Definition & Meaning

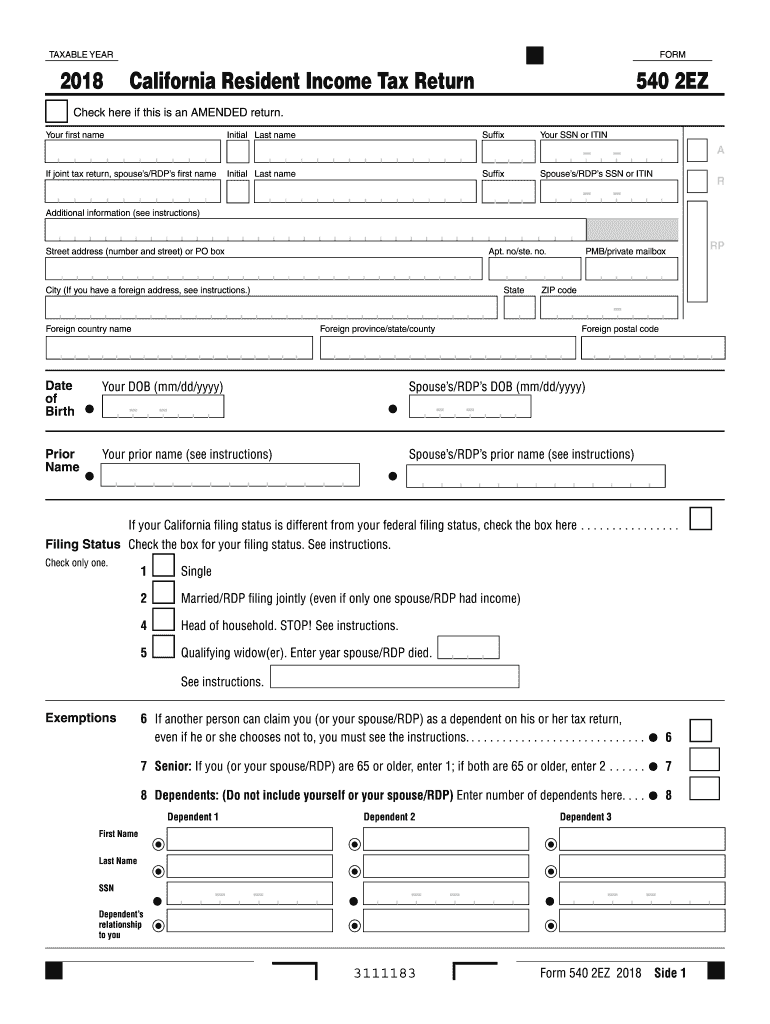

The 540 2EZ 2019 form is a simplified version of the California Resident Income Tax Return. This form is designed for individuals with straightforward tax situations, streamlining the process of reporting income, claiming exemptions, and determining taxes owed or refunds due. It features a concise structure, allowing eligible taxpayers to complete their returns without the complexities associated with more detailed tax forms.

How to Use the 540 2EZ 2019

To use the 540 2EZ 2019 efficiently, start by gathering necessary documents such as W-2s and any other income statements. This form is intended for residents who meet specific criteria, such as a total income below a certain threshold or not itemizing deductions. To complete it, follow instructions carefully, filling out sections on personal information, filing status, and taxable income. Remember to double-check calculations and ensure accuracy to avoid any discrepancies.

Eligibility Criteria

The 540 2EZ 2019 is intended for California residents who meet specific eligibility requirements. Generally, this includes individuals with no dependents, total income under a specified limit, and who derive income solely from wages, salaries, and a small amount of interest income. Taxpayers who do not qualify for any special tax credits or deductions beyond the standard deduction are typically eligible to use this simplified form.

Steps to Complete the 540 2EZ 2019

- Personal Information: Begin by entering your personal details, such as name, address, and Social Security Number.

- Filing Status: Indicate your filing status, whether single or married filing jointly.

- Income Details: Report all applicable income, including wages, interest, dividends, and pensions.

- Deductions & Credits: Use the standard deduction applicable for the year and apply eligible tax credits.

- Calculate Tax: Follow the instructions to compute the total taxes owed or the refund due.

- Sign & Date: Ensure you sign and date the form, as an unsigned form may be considered invalid.

Required Documents

To successfully complete the 540 2EZ 2019, you will need various documents that include, but are not limited to:

- W-2 Forms: Reflect wages and withheld taxes from your employer(s).

- 1099 Forms: Report additional income such as interest and dividends.

- Social Security Statement: If applicable, for reporting social security benefits.

- Proof of Residency: Documentation verifying California residency.

Filing Deadlines / Important Dates

For the tax year 2019, residents using the 540 2EZ form must adhere to established filing deadlines. The typical deadline is April 15, unless it falls on a weekend or public holiday, in which case the due date may extend to the next business day. It is crucial to file the form by this date to avoid late filing penalties and interest charges.

Form Submission Methods (Online / Mail / In-Person)

- Online: Filing online through the California Franchise Tax Board's website is the most efficient method. It provides immediate confirmation of receipt.

- Mail: You can also mail a completed paper form to the designated address specified in the form's instructions. Ensure you allow sufficient time for delivery before the deadline.

- In-Person: While less common, some taxpayers might choose to submit their forms at local Franchise Tax Board offices.

Penalties for Non-Compliance

Failing to file the 540 2EZ 2019 by the due date can result in several penalties:

- Late Filing Penalty: Generally a percentage of the taxes owed.

- Late Payment Penalty: Additional charges for not paying taxes due by the due date.

- Interest Charges: Accumulated on both late payments and any underreported tax amounts.

Avoid these penalties by ensuring timely and accurate filing.

Examples of Using the 540 2EZ 2019

Consider Jane, a California resident with a salary from a single employer and minimal interest income. She qualifies for no special deductions beyond the standard deduction. Jane uses the 540 2EZ 2019 to report her income, claim her deductions, and calculate taxes owed. Given her straightforward tax scenario, the 540 2EZ is optimal for minimizing complexity and ensuring an accurate filing.