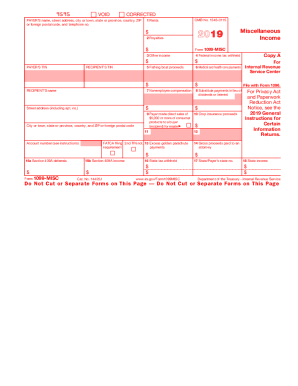

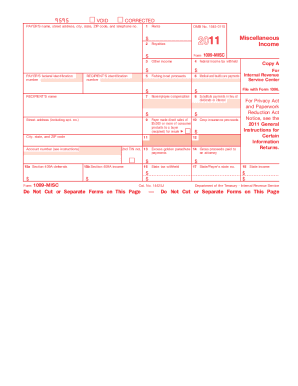

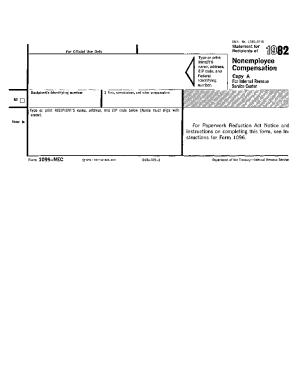

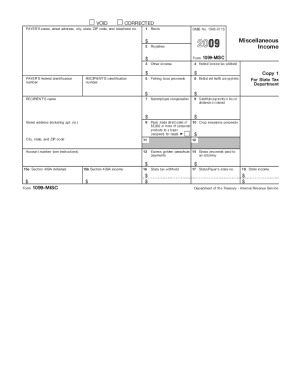

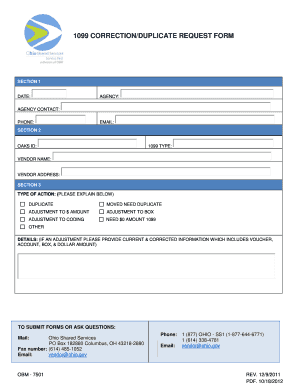

Ensure your process security and compliance with 1099 nec from irs Order Forms template catalog. Find up-to-date forms and organize them online in several steps.

Improve your document managing with our 1099 nec from irs Order Forms collection with ready-made templates that suit your needs. Access the form template, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your documents.

How to use our 1099 nec from irs Order Forms:

Explore all the opportunities for your online document administration using our 1099 nec from irs Order Forms. Get your totally free DocHub account right now!