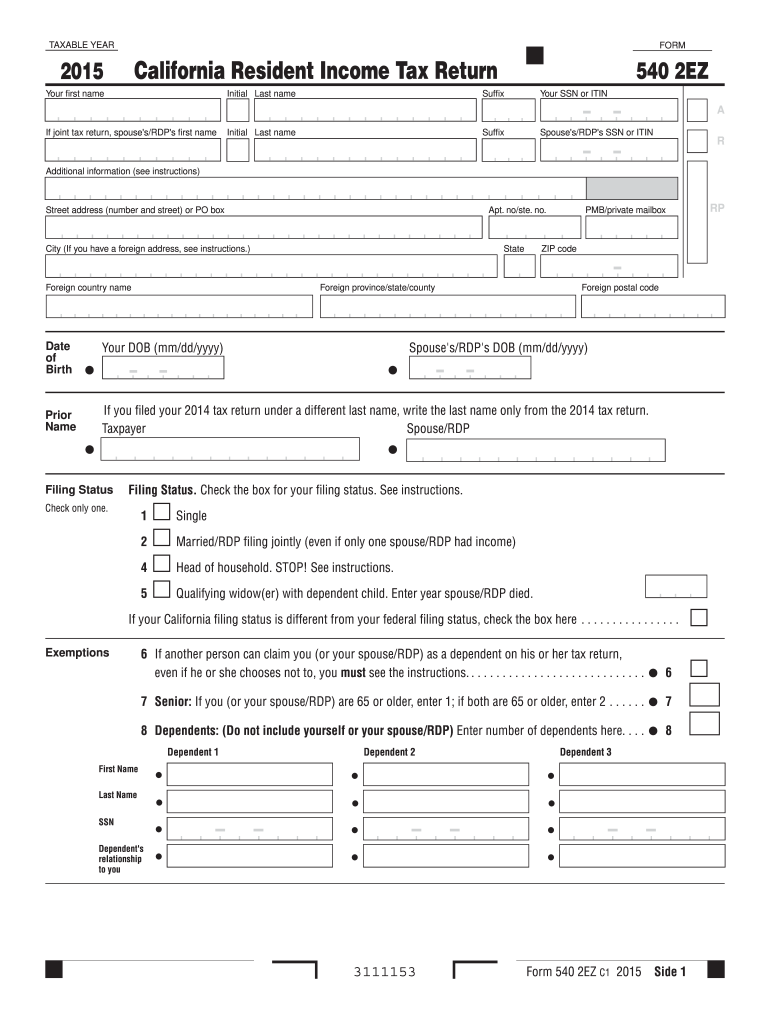

Definition & Meaning of the 540 2EZ Form 2015

The 540 2EZ form is a simplified version of the California Resident Income Tax Return form, specifically designed for taxpayers with straightforward financial situations. For the tax year 2015, this form allows eligible individuals to file their state taxes efficiently, minimizing complexity while ensuring compliance with state tax laws. The form is tailored for those who meet specific criteria, typically involving single or married filing statuses, income limits, and restrictions on deductions and credits.

Key features of the 540 2EZ form include:

- Simplified Calculation: It streamlines tax computations, making it easier for users to determine their total tax owed or refunds.

- Eligibility Focus: It is intended for taxpayers with limited income sources, uncomplicated financial situations, and no dependents.

- Direct Deposit Option: The form facilitates direct deposit for any refunds, speeding up the return process compared to traditional methods.

The 540 2EZ form differs from the standard 540 form in terms of eligibility requirements and the types of income that can be reported, allowing for a more straightforward preparation process for qualifying taxpayers.

How to Use the 540 2EZ Form 2015

Using the 540 2EZ form involves several straightforward steps designed to ensure easy completion and accurate filing. Taxpayers should first verify they meet the necessary qualifications for using this simplified form. Once confirmed, the process includes obtaining the form, gathering relevant financial information, and carefully following the instructions outlined in the form.

Steps to effectively use the 540 2EZ include:

- Obtain the Form: Download a copy from the California Franchise Tax Board website or access it through tax preparation software.

- Gather Documentation: Collect necessary documents such as W-2 forms, 1099 forms, and other statements detailing income.

- Fill Out Personal Information: Provide all required personal details, including Social Security numbers and filing status.

- Report Income: Input total income from all relevant sources—these should generally align with the income amounts listed on W-2 and 1099 forms.

- Calculate Tax: Follow the simple calculation guidelines provided on the form to ascertain the total tax owed or refund due.

After completing these steps, taxpayers should sign the form and submit it through the preferred method to ensure compliance with filing deadlines.

Steps to Complete the 540 2EZ Form 2015

Completing the 540 2EZ form may initially seem daunting, but by breaking the process down into specific steps, it becomes manageable. The following guide outlines a clear approach to filling out the form accurately.

