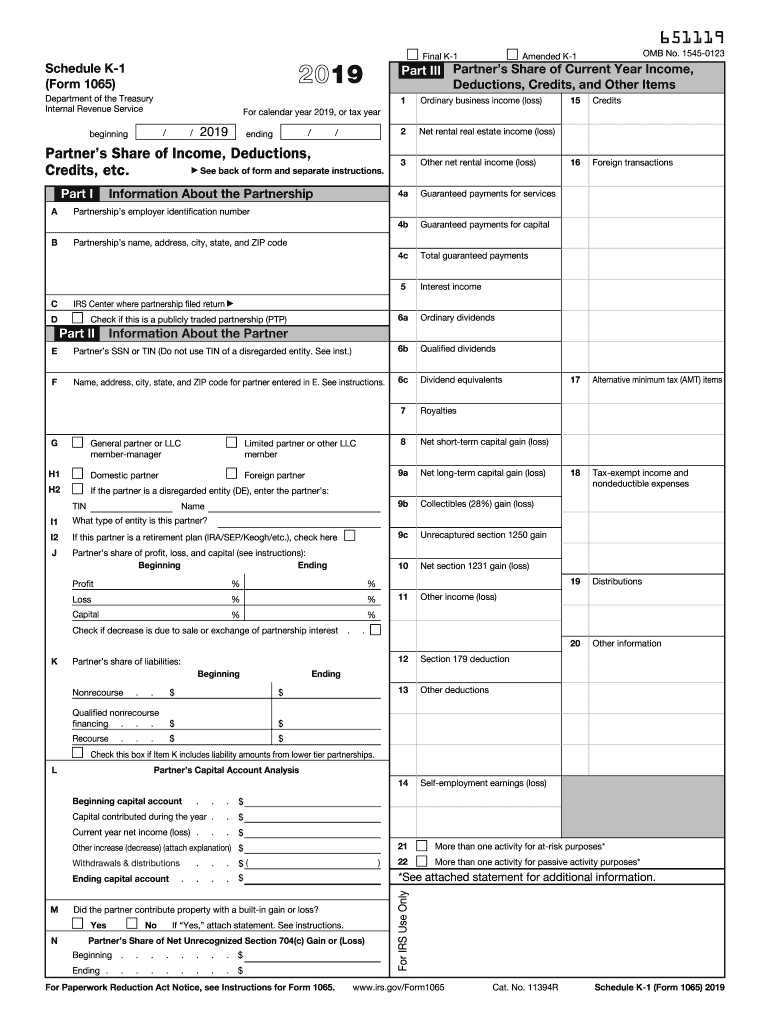

Definition and Overview

Schedule K-1 (Form 1065) is a crucial tax document used by partnerships in the United States to report each partner's share of income, deductions, credits, and other tax-related items. It is a part of the IRS Form 1065, which is filed by partnerships to declare the income, gains, losses, deductions, credits, etc., of the business. This document is essential for partners to complete their personal tax returns, as it outlines their share of the partnership's taxable income or loss. Each partner is required to report the information provided on Schedule K-1 on their individual tax forms, ensuring that the IRS can track the flow of income from businesses to individuals.

How to Use IRS Form 1065 K-1

Partners utilize the K-1 Form to accurately file their personal income taxes. The form details various sections such as ordinary business income, rental income, dividend income, capital gains, and other relevant financial components that must be transferred to personal tax forms, like Form 1040. A comprehensive understanding of each section and its application to personal finances is crucial for accurate tax reporting. Partners need to refer to the guidelines set by the IRS to determine where each figure on the K-1 should be reported on their personal tax returns.

Steps to Complete IRS Form 1065 K-1

Completing the Schedule K-1 involves several meticulous steps. Partnerships must:

- Prepare IRS Form 1065, capturing all partnership financial activities.

- Determine each partner's distributive share of the income, deductions, and credits based on the partnership agreement.

- Fill out individual Schedule K-1 forms for each partner, ensuring accuracy for all listed items.

- Distribute the completed Schedule K-1 to each partner for use in their personal income tax filing.

- Electronically file or mail the completed Form 1065, including all Schedule K-1s, to the IRS before the deadline.

Key Elements of IRS Form 1065 K-1

Schedule K-1 contains critical elements that partners must understand:

- Partner's Identifying Information: Includes the partner's name, address, and social security or tax identification number.

- Partnership's Identifying Information: Contains the partnership's name, address, and employer identification number (EIN).

- Income Sections: Details various types of income, such as business income and capital gains.

- Deductions and Credits: Lists applicable deductions and credits that affect taxable income.

- Partner's Share of Liabilities: Discloses each partner's share of any partnership liabilities.

Legal Use and Importance of IRS Form 1065 K-1

Schedule K-1 is legally required for partnerships and serves a significant role in the tax filing process. It ensures transparency and proper tax reporting between the partnership and its partners. Misreporting or failing to furnish a K-1 can lead to penalties and tax discrepancies. The form's accurate completion and timely distribution help avoid legal complications and ensure compliance with IRS regulations.

Filing Deadlines and Important Dates

The deadline for filing IRS Form 1065, including all K-1 schedules, is typically March 15th following the calendar year the tax period relates to, unless that date falls on a weekend or holiday. For partnerships following a non-calendar fiscal year, the deadline is the 15th day of the third month after the end of the fiscal year. Extensions can be requested using Form 7004, which grants an additional six months.

Who Typically Uses IRS Form 1065 K-1

Schedule K-1 is primarily used by partners in partnerships, which can include Limited Liability Companies (LLCs) taxed as partnerships, limited partnerships, and general partnerships. Each partner, regardless of their role or percentage share in the business, receives a K-1 for their personal tax reporting.

Penalties for Non-Compliance

Failure to file Form 1065 or provide Schedule K-1s to partners can result in significant penalties. The IRS enforces penalties for late filing, incorrect information, and failure to furnish at $210 per missed or incorrect K-1, which can accumulate quickly, severely impacting partnerships financially. Regular updates on reporting requirements, diligent record keeping, and compliance with IRS deadlines are vital to avoid these penalties.

Digital vs. Paper Version

While both digital and paper versions of IRS Form 1065 and Schedule K-1 are accepted by the IRS, electronic filing is encouraged. Digital filing is often faster and reduces the likelihood of errors, as many tax software programs provide guidance and error checks during the process. Electronic filing also speeds up the acknowledgement of receipt by the IRS, helping partnerships ensure they meet filing deadlines.

Software Compatibility

Various tax preparation software solutions, like TurboTax and QuickBooks, help manage the completion and filing of Schedule K-1 forms. These programs often streamline the process by automating calculations and providing step-by-step assistance, reducing the risk of error. Additionally, they often integrate with accounting software, making it easier to pull necessary financial data directly from partnership records.