays in processing.

-

Qualifying Children Information: Include details about your qualifying children, such as their names, social security numbers, and birth dates.

-

Residency Status: Report your residency status for the year in question, with specific focus on U.S. residency, as this impacts EIC eligibility.

-

Reason for Disallowance: Clearly state the reason the EIC was previously disallowed and provide any supporting documentation to clarify circumstances.

-

Signature and Date: Finally, sign and date the form, certifying the accuracy of the information provided.

Key Elements of Form 8

- Taxpayer Identification: This section includes essential details like social security numbers for the taxpayer and dependents.

- Child Residency Requirement: This part confirms that the qualifying child lived with the taxpayer in the United States for over half of the taxable year.

- Income Reporting: Accurate reporting of earned income levels, which influences eligibility, is critical.

IRS Guidelines

IRS guidelines for Form 8862 are stringent to prevent fraud and ensure that only eligible taxpayers receive the Earned Income Credit. These guidelines stipulate that individuals must accurately report their income, residency, and information about any qualifying children. Additionally, taxpayers must not have any fraud penalties related to EIC claims in prior years. Failure to adhere to these guidelines can result in penalties and disqualification from claiming the credit.

Eligibility Criteria

The eligibility criteria for filing Form 8862 are essential for obtaining the EIC after a disallowance. Taxpayers must meet specific income thresholds that vary based on filing status and number of qualifying children. Additionally, the taxpayer must prove U.S. residency and timely filing of tax returns. Special rules may apply to self-employed individuals, which dictate a need for comprehensive income documentation and proof of a stable income source.

Required Documents

Several documents are necessary for completing Form 8862 accurately. These include previous tax returns, W-2 forms, detailed records of residency, and any correspondence from the IRS outlining reasons for EIC disallowance. It might also be beneficial to provide school or medical records confirming the child's residency during the tax year. Comprehensive documentation can expedite the approval process and prevent potential disputes.

Filing Deadlines / Important Dates

Taxpayers must be cognizant of filing deadlines to avoid penalties. Generally, Form 8862 should be submitted with filed tax returns by April 15. However, extensions are available under specific circumstances, providing additional time without incurring penalties. Understanding these timelines is vital for maintaining eligibility and avoiding late fees or missed credits.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple methods for submitting Form 8862, including online submissions through IRS-approved tax software, mailing a hard copy to the designated IRS office, or personally visiting an IRS office for submission. While online submission is the most convenient and speedy method, other methods remain viable alternatives. Each method requires careful adherence to submission instructions to ensure acceptance and timely processing.

Examples of Using Form 8

-

Example 1: A taxpayer with two qualifying children who had EIC disallowed in 2011 due to incorrect income reporting can use Form 8862 to reclaim EIC eligibility by accurately documenting 2012 income.

-

Example 2: A single mother who failed to claim her child's residency properly in 2011 can demonstrate corrected residency documentation with school records in her 2012 filing to regain eligibility.

Penalties for Non-Compliance

Non-compliance with the requirements for filing Form 8862 can result in significant penalties, including the denial of the Earned Income Credit and additional fines. In severe cases, it could lead to criminal charges if fraudulent claims are made. Adhering to the guidelines and accurately completing the form is the best defense against such penalties and ensures a smooth tax filing process.