Definition and Purpose of Colorado Form 106

Colorado Form 106 is an essential tax document specifically designed for partnerships and S corporations operating within the state of Colorado. This form allows these entities to report their income, deductions, and credits to the Colorado Department of Revenue. The filing of Form 106 is crucial for compliance with state tax regulations and for determining the tax liability of nonresident partners and shareholders.

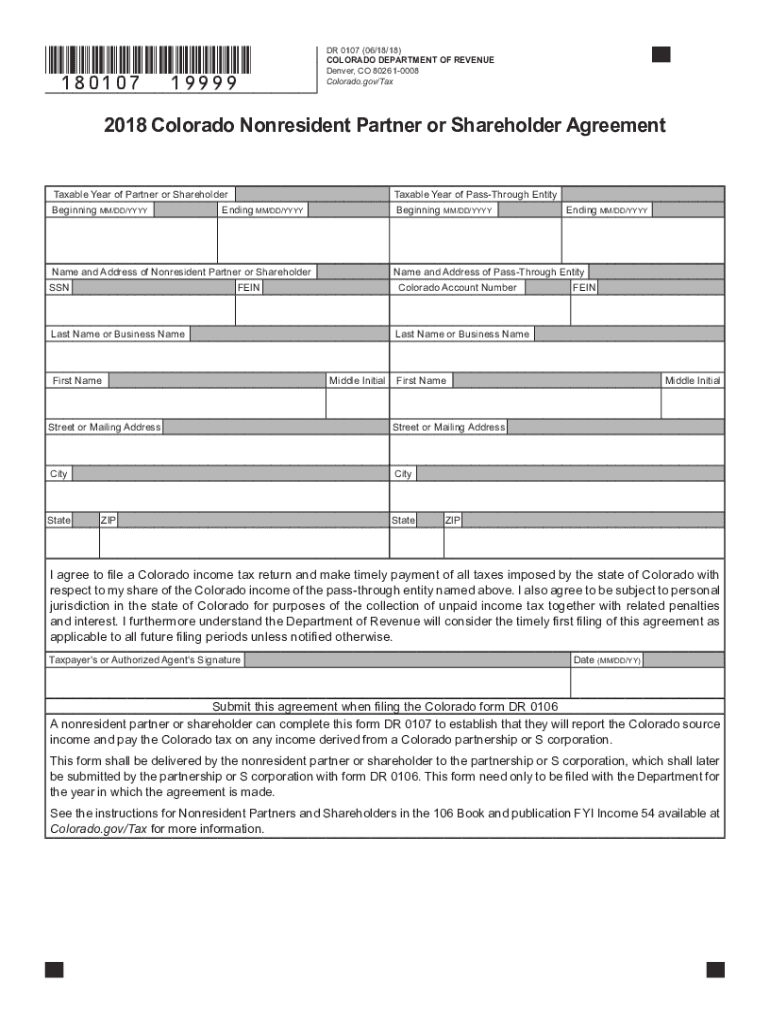

Key Features of Colorado Form 106

- Entity Type: Specifically for partnerships and S corporations.

- Filing Requirement: Necessary for reporting state taxes due on the income generated within Colorado.

- Tax Calculation: Used to calculate the partnership or S corporation's state tax obligations.

This form is particularly important for entities with nonresident partners or shareholders, as it facilitates compliant reporting and tax payment.

Steps to Complete the Colorado Form 106

Completing the Colorado Form 106 requires careful attention to detail. Follow these sequential steps to ensure accurate filings:

-

Gather Required Information: Collect all relevant financial documents, including income statements, deduction records, and information about partners or shareholders.

-

Access the Form: Form 106 can be accessed through the Colorado Department of Revenue's website or obtained from tax preparation software.

-

Fill Out Entity Information: Provide details about the partnership or S corporation at the top of the form, including the name, address, and federal Employer Identification Number (EIN).

-

Report Income and Deductions: Input total income and applicable deductions in their corresponding sections. This includes ordinary income, dividends, and capital gains.

-

Calculate Taxable Income: Subtract total deductions from total income to determine the taxable income.

-

Complete Tax Calculation: Use the applicable tax rate based on the taxable income to calculate the total tax liability.

-

Finalize Partner Distributions: Allocate any income or loss to each partner or shareholder, as they will report this on their individual state tax returns.

-

Review the Information: Double-check all entries for accuracy, ensuring that all calculations are correct.

-

Submit the Form: File the completed form electronically or submit it by mail to the appropriate address provided in the form instructions.

Important Filing Deadlines for Colorado Form 106

Adhering to filing deadlines is crucial for maintaining compliance and avoiding penalties. The following are key deadlines associated with Colorado Form 106:

- Annual Filing Deadline: Colorado Form 106 is typically due on the 15th day of the fourth month following the close of the fiscal year. For calendar year filers, this means the deadline is April 15.

- Extensions: Partnerships and S corporations can apply for a six-month extension, which extends the deadline to October 15.

Penalties for Late Filing

- Late Fees: Submitting Form 106 after the due date may result in late filing penalties.

- Interest on Owed Taxes: Interest can accrue on any taxes not paid by the due date.

Required Documents for Colorado Form 106

When completing Colorado Form 106, having the necessary documents and information at hand is essential for accuracy. The following documents are typically required:

- Financial Statements: Income statements, balance sheets, and other relevant financial data.

- K-1 Forms: Schedule K-1 for each partner or shareholder, which details their respective share of income, deductions, and credits.

- Supporting Documentation: Receipts or statements justifying expenses claimed as deductions and other relevant financial records.

Submission Methods for Colorado Form 106

Colorado Form 106 can be submitted through various methods, allowing taxpayers flexibility in how they file. The available submission methods include:

Electronic Filing

- Online Submission: Taxpayers can file electronically using the Colorado Department of Revenue's online services, which is recommended for its efficiency and speed.

Paper Filing

- Mail Submission: For those who prefer traditional methods or do not have access to electronic filing, Form 106 can be printed and mailed to the designated tax office. Ensure to use the correct address specified in the form's instructions.

Key Elements of Colorado Form 106

Understanding the components of Colorado Form 106 is essential for effective completion. Some of the key elements include:

- Entity Information: Details about the partnership or S corporation.

- Income Section: Areas to report total income, including ordinary income and gains from asset sales.

- Deductions Section: Space to list deductions that lower taxable income, such as operational expenses.

- Tax Liability Calculation: Provides a framework for determining the amount of tax owed based on reported figures.

These elements collectively contribute to a transparent and accurate tax reporting process.