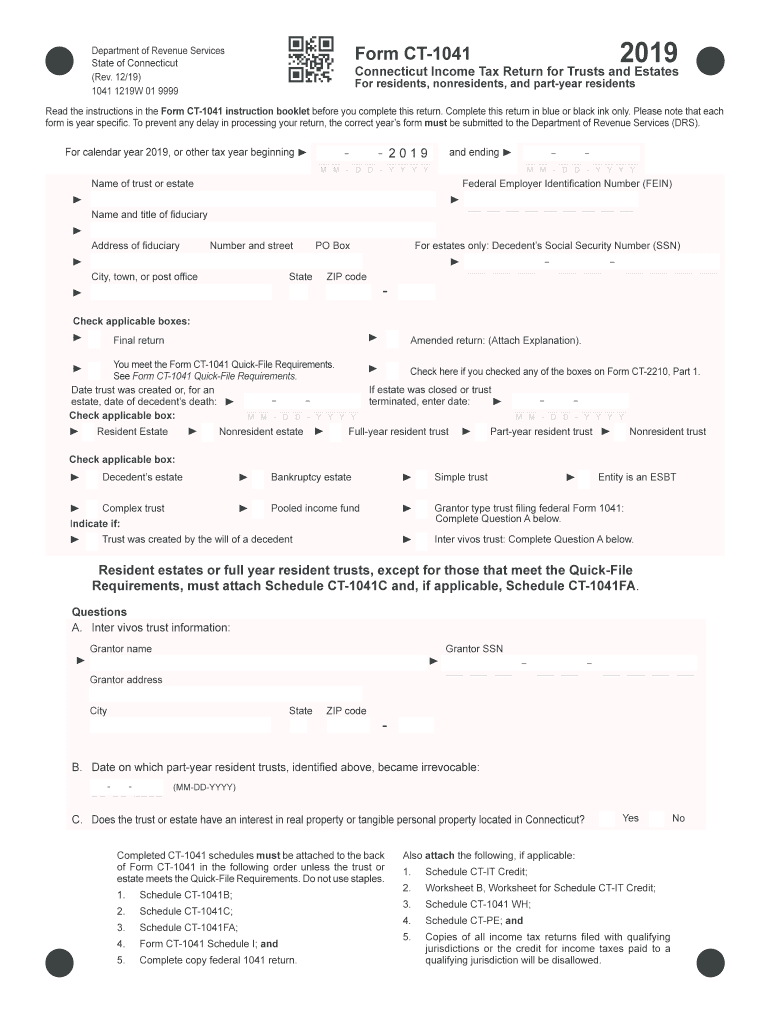

Definition & Meaning of the CT 1041 Form

The CT 1041 form is the Connecticut Income Tax Return specifically designed for trusts and estates. This form is essential for reporting income generated by trusts or estates within the state of Connecticut. The form allows the fiduciary or trustee to compute the taxable income, deductions, and ultimately, the tax due on behalf of the trust or estate.

The CT 1041 form requires the disclosure of various types of income that the trust or estate may generate, including interest, dividends, and capital gains. Additionally, it provides specific sections for detailing any distributions made to beneficiaries, which is critical as these may affect the taxable income reported by the trust or estate.

Using the CT 1041 form accurately is fundamental to ensure compliance with Connecticut tax laws, and it requires meticulous attention to detail, particularly regarding the correct categorization of income and the application of state-specific deductions.

Key Elements of the CT 1041 Form

The CT 1041 form comprises various sections that serve distinct purposes. Understanding these key elements is crucial for accurate completion:

- Trust or Estate Information: Identifying details including the name, address, and federal employer identification number (EIN) of the trust or estate.

- Income Section: This includes lines for reporting various income types such as taxable interest, dividends, and capital gains from asset sales.

- Deductions: The form provides areas for listing allowable deductions, which can include administrative expenses, management fees, and certain distributions to beneficiaries.

- Tax Computation: This section helps in calculating the total tax liability on the income reported, using appropriate tax rates applicable for the tax year.

- Signature Section: The form must be signed by the fiduciary or the individual responsible for the trust or estate, affirming the accuracy of the information provided.

By thoroughly understanding each of these elements, individuals responsible for filing can reduce errors and avoid potential penalties from incorrect submissions.

Steps to Complete the CT 1041 Form

Completing the CT 1041 form involves several structured steps to ensure compliance and accuracy:

- Gather Documentation: Collect all necessary income documentation related to the trust or estate. This includes bank statements, investment summaries, and any records of distributions made to beneficiaries.

- Fill Out Basic Information: Enter the name, address, and EIN of the trust or estate at the top of the form.

- Report Income: Accurately input income figures in the given sections. It's crucial to categorize the income correctly based on its nature—such as interest and dividends.

- List Deductions: Identify and list all allowable deductions that are applicable to the trust or estate. Ensure that necessary documentation supports claims for these deductions.

- Calculate Tax Liability: Utilize the tax computation section to determine the total tax due based on the reported income and deductions. Use the appropriate rates based on the income brackets for the applicable tax year.

- Complete Signature Protocol: Ensure the fiduciary or responsible party signs the completed form, verifying the information's accuracy before submission.

These steps, when followed diligently, contribute significantly to ensuring that the CT 1041 form is accurately completed, minimizing the risk of delays or penalties.

Filing Deadlines and Important Dates for the CT 1041 Form

Understanding the deadlines associated with the CT 1041 form is critical for ensuring timely filing and avoiding unnecessary penalties. The general filing deadline for the form coincides with the federal income tax return deadline, typically April 15. However, for trusts and estates, if the return is due on a weekend or holiday, it is extended to the next business day.

- Extensions: Fiduciaries can request a six-month extension to file the CT 1041 form, typically extending the deadline to October 15. However, any taxes owed must be paid by the original deadline to avoid interest and penalties.

- Amended Returns: If discrepancies are discovered after submission, an amended CT 1041 form should be filed promptly to correct any errors.

Awareness of these important dates helps fiduciaries ensure compliance with Connecticut tax regulations and maintain good standing with tax authorities.

Important Terms Related to the CT 1041 Form

Familiarity with key terminology associated with the CT 1041 form enhances understanding and ensures accurate reporting:

- Fiduciary: Refers to the individual or entity that manages and administers the trust or estate.

- Beneficiary: An individual or entity designated to receive assets or income from the trust or estate.

- Taxable Income: The income amount that is subject to tax after deductions are applied.

- Distributions: Payments made from the trust or estate to beneficiaries that may affect the overall taxable income reported.

- EIN (Employer Identification Number): A unique identification number assigned to trusts or estates for tax purposes.

Understanding these terms enables the fiduciary to navigate the CT 1041 form with confidence and accuracy, ensuring the relevant aspects are correctly addressed.

Legal Use of the CT 1041 Form

The CT 1041 form has several legal implications that must be adhered to during its completion and filing. The form serves as the official declaration of the trust's or estate's income and tax obligations to the state of Connecticut, and failing to file it correctly may result in legal penalties.

- Compliance with State Law: The form must be filled out in compliance with Connecticut tax law, requiring an accurate representation of income, deductions, and distributions.

- Record Keeping: Legal requirements mandate that all documentation pertaining to the sources of income and deductions be retained for a specific period in case the state requires verification of the information reported.

- Audit Trail: In the event of audits by the state tax authority, the CT 1041 form serves as an essential piece of documentation providing proof of compliance with tax obligations.

By understanding the legal dimensions surrounding the CT 1041 form, fiduciaries can ensure that they meet all obligations and safeguard against potential legal repercussions.