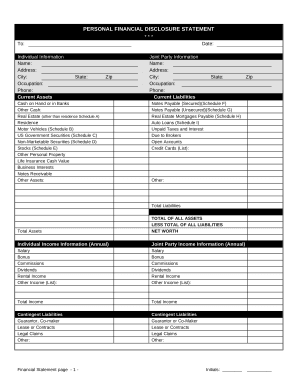

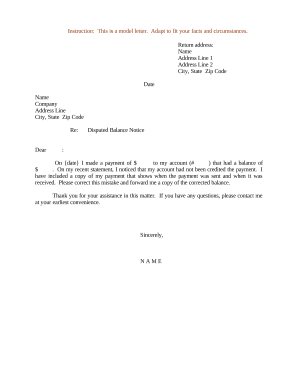

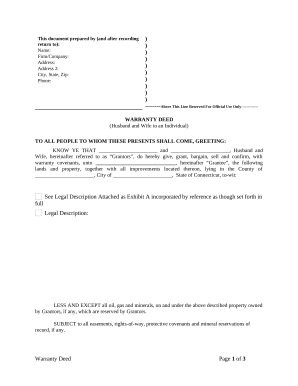

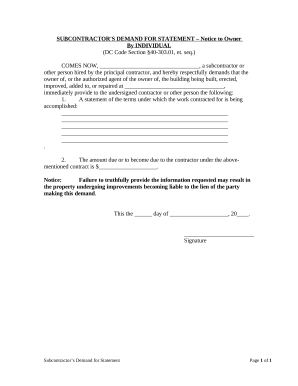

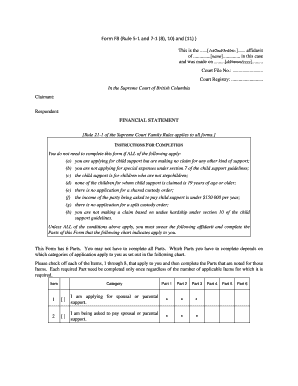

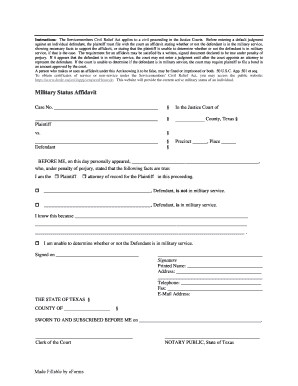

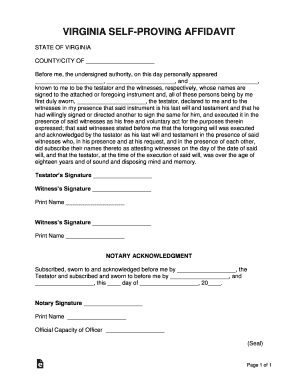

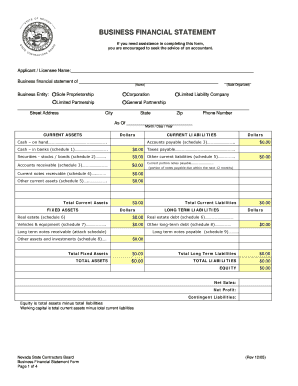

Select and preview Sole proprietorship Balance Sheet Templates online. Get a form appropriate to your case, adjust and eSign it, and securely send it with your colleagues and financial institutions.

Accelerate your document managing with the Sole proprietorship Balance Sheet Templates collection with ready-made templates that meet your requirements. Access the document template, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with your documents.

The best way to use our Sole proprietorship Balance Sheet Templates:

Explore all of the possibilities for your online document management with our Sole proprietorship Balance Sheet Templates. Get a free free DocHub profile today!