Definition & Meaning

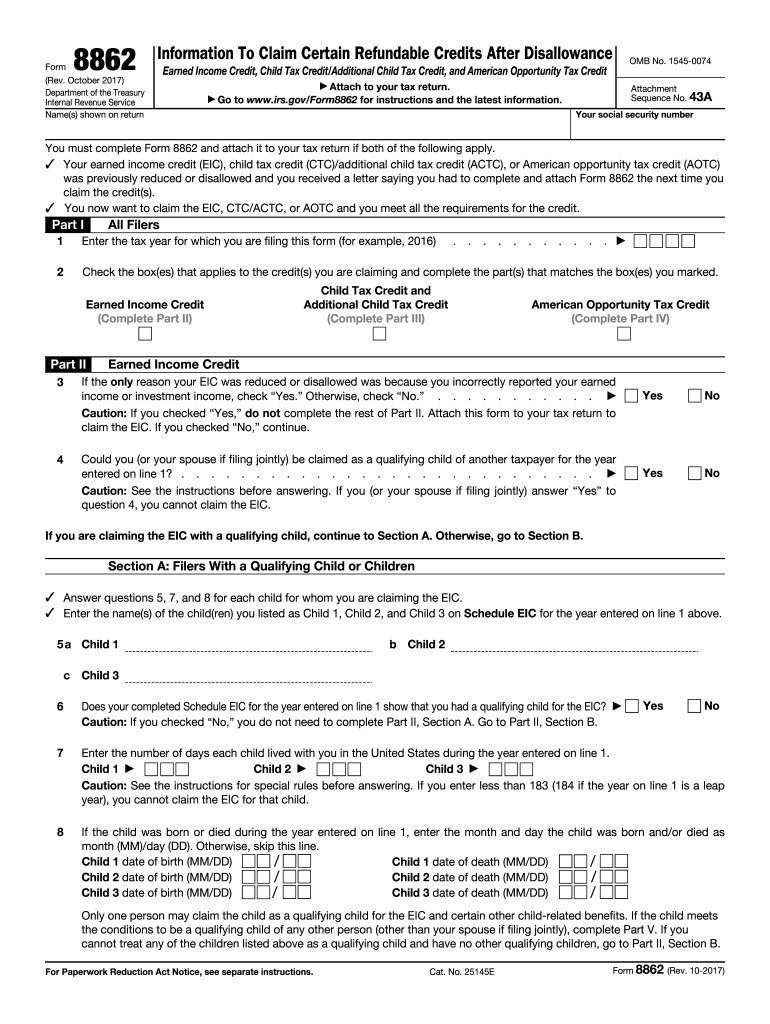

IRS Form 8862 is a critical document used by taxpayers in the United States who seek to reclaim eligibility for certain tax credits after they have been previously disallowed by the Internal Revenue Service (IRS). Specifically, this form is required for individuals who wish to claim credits like the Earned Income Credit (EIC), Child Tax Credit (CTC), and American Opportunity Tax Credit (AOTC) after denial. The purpose of IRS Form 8862 is to verify that the taxpayer now qualifies to receive these credits once again, by ensuring all criteria are met according to IRS regulations.

How to Use the IRS Form 8862

Using IRS Form 8862 involves completing and submitting the form as part of your tax return. This submission is necessary when you are reapplying for credits that have been denied in a previous year. The form guides you in providing specific information required by the IRS to evaluate your eligibility, including your filing status, income levels, and information about any qualifying children if applicable. Through the correct completion of this form, you demonstrate your eligibility for the disallowed credits.

- Ensure Eligibility: Confirm you meet all eligibility requirements for the credit.

- Complete the Form: Fill out all applicable sections, including filing status and qualifying children information.

- Attach to Tax Return: Include IRS Form 8862 with your federal tax return submission.

- Submit: File your completed tax return with the IRS by the designated deadline.

How to Obtain the IRS Form 8862

IRS Form 8862 can be obtained through multiple sources. The most straightforward method for many taxpayers is downloading it directly from the official IRS website. Alternatively, many tax preparation software platforms provide the form as part of their document library. If needed, physical copies of the form can also be requested from the IRS by mail or picked up at local IRS offices. Remember, ensuring you have the most current version is crucial as tax codes and forms can change.

- Online: Available for download in PDF format from the IRS official site.

- Tax Software: Integrated within platforms such as TurboTax or QuickBooks.

- Mail or In-Person: Request a mailed copy or pick up from IRS locations.

Steps to Complete the IRS Form 8862

Completing IRS Form 8862 involves a series of steps to ensure accuracy and compliance with IRS guidelines:

- Personal Information: Enter your name, Social Security number, and filing status.

- Questions About Eligibility: Answer specific questions regarding the tax credit you are claiming, addressing why previous disallowance issues no longer apply.

- Qualifying Children: Provide information for any children you are claiming as dependents if applicable.

- Review: Double-check all entries for accuracy and ensure all required fields are completed.

- Attach: Add the competed form to your current tax return for submission.

Who Typically Uses the IRS Form 8862

IRS Form 8862 is typically used by taxpayers who have had claims for credits like the Earned Income Credit disallowed previously but now believe they meet the eligibility criteria anew. This includes individuals with varying circumstances such as changes in income, marital status, or number of dependents. It is important for those resubmitting eligibility for these credits to illustrate compliance and fulfill the IRS’s conditions for the credit.

- Individuals: Taxpayers with previously denied credits.

- Families: Those claiming credits for dependent children.

- Students: Those applying for educational credits like the AOTC.

Key Elements of the IRS Form 8862

IRS Form 8862 comprises several key elements essential for processing:

- Personal Information: Identifying details such as name and Social Security number.

- Credit-specific Questions: Queries unique to the credit type being claimed.

- Dependents’ Information: Detailed data on qualifying children, where needed.

- Filing Status: Clarification of the taxpayer’s current filing status, whether single, married, head of household, etc.

IRS Guidelines

The IRS has established specific guidelines governing the use of Form 8862. These guidelines outline the conditions under which the form must be submitted, ensuring that the credits claimed are warranted based on current circumstances. Taxpayers should familiarize themselves with these rules to avoid errors or delays in processing.

- Eligibility Verification: Demonstrate changes in conditions since previous credit denial.

- Documentation Requirements: Securely submit all requisite documents to support eligibility claims.

- Timely Filing: File the form as part of your tax return by the IRS deadline.

Eligibility Criteria

The eligibility for using IRS Form 8862 hinges on several factors:

- Previous Denial: Must have been previously disallowed for the credit.

- Current Compliance: Must now meet all eligibility guidelines for the credit.

- Filing Accuracy: Ensure that all information provided on the form is correct and aligns with current IRS definitions for dependents, income, and filing status.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting IRS Form 8862:

- Online: Electronically file using IRS-approved tax software.

- Mail: Submit the physical form along with a paper tax return via postal services.

- In-Person: Visit a local IRS office for direct submission if mailing or online filing is not feasible.

Consider the most efficient method for your circumstances, such as timeliness and access to resources, to ensure successful filing.