- Obtain the Form: Download the latest version directly from the California Franchise Tax Board website.

- Enter Personal Information:

- Fill in your name, mailing address, and Social Security number.

- Choose your filing status (single or married filing jointly).

- Report Income:

- Input total wages, salaries, and tips as indicated on your W-2.

- Include any taxable pensions or other income as applicable.

- Calculate Adjusted Gross Income (AGI):

- The form will have specific lines to help calculate your AGI based on input income figures.

- Determine Deductions and Credits:

- Complete the sections for any applicable worldwide credits or special deductions—in most straightforward cases, these sections may remain blank.

- Calculate Taxes Owed or Refunds Due:

- Follow the formula or tables provided within the form to ascertain total tax owed.

- Subtract any credits to determine if a refund is due.

- Complete Signing and Submission:

- Add a signature and date to validate the form.

- Choose a submission method: e-filing or mailing to the appropriate processing address.

It is crucial to double-check entered information for accuracy before submission, as errors could lead to delays or complications.

Key Elements of the 540 2EZ Form 2015

Several essential components define the 540 2EZ form, ensuring users understand all necessary sections while completing their tax returns effectively. Recognizing these critical elements helps enhance organizational efficiency when filling out the form.

- Personal Information Section: This section captures taxpayer information, including names, Social Security numbers, and addresses to properly identify the individual filing.

- Income Reporting Lines: Designated lines for capturing W-2 wages, pensions, and other relevant income sources, which serve as the primary basis for tax calculations.

- Standard Deduction Information: The form typically allows individuals to claim a basic standard deduction without detailed itemization, facilitating simpler filing.

- Tax Calculation Tables: These provide straightforward methodologies for calculating taxes owed based on reported income, minimizing confusion.

- Signature Requirement: A place for the taxpayer’s signature validates the authenticity of the form and confirms the information provided is accurate to the best of the taxpayer's knowledge.

Understanding these key elements ensures taxpayers use the 540 2EZ form correctly, promoting accurate reporting and adherence to tax obligations.

Eligibility Criteria for the 540 2EZ Form 2015

To successfully utilize the 540 2EZ form, certain eligibility criteria must be met. These restrictions ensure that only those with simpler tax situations utilize this streamlined form, maintaining efficiency within the tax filing process.

Eligibility criteria include:

- Filing Status: Taxpayers must file as single or married filing jointly. Other statuses such as head of household or married filing separately may not qualify.

- Income Limitations: Total income must not exceed $100,000 for single filers and $200,000 for married couples filing jointly, ensuring that the form remains appropriate for simpler financial situations.

- Dependent Status: Taxpayers cannot claim dependents; the form is intended for those without children or qualifying dependents.

- Certain Incomes Exclusion: Only specific sources of income can be reported. For example, income from self-employment or real estate is generally not applicable for this form.

These eligibility requirements facilitate an easier tax return process for qualified individuals, helping to ensure compliance while simplifying the filing experience.

Important Terms Related to the 540 2EZ Form 2015

Understanding key terminology associated with the 540 2EZ form aids taxpayers in accurately interpreting the form and executing the required procedures. Acquainting oneself with these terms will help facilitate a more comprehensive understanding of the tax process.

- Adjusted Gross Income (AGI): The total income minus specific deductions; this figure is critical for determining tax liability.

- Standard Deduction: A predetermined amount allowed by the tax code that can be subtracted from AGI, effectively lowering taxable income.

- Tax Credits: Direct reductions of tax owed. Unlike deductions, which reduce taxable income, credits lower the tax bill directly.

- Filing Status: Designation that affects the tax rate and standard deductions available to an individual, usually influenced by marital status and dependence considerations.

- Refund: The amount owed back to the taxpayer from the state, usually resulting from overpayment of taxes through withholding or estimated payments.

If taxpayers familiarize themselves with these terms, it enhances their capacity to navigate the 540 2EZ form and the broader context of taxation.

Examples of Using the 540 2EZ Form 2015

Utilizing the 540 2EZ form can simplify how individual residents manage their state income tax obligations. Here are practical examples demonstrating its application in various scenarios.

- Single Individual with Simple Income: A solitary taxpayer earning $50,000 solely from wages could utilize the 540 2EZ form to report income, claim the standard deduction, and calculate the owed tax efficiently without itemizing.

- Married Couple Filing Jointly: A married couple with a combined income of $150,000, without children or complex deductions, can leverage the form to streamline their state tax filings while ensuring all income sources are adequately reported.

- Student with Minimal Income: A college student working part-time and earning less than the income threshold can use the 540 2EZ to report their earnings, potentially resulting in a refund due to tax withholding, making the process of reclaiming funds simple.

These examples highlight the scenarios well-suited for the 540 2EZ form, enabling users to fulfill their state tax obligations effectively while minimizing complexity.