Definition and Purpose of the 2015 Form 1120-REIT

The 2015 Form 1120-REIT is the U.S. Income Tax Return specifically designed for Real Estate Investment Trusts (REITs). This form is utilized by REITs to report their taxable income, deductions, and overall tax liability for the tax year 2015. Form 1120-REIT is crucial for establishing compliance with IRS regulations and fulfilling the tax obligations associated with income derived from real estate investments.

Key Functions of Form 1120-REIT

-

Income Reporting: REITs must report various income sources, including rental income, capital gains, and dividends received from other REITs.

-

Deductions: The form allows REITs to claim deductions related to dividends paid to shareholders, thereby reducing taxable income.

-

Tax Computation: It includes sections for calculating tax due on taxable income, factoring in any tax credits or other adjustments.

Understanding the specifics of this form is essential for REIT professionals and stakeholders, as it not only impacts tax liabilities but also the strategic management of real estate investments.

How to Obtain the 2015 Form 1120-REIT

The 2015 Form 1120-REIT can be accessed through several avenues. While it is available on the official IRS website, it is important to ensure that you are downloading the correct version for the 2015 tax year.

Methods of Acquisition

-

IRS Website: Navigate to the IRS.gov forms repository and search for "Form 1120-REIT" in the search bar. Download the PDF directly from the website.

-

Tax Preparation Software: Many tax preparation software programs automatically include Form 1120-REIT within their offerings, allowing businesses to fill it out electronically.

-

Professional Accountants or Tax Advisors: Consulting with a tax professional can provide guidance and access to the necessary forms, along with the benefit of expert advice on completion and submission.

Ensuring you have the correct form and the latest instructions is crucial for compliance and accuracy in tax filings.

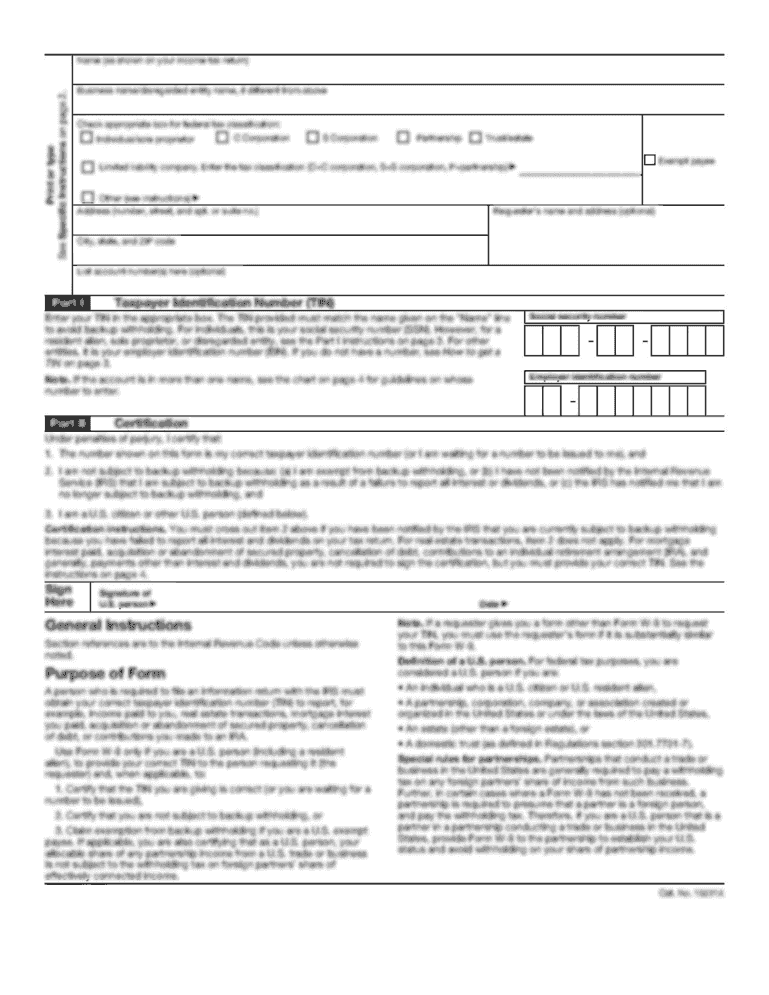

Steps to Complete the 2015 Form 1120-REIT

Completing the 2015 Form 1120-REIT involves following specific steps to ensure that all required information is accurately reported. Each section of the form has its own importance, and detailed attention must be paid to the instructions.

