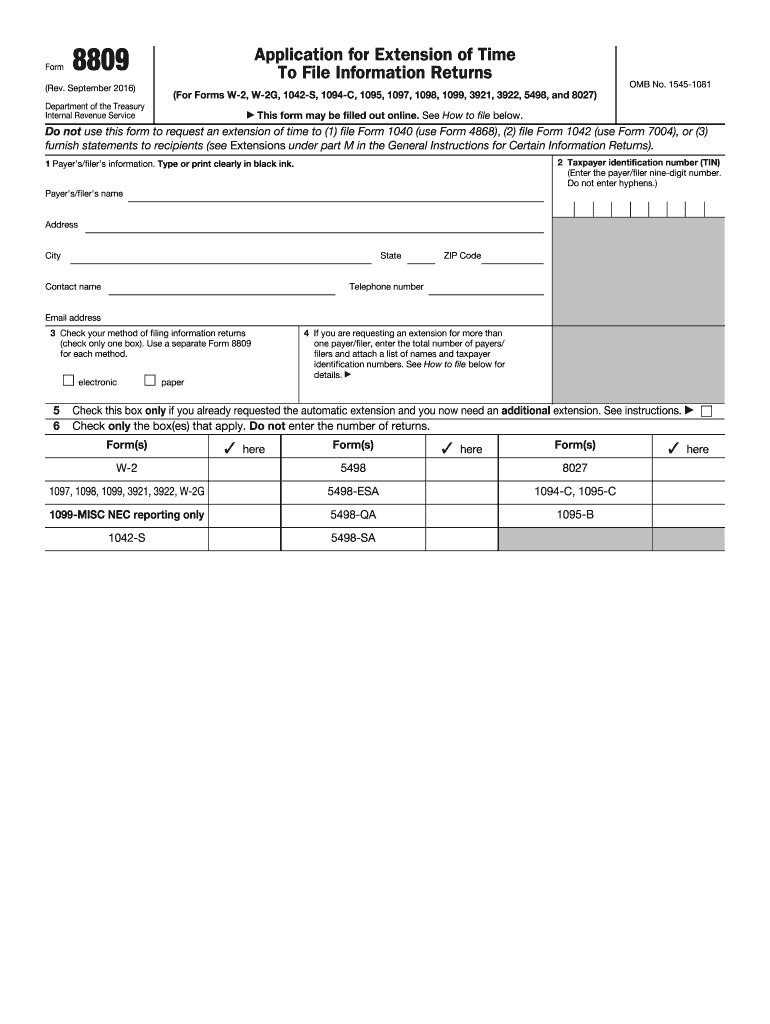

Definition & Purpose of Form 8809

Form 8809 is primarily used to request an extension of time to file certain information returns with the Internal Revenue Service (IRS). It applies to forms such as the W-2, 1099, and others, allowing filers additional time to prepare their submissions without incurring penalties. In 2016, this form served the same essential purpose, providing filers with a structured mechanism to seek a temporary extension to comply with IRS deadlines.

Key Features

- Extension Duration: Typically provides a 30-day automatic extension, with provisions for an additional extension under specific circumstances.

- Eligibility: Primarily intended for businesses and individuals required to file various information returns.

- Method of Filing: Can be submitted electronically or via traditional paper forms.

How to Use the 2016 Form 8809

To effectively use the 2016 Form 8809, it’s crucial to understand the application process and submission guidelines. This form is designed to simplify the extension request procedure, ensuring that filers can avoid potential penalties for late filing.

Step-by-Step Process

- Obtain the Form: Access Form 8809 from the IRS website or by contacting the IRS directly.

- Complete the Necessary Sections: Fill out the form with details about the specific returns for which you need an extension. Include identification information such as name, address, and taxpayer identification number.

- Specify the Type of Return: Clearly indicate which information return (e.g., W-2, 1099) the extension request covers.

- Submit the Form: Depending on preference and convenience, you can submit the form electronically or mail it to the IRS.

- Await Confirmation: Whether submitting online or by mail, monitor for confirmation from the IRS on the status of your extension request.

Steps to Complete the 2016 Form 8809

Completing the 2016 Form 8809 involves specific steps to ensure the form is processed correctly by the IRS. Understanding each section helps in avoiding errors and delays in the extension process.

Detailed Instructions

- Identification Information: Fill out the name, address, and taxpayer identification number sections accurately. Errors here can lead to processing delays.

- Type of Return: The form will specify the types of returns eligible for extension requests—such as W-2, 1098, or 1099.

- Extension Request Details: Clearly indicate the filing reason and provide any necessary supporting documentation if prompted.

- Signature and Date: Authenticate the document by signing and dating it before submission.

Filing Methods for the 2016 Form 8809

Submitting the 2016 Form 8809 can be done through various methods, allowing filers to choose the most convenient option based on their circumstances and preferences.

Submission Options

- Electronic Submission: The fastest method is through the IRS’s FIRE (Filing Information Returns Electronically) system. It ensures quicker processing and immediate confirmation of receipt.

- Mail Submission: Traditional paper filing is also available for those who prefer mailing the form. Ensure early submission to account for postal delays.

Who Typically Uses the 2016 Form 8809

Various individuals and business entities commonly use the 2016 Form 8809 to manage filing deadlines effectively.

Typical Users

- Businesses: Corporations and small businesses needing more time to file multiple information returns.

- Tax Professionals: Certified accountants and tax advisors often file on behalf of their clients.

- Individuals: Particularly beneficial for self-employed individuals managing their returns.

IRS Guidelines for the 2016 Form 8809

Understanding IRS guidelines related to the 2016 Form 8809 is essential to ensure compliance and avoid potential penalties.

Key IRS Instructions

- Automatic vs. Additional Extensions: The form automatically grants a 30-day extension but outlines conditions for requesting additional time.

- Accuracy and Completeness: Ensure that all provided information is complete and accurate to prevent rejection or delay.

- Timely Submission: Remain aware of IRS deadlines for submitting the extension request before the original due date of the returns.

Penalties for Non-Compliance

Failing to comply with Form 8809 requirements can lead to penalties, highlighting the importance of understanding the submission process and deadlines.

Common Penalties

- Late Fees: Missing the filing deadline without an approved extension can result in fees.

- Interest Accruals: Penalties might include interest accrual on taxes owed due to late filing of the returns.

- Denial of Future Requests: Repeated non-compliance could impact future extension requests.

Filing Deadlines and Important Dates

Identifying critical filing deadlines and important dates for using Form 8809 ensures timely action and avoids penalties.

Key Dates

- Standard Filing Deadline: The initial due date for returns typically aligns with January 31 for forms like W-2, and February 28 for paper filings of forms like 1099 in 2016.

- Extension Request Timing: Ensure Form 8809 is filed on or before the specific return's due date to be valid.

Software Compatibility for 2016 Form 8809

Compatibility with various tax software ensures ease of use and integration into personal or business workflows for the 2016 Form 8809.

Common Software

- TurboTax and QuickBooks: Popular choices that often include specific modules for handling IRS form submissions, including extensions.

- Dedicated Tax Software Platforms: Provide comprehensive support for electronically filing the 2016 Form 8809 without manual intervention.

This tailored content provides an in-depth, structured guide to the "2016 form 8809," ensuring compliance and promoting an effective filing process.