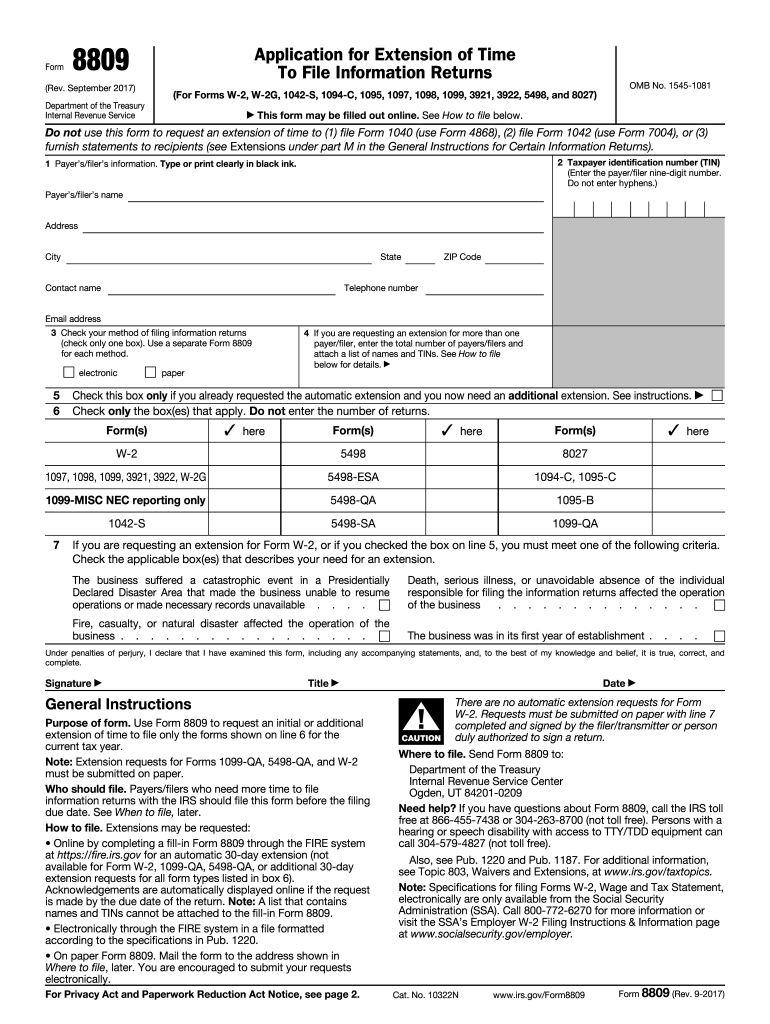

Definition and Purpose of Form 8

Form 8809, officially named the "Application for Extension of Time to File Information Returns," is a crucial document used to request additional time from the Internal Revenue Service (IRS) for filing various information returns, such as Forms W-2 and 1099. The primary purpose of Form 8809 is to provide taxpayers and businesses a structured method to officially request an extension, thus preventing late filing penalties and ensuring accurate reporting of necessary information. The form does not extend the deadline for sending out copies to recipients, thus planning is essential.

Eligibility Criteria for Using Form 8

Eligibility to file Form 8809 is broad, but it is vital to ensure that the criteria align with the purpose of requesting more time to file different types of information returns. Entities such as corporations, partnerships, trusts, estates, and certain individuals responsible for submitting information returns can apply for an extension. It is essential that the filer determines whether an automatic 30-day extension applies or if a second extension can be requested for specific forms. Each case should be evaluated to understand the specific form requirements and deadlines.

IRS Guidelines and Compliance

The IRS provides detailed guidelines to ensure proper completion and submission of Form 8809. Familiarity with IRS regulations concerning the form is critical for compliance. As part of compliance, it is necessary to submit the form before the original due date of the returns for which an extension is being sought. The IRS stipulates that all filers must verify and adhere to the specific instructions regarding the forms covered by Form 8809 and the conditions under which extensions are granted. Understanding these guidelines helps in avoiding penalties and ensuring the timely processing of extension requests.

Filing Deadlines and Important Dates

One of the key aspects of using Form 8809 is understanding the filing deadlines and ensuring submissions are timely. The extension request must be filed by the original due date of the information returns. Failing to meet these deadlines can result in the IRS denying the extension request, leading to potential penalties for late filing. It is equally crucial to observe the timeframe for electronically filed extensions, which may have different cutoff times compared to paper filings. Marking these deadlines is essential for maintaining compliance and avoiding unnecessary penalties.

Steps to Complete Form 8

Completing Form 8809 involves specific steps to ensure accuracy and compliance. Each form field must be filled accurately, including the filer's name, contact information, and the types of returns needing an extension. A step-by-step process includes:

- Identifying the specific information returns for which an extension is sought.

- Completing all sections of the form with accurate and current information.

- Reviewing the form for errors before submission, ensuring all information is correct and complete.

- Deciding on a submission method: electronically or via paper, keeping in mind the methods may have different processing times and requirements.

Form Submission Methods: Online and Mail

Form 8809 can be submitted either electronically or via standard mail. The IRS encourages electronic submission, which generally results in faster processing and confirmation of receipt. Electronic submission can be done through the IRS's FIRE (Filing Information Returns Electronically) system. For those who opt for mail, ensuring that the forms are sent to the correct IRS address is critical. Each submission method has its nuances, and choosing the most appropriate one depends on factors such as the deadline proximity and convenience for the filer.

Penalties for Non-Compliance

Non-compliance, such as failing to file Form 8809 on time or incorrectly completing it, can result in penalties from the IRS. It is crucial to understand the implications of late or incorrect submissions, which can lead to financial penalties and complications with tax compliance. The IRS can impose various penalties depending on the severity and situation of non-compliance. Thus, diligent attention to IRS instructions and timely, accurate filing of Form 8809 is essential to avoid these repercussions.

Examples and Scenarios of Using Form 8809

Practical examples help illustrate when and how Form 8809 can be used effectively. For instance, businesses managing large volumes of forms like W-2s or 1099-MISCs might require extra time due to unforeseen circumstances, such as system breakdowns or staff shortages. Another scenario could involve partnerships or corporations that were unable to gather all necessary data by the initial deadline due to complex transactions and records reconciliation. Understanding these examples helps filers evaluate their needs for extensions and demonstrates potential challenges that necessitate the use of Form 8809.