Detailed Completion Process

-

Identification Information: Fill in the REIT's name, address, and Employer Identification Number (EIN) at the top of the form.

-

Income Calculation:

- Report income from rents and other real estate sources.

- Include capital gains and any other applicable income.

-

Deductions Section:

- Input the dividends paid to shareholders.

- Include operational expenses and allowable deductions.

-

Tax Calculation: Calculate the taxable income using the reported income and deductions, and determine the tax due.

-

Signature and Filing: Ensure that the form is signed by an authorized individual and submitted according to IRS guidelines.

Important Tips

- Review each section thoroughly for accuracy.

- Consult IRS instructions for specific line items if there is uncertainty.

- Retain a copy of the completed form for your records.

This step-by-step approach simplifies the complexities of the form while ensuring compliance with tax regulations.

Important Terms Related to 2015 Form 1120-REIT

Familiarity with specific terminology is essential for navigating the 2015 Form 1120-REIT and understanding its implications on taxation for REITs.

Key Terms Explained

-

REIT (Real Estate Investment Trust): A corporation that owns, operates, or finances income-producing real estate.

-

Taxable Income: The earnings of a REIT after deductions and exceptions are applied.

-

Dividends Paid Deduction: A tax deduction that REITs can claim for distributions made to shareholders, which directly reduces taxable income.

-

Prohibited Transactions: Certain types of transactions that a REIT must avoid to maintain its tax-favored status.

Understanding these terms enhances comprehension of the form and its requirements, facilitating better preparation and filing.

IRS Guidelines for Filing the 2015 Form 1120-REIT

The Internal Revenue Service provides specific guidelines for filing Form 1120-REIT that are crucial for compliance. Familiarity with these guidelines helps ensure that all filings are correct and submitted on time.

Filing Requirements and Recommendations

-

Filing Deadline: The form is typically due on the fifteenth day of the third month after the end of the REIT’s tax year. For 2015, this means the deadline was March 15, 2016, unless an extension was requested.

-

Method of Submission: REITs can file the form electronically or via mail. It is advisable to confirm that submissions comply with IRS electronic filing standards if filing electronically.

-

Record Keeping: Maintain detailed records of income, deductions, and supporting documents for at least three years, as the IRS may audit these records.

Following these guidelines is essential to avoid penalties and ensure that REITs maintain their favorable tax status.

Key Elements of the 2015 Form 1120-REIT

The 2015 Form 1120-REIT is composed of various sections that need to be filled out accurately to capture the financial activity of a REIT for the tax year.

Major Components Breakdown

-

Part I: Income: This part requires detailed reporting of total income from multiple sources, emphasizing real estate income.

-

Part II: Deductions: Here, organizations list eligible deductions, critical for reducing taxable income.

-

Part III: Tax Computation: This section outlines how to calculate the tax owed based on taxable income and includes important tax credits.

-

Schedule C: Dividends Paid: This schedule provides the necessary details for calculating the dividends paid deduction, allowing for tax-efficient distribution strategies.

By understanding and effectively managing each element of the form, REITs can optimize their tax position and ensure compliance with reporting requirements.

Penalties for Non-Compliance with the 2015 Form 1120-REIT

Filing the 2015 Form 1120-REIT correctly and on time is critical for all REITs. Non-compliance can lead to significant penalties and complications.

Potential Consequences of Filing Errors

-

Late Filing Penalties: If Form 1120-REIT is not filed by the deadline, the IRS may impose a penalty based on the number of days the form is late.

-

Accuracy-Related Penalties: Mistakes in reported income, deductions, or claims for credits can lead to additional penalties if the IRS determines there has been negligence or substantial understatement of income.

-

Loss of REIT Status: Missing filing deadlines or incorrectly filing the form may result in a REIT losing its tax status, with serious tax implications, including being taxed at higher corporate rates.

Compliance with filing requirements and a thorough understanding of the penalties associated with Form 1120-REIT are essential for maintaining a REIT's favorable tax standing.