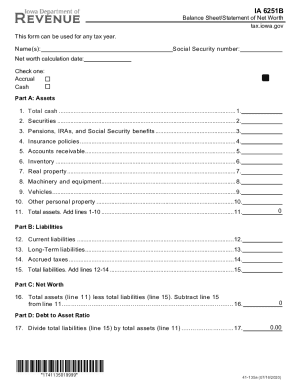

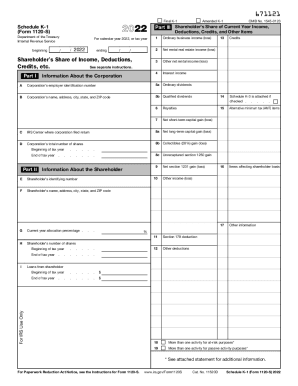

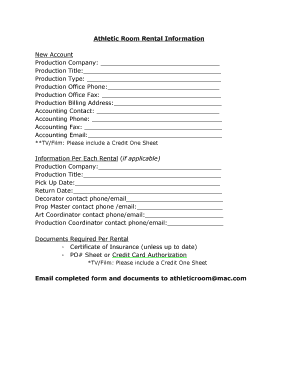

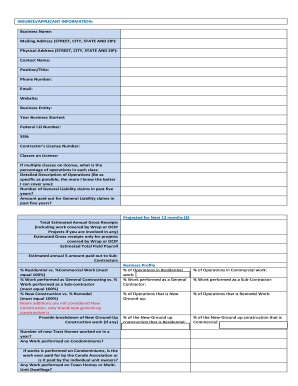

Enhance your productivity and financial record accuracy with DocHub's Tax Balance Sheet Templates. Stay compliant and fill out your financial statements online.

Accelerate your file operations with the Tax Balance Sheet Templates online library with ready-made document templates that meet your requirements. Get the document, edit it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with your documents.

How to use our Tax Balance Sheet Templates:

Examine all of the opportunities for your online file administration with the Tax Balance Sheet Templates. Get your free free DocHub profile right now!