Definition and Purpose of the 2014 106 Form CO

The 2014 106 form CO refers to the Colorado Corporate Income Tax Return, which is used by corporations to report their income, calculate their tax liability, and claim any applicable tax credits. This form is vital for any corporation conducting business within Colorado, as it ensures compliance with the state’s tax regulations. The 106 form encompasses various details regarding the corporation’s financial activities, including income, deductions, and tax credits. Businesses must accurately complete and submit this form to avoid penalties and ensure proper tax collection based on their reported financials.

Importance of Filing the 2014 106 Form CO

Filing the 2014 106 form CO is critical for several reasons:

- Legal Compliance: Corporations are legally required to file this form to meet state tax obligations.

- Tax Calculation: The form assists in determining the precise tax liability for a corporation, ensuring that they only pay what they are legally obligated to.

- Access to Tax Credits: By filing the form, corporations can identify and claim any eligible tax credits, which can reduce their overall tax burden.

How to Obtain the 2014 106 Form CO

Acquiring the 2014 106 form CO is a straightforward process. Corporations can find and download the form through these methods:

- Colorado Department of Revenue Website: The most reliable source is the official website of the Colorado Department of Revenue, which provides the form in a downloadable PDF format.

- Tax Preparation Software: Many tax software providers include the form as part of their offerings, which can facilitate electronic filing.

- Local Tax Offices: Businesses may also request copies at local offices or receive assistance from tax professionals who are familiar with the filing requirements.

Steps to Complete the 2014 106 Form CO

Completing the 2014 106 form CO involves several essential steps, each aimed at accurately reporting financial information:

-

Gather Financial Documents:

- Collect all relevant documents, including income statements, balance sheets, and prior tax returns.

-

Fill Out Identification Information:

- Provide the corporation’s name, address, and federal employer identification number (EIN) at the top of the form.

-

Report Income:

- Accurately report total income earned by the corporation during the tax year, including dividends and interest.

-

Claim Deductions:

- Identify applicable deductions, which can reduce taxable income significantly. Deductions may include operating expenses and business costs.

-

Calculate Tax:

- Use the tax tables provided by the Colorado Department of Revenue to compute the corporation’s tax liability based on reported income and deductions.

-

Review and Submit:

- Thoroughly review the completed form for accuracy before submitting it. Filing may be done electronically or via mail to the appropriate tax authority.

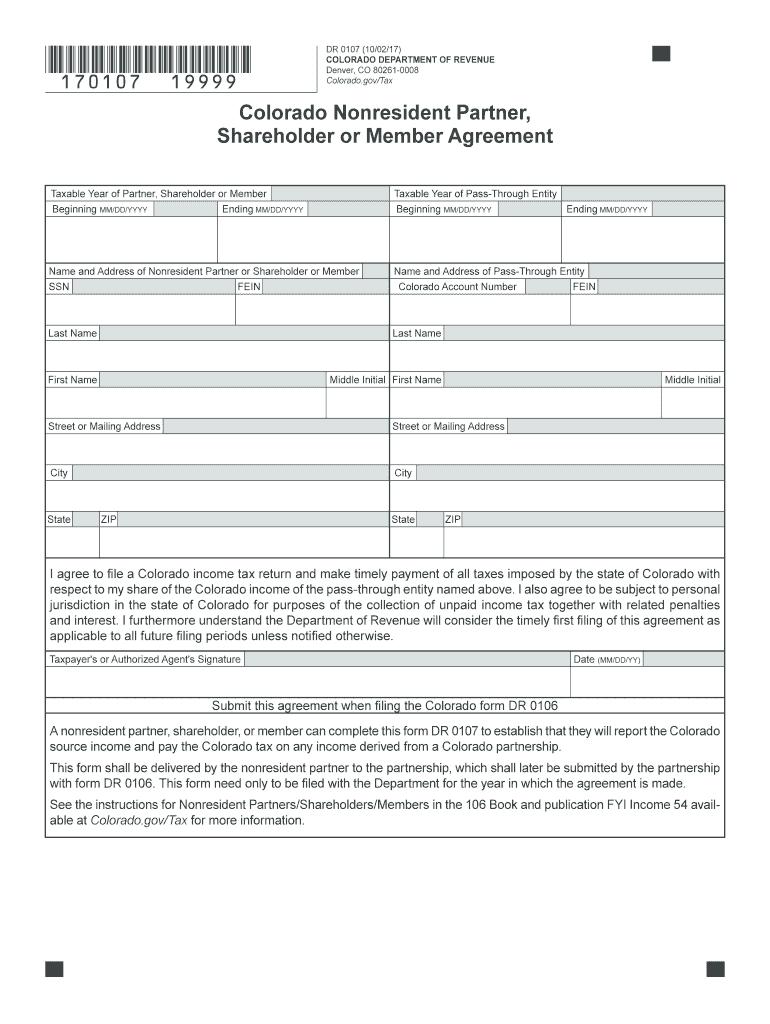

Key Elements of the 2014 106 Form CO

Understanding the essential components of the 2014 106 form CO is crucial for accurate filing. The primary elements include:

- Identification Section: Where the corporation details its name, address, and identification numbers.

- Income Section: A line-by-line breakdown of gross income from various sources.

- Deductions and Adjustments: Essential to maintain compliance and reduce the taxable income base.

- Tax Computation Section: Where the tax owed is calculated based on total income and applicable rates.

- Signatures and Declarations: This section requires authorized personnel from the corporation to sign, certifying the accuracy of the information provided.

Filing Deadlines for the 2014 106 Form CO

Corporations need to be aware of specific deadlines associated with the 2014 106 form CO to ensure timely submission:

- Standard Filing Deadline: The form is typically due on the 15th day of the fourth month following the close of the corporation's tax year.

- Extensions: Corporations may request an extension to file, extending the deadline by six months, but it is important to note that any taxes owed are still due by the original deadline to avoid interest and penalties.

IRS Guidelines for the 2014 106 Form CO

While the 2014 106 form CO is a Colorado-specific form, corporations must still adhere to relevant IRS guidelines regarding federal income reporting. This includes:

- Correct Reporting of Federal Adjusted Gross Income: The income reported on the state form must align with the federal tax return filed with the IRS.

- Consistent Treatment of Deductions: Deductions claimed on the state form should correspond with those reported federally, adhering to IRS regulations on allowable deductions.

- Documentation: Corporations are advised to maintain detailed records supporting all figures reported on both state and federal forms to ensure compliance during audits.

Important Terms Related to the 2014 106 Form CO

Familiarity with key terms associated with the 2014 106 form CO can enhance understanding of the tax reporting process:

- Tax Liability: The total amount of tax that a corporation is legally obligated to pay.

- Deductions: Specific expenses that can be subtracted from total income, reducing the overall taxable income.

- Tax Credits: Dollar-for-dollar reductions in tax liability that can result in lower taxes owed.

- EIN: Employer Identification Number, a unique identifier assigned to a business entity for tax purposes.

Who Typically Uses the 2014 106 Form CO

The 2014 106 form CO is predominantly utilized by:

- Corporations: Traditional C corporations, including large and small entities operating within Colorado.

- S Corporations: Certain S corporations that elect to file under the corporate income tax structure in Colorado may also be required to use this form.

- Limited Liability Companies (LLCs): LLCs that have opted for corporate taxation rather than pass-through taxation must file this form.

Understanding these aspects of the 2014 106 form CO helps ensure that corporations navigate their tax obligations effectively and comply with state requirements. Each section of this form plays a vital role in capturing their financial performance and responsibilities for the tax year.