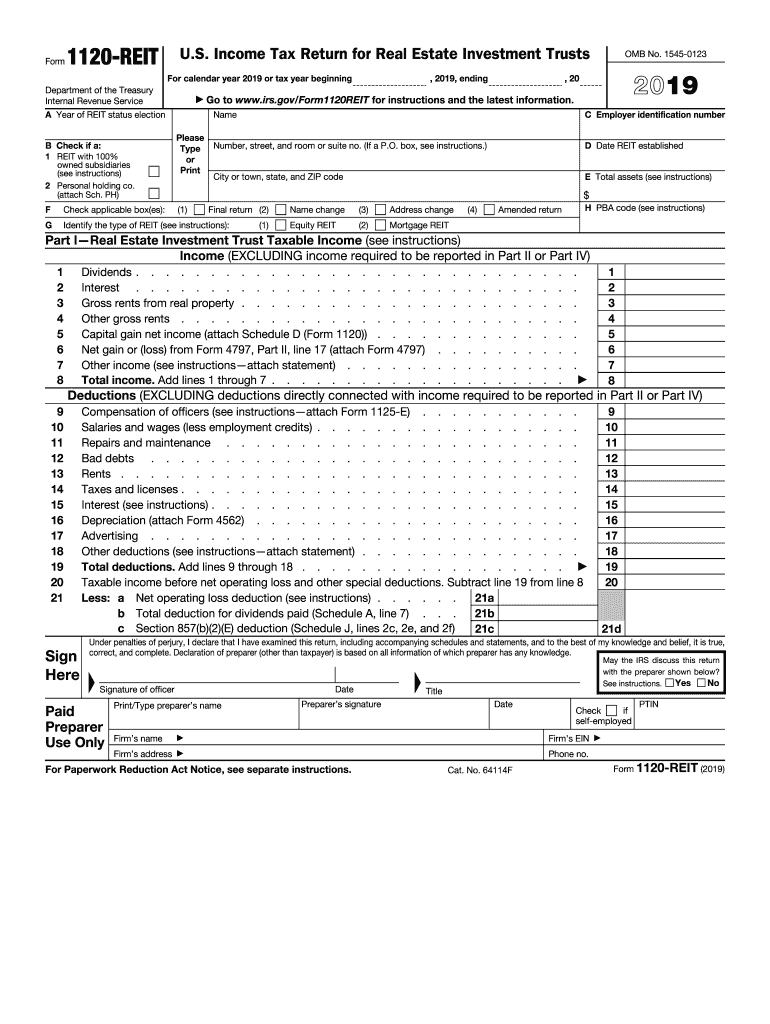

Definition & Meaning of Form 1120-REIT

Form 1120-REIT is the U.S. federal income tax return specifically designated for Real Estate Investment Trusts (REITs). It is used by qualifying entities to report income, deductions, and tax liabilities uniquely associated with their operations as a REIT. The form is essential for compliance with the Internal Revenue Service (IRS) regulations and outlines how the organization meets the legal requirements to maintain its REIT status, including income distribution requirements and adherence to certain operational structures.

- REIT Basics: To qualify as a REIT, an entity must primarily invest in real estate, derive at least 75% of its gross income from real estate-related sources, distribute at least ninety percent of its taxable income as dividends to shareholders, and have a structured corporate governance model compliant with IRS rules.

- Importance of Form 1120-REIT: Filing this form accurately is critical for tax compliance. Failure to meet requirements can lead to losing REIT status, which can have significant tax implications.

How to Use the Form 1120-REIT

The 1120-REIT is primarily used to report the financial activities of a REIT for a specific tax year. Understanding its structure is essential for ensuring accurate reporting.

- Reporting Requirements: Entities must report their total income sources, including rents, interest, and capital gains.

- Deductions: The form allows for various deductions, such as operating expenses, depreciation, and interest expenses, which can significantly influence the taxable income figure.

- Dividend Distributions: Entities must report the dividends paid to shareholders. Meeting the minimum distribution requirement (at least 90% of taxable income) is crucial for maintaining REIT status.

Steps to Complete Form 1120-REIT

Filling out Form 1120-REIT involves several critical steps that require attention to detail.

- Gather Necessary Information: This includes financial statements, records of income, and itemized deductions for the year.

- Complete Basic Information: Fill out the entity's legal name, address, Employer Identification Number (EIN), and the calendar year for which the form is being submitted.

- Income Reporting: Accurately report all income sources on the first page, including rental income and any gains.

- Deductions and Credits: Utilize the proper sections to list deductions, ensuring that those related to the operations and investment properties are included.

- Distributions: Calculate and report the dividends paid to shareholders.

- Sign and Submit: Ensure the form is signed by an authorized officer and submit it via the chosen method—either electronically or by mail.

Important Terms Related to Form 1120-REIT

Understanding terminology used in and around Form 1120-REIT is essential for effective communication and compliance.

- Qualified REIT Income: Income that meets the specific IRS requirements to qualify as income derived from real estate operations.

- Taxable Income: The income that is subject to taxation after applying relevant deductions and exemptions.

- Prohibited Transactions: Transactions that can jeopardize REIT status, such as selling property held for less than a year or engaging in certain activities that do not align with the REIT’s operational goals.

IRS Guidelines for Filing Form 1120-REIT

The IRS outlines specific guidelines that must be followed when filing Form 1120-REIT.

- Filing Deadlines: Generally, Form 1120-REIT is due on the fifteenth day of the fourth month following the close of the taxable year.

- Record-Keeping Requirements: REITs must maintain accurate financial records for all income, expenses, and distributions, as these documents may be required in the case of an IRS audit.

- Compliance with REIT Regulations: The form must demonstrate adherence to REIT qualifications, including income distribution and corporate structure.

Filing Deadlines for Form 1120-REIT

Adhering to filing deadlines is crucial for REITs to maintain compliance with IRS requirements.

- Standard Due Date: Form 1120-REIT must typically be filed by the fifteenth day of the fourth month after the end of the tax year.

- Extensions: If additional time is needed, filing for an extension (Form 7004) is permissible, which grants an automatic six-month extension. Accurate planning can prevent late penalties.

Required Documents for Form 1120-REIT

To successfully complete Form 1120-REIT, certain documents are necessary.

- Financial Statements: Accurate income statements and balance sheets detailing revenue and expenses are needed.

- Dividend Reports: Documentation of all dividends paid to shareholders throughout the tax year is critical.

- Supporting Schedules: Any applicable schedules that delineate specific income types, deductions, or special accounts must accompany the form to provide full transparency.

Digital vs. Paper Version of Form 1120-REIT

Both digital and paper versions of Form 1120-REIT are available, with varying benefits depending on the method chosen.

- Digital Filing: Electronic submission is encouraged as it typically ensures faster processing times and may reduce errors. Users can often receive immediate confirmations of submission.

- Paper Filing: While this method may be preferred by some, it generally requires more time for processing, and there is a risk of delay or loss within the postal system.

Penalties for Non-Compliance with Form 1120-REIT

Failure to comply with submission and reporting requirements can lead to significant penalties for REITs.

- Financial Penalties: Non-compliance can result in fines assessed for failure to file, failure to pay taxes owed, or inaccuracies in reporting.

- Loss of REIT Status: Serious infractions might result in the loss of REIT designation, leading to tax liabilities that significantly differ from those applied to a REIT. This may lead to higher taxation on previously untaxed income.