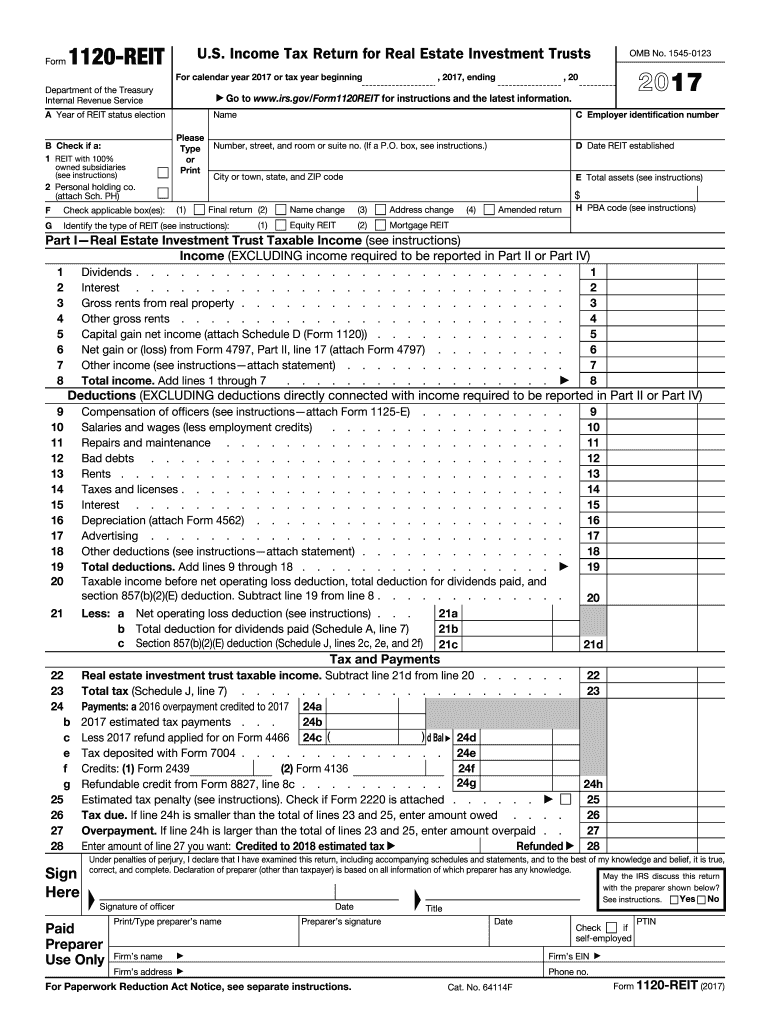

Definition and Meaning of 2017 Form 1120-REIT

The 2017 Form 1120-REIT is the U.S. Income Tax Return specifically designed for Real Estate Investment Trusts (REITs). It serves as a crucial tax document filed by REITs to report their financial activities to the Internal Revenue Service (IRS) for the tax year. The form encompasses various sections dedicated to reporting taxable income, deductions, and taxes on net income derived from foreclosure properties. Additionally, it contains schedules that facilitate the calculation of dividends paid and help reconcile the income reported on the books with that reported on the return.

Understanding Form 1120-REIT is essential for compliance with the U.S. tax code, particularly for organizations that elect to be treated as REITs. By adhering to the specific guidelines set forth by the IRS, these entities can often benefit from tax deductions and avoid double taxation on certain income types. The form also delineates requirements for maintaining REIT status while reporting necessary financial data accurately.

Key Components of the Form

- Taxable Income Reporting: Detail income earned from rental properties, sales of real estate, and other related activities.

- Deductions: Include allowances for depreciation, interest expenses, and other business-related costs.

- Dividends Calculation: Report dividends distributed to shareholders, a mandatory requirement for REIT classification.

- Schedule Reconciling Income: Align financial records with IRS reporting requirements to ensure consistency and accuracy.

