Understanding Form 8809

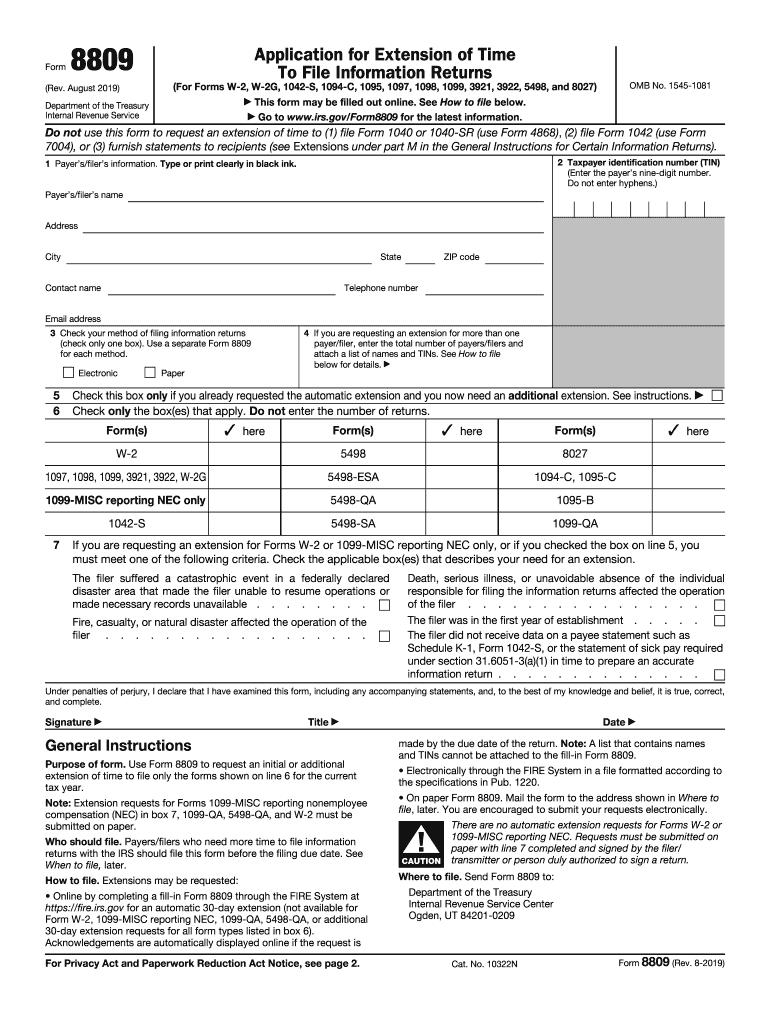

Form 8809 is utilized to request an extension of time for filing various information returns with the Internal Revenue Service (IRS). It is crucial for taxpayers who might need additional time to gather and submit necessary information for completing their returns. This extension applies to a wide range of information forms, including but not limited to W-2 and 1099.

How to Use Form 8809

-

Determine Eligibility: Before using Form 8809, ensure you are eligible for an extension. The form is applicable for entities required to file information returns, such as corporations, partnerships, and self-employed individuals.

-

Filing for Different Forms: Form 8809 can be used to request extensions for multiple information returns simultaneously. Specify the form types you are requesting an extension for on the application.

-

Submission Timing: Submit this form before the original due date of the returns you are seeking to extend. It is crucial to adhere to timing to avoid penalties.

Obtaining Form 8809

Form 8809 can be obtained through several methods, ensuring flexibility for users:

- IRS Website: Downloadable as a PDF from the official IRS website.

- Local IRS Offices: Hard copies can be obtained by visiting a local IRS office.

- Tax Software: Many tax preparation software options offer a digital version of Form 8809, allowing for a seamless integration into your existing tax filing process.

Steps to Complete Form 8809

-

Identify Forms: Clearly identify which information returns you are seeking an extension for (e.g., W-2, 1099).

-

Fill Out Basic Details: Provide fundamental details about your business, including employer identification number (EIN) and business name.

-

Select Requested Extension Period: Some extensions are automatic; make sure to indicate if you are applying for an extension longer than the standard timeframe.

-

Submit: Submit the completed form through mail or electronically, depending on your preference and jurisdiction capabilities.

Key Elements of Form 8809

-

Request for Extension: The primary feature of the form is to request additional time to file specified returns. This is achieved by marking the relevant boxes and specifying the extension duration needed.

-

Contact Information: Accurate entry of contact information is essential, as this is how the IRS communicates approval or any issues with your request.

Legal Use of Form 8809

Form 8809's primary legal purpose is to provide taxpayers an opportunity to avoid penalties associated with late filings by granting them extra preparation time. It is important to note that while the form provides additional time to file, it does not extend the time to pay any taxes owed.

IRS Guidelines for Form 8809

-

Automatic Extensions: The IRS provides an automatic 30-day extension for many forms. In such cases, Form 8809 helps apply for an additional time frame if necessary, which is manually reviewed.

-

Submission Options: Ensure to follow the IRS guidelines for format and submission. The form can be submitted electronically or via mail.

Filing Deadlines and Important Dates

- General Deadline: The form should be filed before the due date of the returns for which an extension is sought.

- Specific Deadlines: Depending on the information return type, deadlines might vary. Common filing deadlines are generally around January 31st or March 31st.

Penalties for Non-Compliance

Not adhering to deadlines or improperly filing for an extension could result in IRS penalties. These could include fines and increased scrutiny on returns or multiple late filings.

- Penalties: Late submission of information returns without an extension request leads to penalties, determined per form and per day delayed.

Understanding and appropriately utilizing Form 8809 can offer significant relief in managing filing responsibilities effectively while preventing potential punitive repercussions from the IRS. It's advisable to fully review requirements and consult with tax professionals if uncertainties arise.