Overview of Colorado Form 106: Definition & Purpose

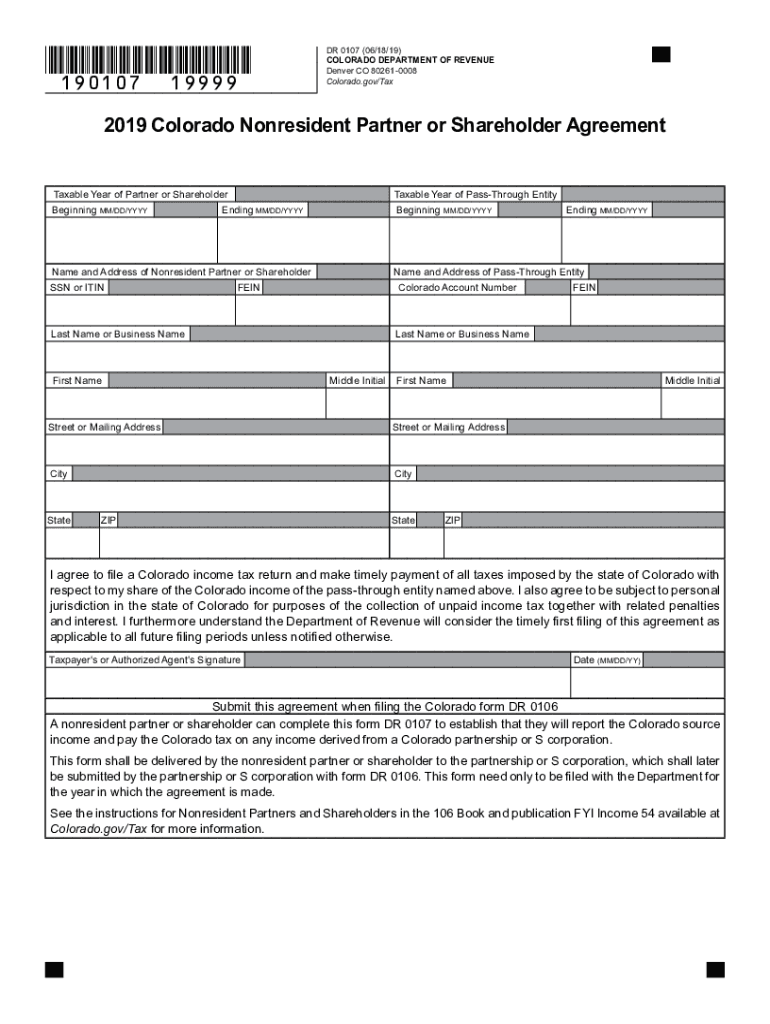

Colorado Form 106, officially known as the DR 0106, is a critical document used for filing income tax returns for multiple entity types, including partnerships and S corporations. This form plays an essential role in reporting Colorado-source income and fulfilling the tax obligations of these entities. It is specifically designed for the state of Colorado and must be utilized by qualified businesses to ensure compliance with state tax regulations.

The purpose of Form 106 encompasses various reporting responsibilities:

- Tax Liability Reporting: It allows partnerships and S corporations to report income earned from activities conducted within Colorado.

- Pass-Through Entities: This form enables these entities to pass income, deductions, and credits to individual partners or shareholders.

- Disclosure of Certain Information: It aids in disclosing pertinent tax-related information to the Colorado Department of Revenue, supporting state-level tax assessment processes.

Understanding the function of Colorado Form 106 is vital for businesses that fall within its scope, ensuring they adhere to legal requirements while accurately reporting income.

Key Elements of Colorado Form 106: A Breakdown

Colorado Form 106 includes several key components that detail the income sources and various adjustments necessary for accurate reporting:

- Income Reporting: The form necessitates reporting all sources of income earned in Colorado, ensuring that any applicable deductions or credits are included.

- Deductions and Adjustments: Specific lines on the form allow businesses to adjust their gross income based on qualifying deductions, aligning tax liability with the financial reality of the entity.