How to Use the 2017 Form 1120-REIT

Utilizing the 2017 Form 1120-REIT requires an understanding of each section of the form, as accurate completion ensures compliance with IRS regulations. The document is structured to guide users through relevant financial data entry while also providing prompts for different schedules that may be necessary to elaborate on specific transactions.

Steps to Use the Form

- Gather Financial Records: Collect all relevant financial statements, including profit and loss statements and balance sheets.

- Complete the Basic Information Section: Enter essential details such as the REIT's name, address, and Employer Identification Number (EIN).

- Report Revenue: Detail all income sources including rental income, interest income, and capital gains from asset sales.

- Deductions Section: List permissible deductions such as property depreciation and operating expenses.

- Schedule Dividends: Accurately report dividends paid to shareholders to maintain regulatory compliance.

- Sign and Date the Return: Ensure the authorized representative of the entity properly signs and dates the form before submission.

Adhering to these steps is imperative in ensuring that the form is filled out completely and accurately, reducing the risk of errors that could lead to compliance issues.

Obtaining the 2017 Form 1120-REIT

To begin the process of filing, the 2017 Form 1120-REIT can be acquired through several official channels, ensuring that the correct version is used for the tax reporting period.

Sources for Obtaining the Form

- IRS Website: The form is available for download directly from the IRS's official site in PDF format. This ensures that users access the most current version.

- Tax Software Programs: Many tax preparation software platforms include Form 1120-REIT as part of their offerings, simplifying the filing process.

- Tax Professionals: Certified public accountants (CPAs) or tax advisors can provide the form and assist with its completion based on the unique financial circumstances of the REIT.

Using the latest version is essential for compliance, as prior iterations may contain outdated data requirements or classifications.

Steps to Complete the 2017 Form 1120-REIT

Completing the 2017 Form 1120-REIT involves a systematic approach to ensure all financial data is captured accurately. Each section of the form is interrelated, and understanding the flow will help in meticulously filling it out.

Detailed Breakdown of the Completion Process

- Fill Out Identification Information: Begin by entering the basic identification details, including the REIT's name and address.

- Income Reporting:

- Report gross rental income, including any uncollectible rents.

- Document any sales of real estate or other operational income.

- Expenses and Deductions:

- Outline operational costs such as maintenance, repair expenses, and utilities.

- Include depreciation calculations using IRS guidelines to represent the value loss of properties owned by the REIT.

- Schedule of Dividends:

- Recount all dividends declared and distributed during the tax year.

- Ensure that the amounts align with shareholder agreements and accounting records.

- Finalize Review:

- Double-check all sections for accuracy.

- Confirm alignment with supporting documentation to mitigate discrepancies.

- Submission:

- Determine the submission method, whether online e-filing or mailing a paper copy, and follow the necessary procedure accordingly.

Following these steps comprehensively helps in minimizing errors and enhances compliance, safeguarding against potential audits or penalties.

Important Terms Related to the 2017 Form 1120-REIT

Understanding key terms associated with the 2017 Form 1120-REIT is crucial for effective navigation of the tax obligations tied to REITs. Each term denotes significant aspects of the filing process and can impact strategic decision-making within the organization.

List of Key Terms

- Real Estate Investment Trust (REIT): An entity that owns, operates, or finances income-generating real estate, adhering to specific IRS regulations.

- Dividends: Payments made to shareholders, which must meet specific distribution requirements under IRS rules to maintain REIT status.

- Taxable Income: The portion of income subject to tax, excluding allowable deductions and adjustments.

- Depreciation: A method of allocating the cost of tangible assets over their useful lives, recognized in tax filings to minimize taxable income.

- Foreclosure Property: Property that was acquired through foreclosure, which has specific tax implications regarding its income.

- Audit Trail: A comprehensive log used to trace the origins and changes made to financial records, pertinent in maintaining compliance and clarity in filings.

Incorporating these terms into overall tax planning and reporting ensures clarity and helps in aligning with IRS expectations, ultimately facilitating better management of tax liabilities.