Definition & Meaning of the Florida F1065SK1 2010 Form

The Florida F1065SK1 2010 form is a tax document utilized for reporting a partnership's share of income, deductions, credits, and other relevant items during the tax year 2010. Specifically, this form details the allocation of various financial elements among partners in a business structure, enabling partners to correctly report their financial share on individual tax returns. The information provided on the F1065SK1 includes essential data such as business income types, financial deductions, and credits attributed to each partner, fostering transparency and compliance with IRS regulations.

The key components of the Florida F1065SK1 form typically encompass:

- Ordinary Business Income: The primary earnings generated from the partnership’s day-to-day operations.

- Rental Income: Earnings from properties rented as part of the partnership's business model.

- Capital Gains and Losses: Profits or losses originating from the sale or investment alterations of capital assets.

- Deductions: Eligible expenses that partners can subtract from their total income to calculate taxable income.

Understanding this form and its implications is crucial for ensuring accurate tax reporting and compliance, avoiding potential penalties associated with misreporting errors.

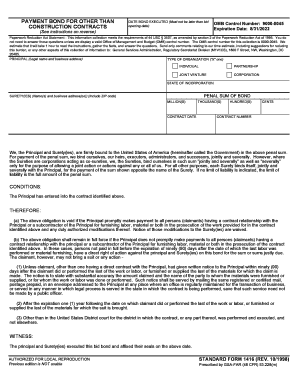

Steps to Complete the Florida F1065SK1 2010 Form

Completing the Florida F1065SK1 2010 form requires meticulous attention to detail to ensure the accuracy of financial reporting. Below are the essential steps for successfully filling out this form:

-

Gather Necessary Information:

- Collect partner information, including names, addresses, and Tax Identification Numbers (TINs).

- Compile comprehensive financial records reflecting the partnership’s income, expenses, and deductions for the year.

-

Accurately Report Income:

- Report ordinary business income by reviewing the partnership's financial statements.

- Include all relevant income sources such as rental income and any other applicable earnings.

-

Detail Deductions:

- Prepare a list of all deductible expenses incurred throughout the year.

- Ensure each deduction corresponds to its respective category on the form.

-

Allocate Income and Deductions to Partners:

- Distribute the total income and deductions among partners based on the partnership agreement.

- Each partner's share must correspond with their ownership percentage or agreed-upon allocation method.

-

Review for Accuracy:

- Double-check all entries for accuracy, ensuring all reported figures align with financial records.

- Consider having a tax professional review the completed form to ensure compliance with IRS standards.

-

Submit the Form:

- After verifying the accuracy of the Form F1065SK1, submit it along with any required documentation either through electronic means or by conventional mail.

Accurate completion of the Florida F1065SK1 form is crucial for maintaining compliance and ensuring that partners can report their respective shares of the partnership's income accurately on their individual tax returns.

Important Terms Related to the Florida F1065SK1 2010 Form

Understanding key terms associated with the Florida F1065SK1 2010 form aids in navigating tax reporting and compliance. Familiarity with these terms can facilitate a smoother filing process and enhance knowledge regarding partnership tax obligations. Some important terms include:

- Partnership: A business arrangement where two or more individuals share ownership and operational responsibilities, with profits and losses distributed among partners.

- Schedule K-1 (Form 1065): A supplementary form issued by partnerships to report each partner's share of income, deductions, and credits.

- Distributive Share: The portion of income or loss distributed to a partner, typically calculated based on each partner’s ownership interest.

- Tax Identification Number (TIN): A unique identifier used by the IRS for processing tax returns and payments, essential for all partners.

- Net Income: Total revenue remaining after deducting all expenses, indicating the profitability of the partnership.

Understanding these terms helps partners manage their obligations effectively and promotes better communication with tax professionals when seeking assistance with tax matters.

Who Typically Uses the Florida F1065SK1 2010 Form?

The Florida F1065SK1 2010 form is primarily used by partnerships within the state of Florida that are required to file an informational tax return. The following entities and individuals typically utilize this form:

- Partnerships: General partnerships and limited partnerships that distribute profits to partners must complete this form to report their earnings and allocate tax liabilities accurately.

- Limited Liability Companies (LLCs): Multi-member LLCs often elect to be taxed as partnerships, necessitating the use of this form to report individual partner allocations.

- Tax Professionals: Certified Public Accountants (CPAs) and tax advisors utilize this form to assist their clients in fulfilling tax responsibilities associated with partnership income reporting.

- Partner Individuals: Each partner in the partnership must understand the information on the F1065SK1 to accurately report their income on their personal tax returns.

Overall, the Florida F1065SK1 form serves as a vital tool for various stakeholders involved in partnerships to ensure compliance with tax regulations while accurately reporting financial activities.

Legal Use of the Florida F1065SK1 2010 Form

The legal use of the Florida F1065SK1 2010 form involves compliance with tax laws and regulations set forth by the IRS and Florida state authorities. The following points outline the legal framework surrounding the use of this form:

- IRS Compliance: Partnerships must file the F1065SK1 form as part of their obligation under IRS guidelines. Failure to report accurately may incur penalties or audits.

- Accurate Reporting: Partners are legally bound to report their distributive shares of income and deductions as detailed on the form. Misrepresentation or inaccuracies can lead to serious consequences, including penalties or increased tax liabilities.

- Record Keeping: Partnerships are required to maintain detailed records supporting the amounts reported on the F1065SK1 form. These records must be available for review by tax authorities.

- Confidentiality: Information disclosed on the form, such as partners' TINs, should be handled confidentially to protect sensitive financial data.

- Eligibility Requirements: Only eligible partnerships are permitted to use the F1065SK1 form for reporting, ensuring that only qualifying entities participate under legal regulations.

Legal adherence to the regulations associated with the Florida F1065SK1 form protects partnerships and their partners from potential legal disputes and fosters transparency in financial reporting.