- K-1 Schedules: For S corporations, the form requires distribution of Schedule K-1 to shareholders, detailing each individual's share of the income, deductions, and credits.

Each of these elements plays a crucial role in calculating the overall tax liability, and proper completion is fundamental to comply with state tax laws.

Essential Steps to Complete Colorado Form 106

Completing Colorado Form 106 involves a straightforward process, though careful attention must be given to accuracy. Here are the essential steps:

- Obtain the Form: Access Colorado Form 106 via the Colorado Department of Revenue's website or through an authorized tax preparation service.

- Gather Financial Information: Compile financial documents, including income statements, expense reports, and previous tax returns to provide a comprehensive overview of the entity's financial status.

- Complete the Form: Fill out the required fields for income, deductions, and credit reporting. Ensure that all income earned within Colorado is reported accurately.

- Distribute K-1 Schedules: For S corporations, prepare and distribute Schedule K-1 to each shareholder, ensuring it reflects their correct share of the income and deductions.

- Review and Submit: Check the accuracy of all entries. Submit the completed Form 106 electronically or via mail, adhering to the submission guidelines provided by the state.

Attention to detail in each step will facilitate a smoother filing process and reduce the potential for errors that lead to compliance issues.

Common Filing Deadlines for Colorado Form 106

Timeliness is crucial for filing tax returns, including the Colorado Form 106. The deadlines can vary, but there are general timelines to be aware of:

- Annual Deadline: The filing deadline for Colorado Form 106 usually coincides with the federal tax return due date, which is typically on or around April fifteenth.

- Extensions: If additional time is needed to prepare the return, entities may file for an extension, allowing for a six-month delay. However, any taxes owed must still be paid by the original deadline to avoid penalties.

- Filing Notifications: It is also advisable to monitor any specific notifications from the Colorado Department of Revenue, as deadlines can sometimes be altered based on state policy or changes in tax legislation.

Observing these deadlines ensures compliance and mitigates the risk of incurring penalties for late submissions.

Who Utilizes Colorado Form 106: Typical Entities and General Scenarios

Colorado Form 106 is chiefly utilized by specific types of business entities that are structured as partnerships or are classified as S corporations. The primary users include:

- Partnerships: These entities are often formed for various business ventures and require Form 106 to report their income effectively.

- S Corporations: This designation allows for pass-through taxation, benefiting shareholders, who also utilize the K-1 provided with the Form 106.

- Limited Liability Companies (LLCs): If classified as partnerships or S corporations for tax purposes, LLCs are also required to file Form 106.

Understanding the various entities that utilize this form helps delineate its significance in the larger context of state taxation and business compliance.

Important Terms Related to Colorado Form 106

Familiarizing oneself with specific terminology related to Colorado Form 106 can enhance understanding and facilitate accurate and efficient tax filing:

- Pass-Through Entities: Business structures that allow income to pass through to the owners' personal tax returns, avoiding double taxation.

- Schedule K-1: A tax document used to report income, deductions, and credits to shareholders or partners required to file individual tax returns.

- Colorado-source Income: Income generated from activities or transactions conducted within the boundaries of Colorado, which is subject to state taxation.

- Estimated Payments: Payments made quarterly towards expected tax liabilities, which can be crucial for reducing end-of-year tax burdens.

Clarifying these key terms aids in comprehending the entirety of the tax obligations outlined within Colorado Form 106.

Legal Use of Colorado Form 106: Implications for Compliance

The use of Colorado Form 106 is not only a matter of financial accuracy; it is also a legal obligation under Colorado law. Entities that fail to file the form or inaccurately report income may face several consequences, including:

- Fines and Penalties: Non-compliance can incur financial penalties, which may escalate the longer the filing is delayed.

- Audit Risks: Incomplete or suspect filings raise red flags and may result in audits by the Colorado Department of Revenue.

- Increased Tax Liability: Erroneous filings could lead to incorrect tax calculations, potentially resulting in higher tax liabilities and interest charges.

Ensuring that Colorado Form 106 is correctly completed and submitted is paramount for maintaining compliance and avoiding the aforementioned repercussions.