Definition of the Colorado S Form

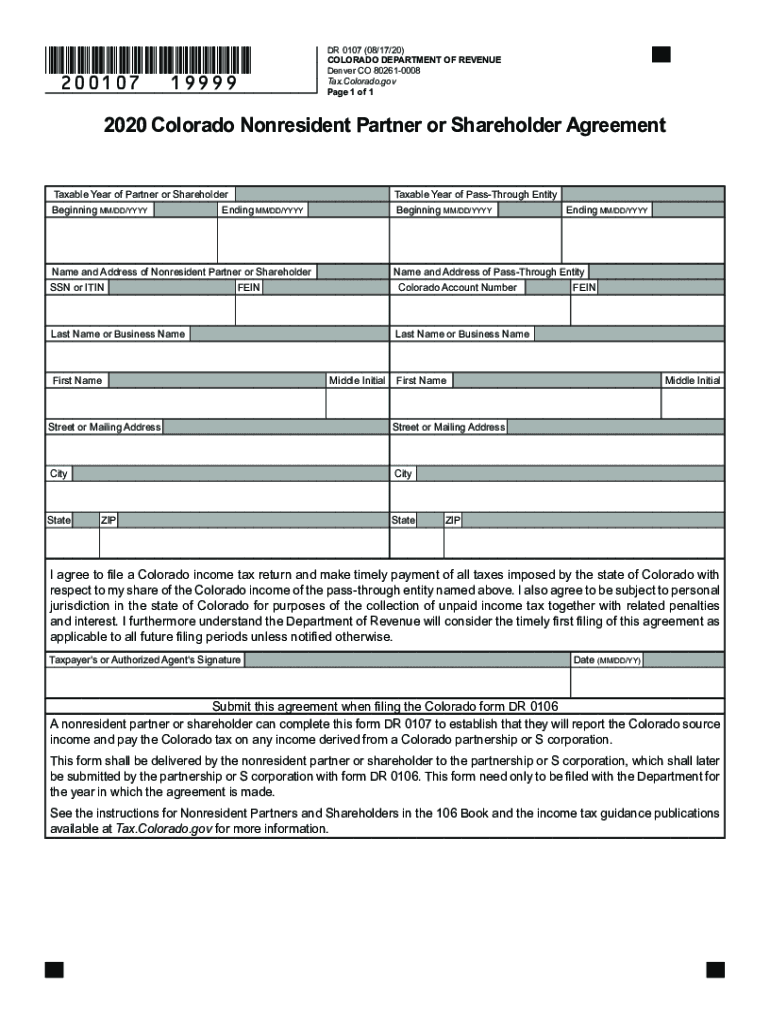

The Colorado S form, officially known as Form DR 0106, is utilized by S Corporations to report corporate income, deductions, and credits to the Colorado Department of Revenue. This form is essential for S Corporations that elect to be treated as pass-through entities for state income tax purposes, aligning with federal tax classification. The income is distributed to shareholders, who then report it on their personal tax returns. This mechanism avoids double taxation at the corporate level, which is a significant advantage for many small business owners. The form must detail total income, deductions, and the distribution of income to shareholders, ensuring compliance with both state and federal tax regulations.

Key elements of the Colorado S Form

- Income Reporting: Detailed reporting of all income sources, including business income and other income types.

- Deductions and Credits: Listing allowable deductions and claiming credits relevant to state taxes.

- Shareholder Information: Information regarding all shareholders must be accurately recorded to show who receives distributed income.

- Tax Liability Calculation: The form calculates the overall tax liability based on the taxable income that flows through to shareholders.

Steps to Complete the Colorado S Form

Completing the Colorado S form requires careful attention to detail, as accurate reporting is crucial to avoid penalties or audits. Here are the steps to successfully fill out Form DR 0106:

-

Gather Necessary Documentation:

- Collect financial records, including profit and loss statements, balance sheets, and previous year filing information.

- Ensure you have all shareholder information, including their ownership percentages and Social Security or Tax Identification Numbers.

-

Input Business Information:

- Fill in the business name, address, and the Colorado Secretary of State ID number.

- Indicate the date of incorporation and the tax year for which the form is filed.

-

Report Income:

- Detail all sources of income, including gross sales, interest, dividends, and other received income.

- Calculate total income using the provided lines on the form.

-

Claim Deductions:

- Identify and enter allowable deductions, which may include business expenses, salaries, and certain tax credits.

- It’s essential to accurately document each deduction to support your entries.

-

Shareholder Allocations:

- Allocate income and deductions to each shareholder based on their ownership percentages.

- Complete the shareholder grid on the form, ensuring each shareholder's pro-rata share of income and deductions is accurate.

-

Final Review and Submission:

- Review the entire form for accuracy and completeness.

- Submit the form electronically or by mail to the Colorado Department of Revenue by the designated deadline.

Important Terms Related to the Colorado S Form

Understanding essential terminology related to the Colorado S form is crucial for compliance and effective communication. Here are some terms that are frequently associated:

- S Corporation: A special type of corporation that meets specific Internal Revenue Code requirements, allowing it to pass income directly to shareholders to avoid double taxation.

- Pass-through Entity: A business entity that does not pay corporate income tax but passes its income on to its owners or shareholders, who then report it on their personal tax returns.

- Shareholder: An individual or entity owning shares in the S Corporation, entitled to receive a portion of the corporate income.

- Filing Status: Indicates how a taxpayer will report their income and tax based on their business structure and personal tax situation.

- Tax Credit: A reduction of a taxpayer's liability that can lower the total taxes owed; some may be applicable to shareholders of S Corporations.

Filing Deadlines / Important Dates

Awareness of filing deadlines for the Colorado S form is vital for compliance and avoiding penalties. The following are key dates:

- Tax Filing Deadline: The Colorado S form DR 0106 must be filed by the 15th day of the fourth month following the end of the fiscal year. For corporations with a calendar year-end (December 31), this is typically April 15.

- Extension Deadline: If an extension is filed, the deadline for submitting the DR 0106 generally falls six months later, resulting in an October 15 due date for calendar-year filers.

- Estimated Payments: If applicable, estimated tax payments for the following year should be made to avoid underpayment penalties.

Who Typically Uses the Colorado S Form

The Colorado S form is primarily used by specific types of entities and individuals in Colorado:

- Small Business Owners: Owners of S Corporations looking to benefit from pass-through taxation to streamline their tax obligations and reduce the overall tax burden.

- Limited Liability Companies (LLCs): LLCs that opt to file as S Corporations for tax purposes often utilize this form to report income and deductions.

- Incorporated Partnerships: Partnerships that have elected S Corporation status may utilize the form to report earnings in compliance with state tax laws.

- Tax Professionals: Accountants and tax advisors prepare and submit the Colorado S form on behalf of their clients, ensuring adherence to applicable regulations and optimizing tax strategy.

This information provides critical insight into the Colorado S form, facilitating easier compliance and understanding for businesses operating within the state.