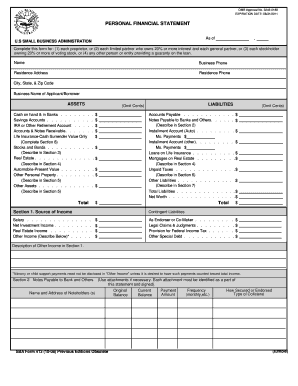

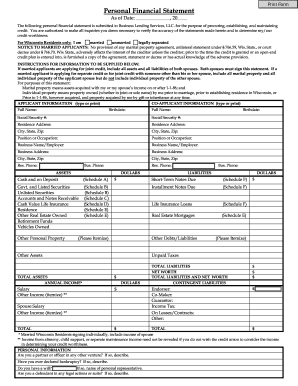

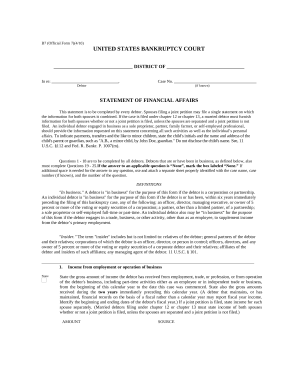

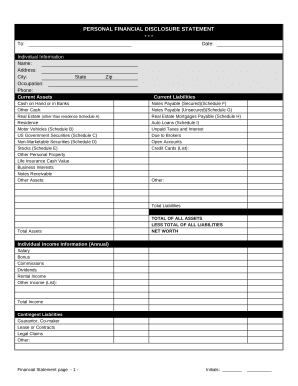

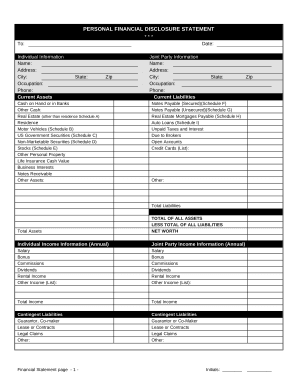

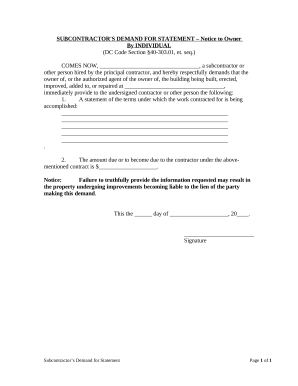

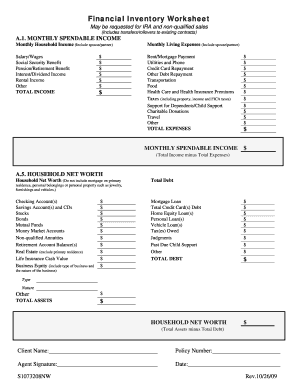

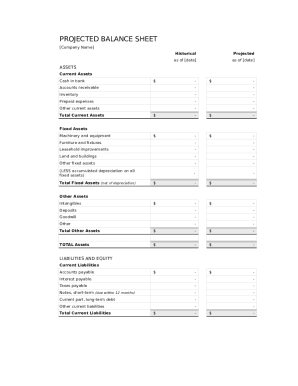

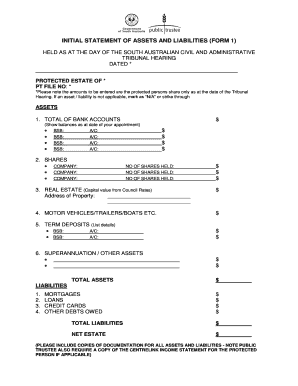

Choose and preview Personal assets liabilities Balance Sheet Templates online. Obtain a form relevant to your case, adjust and sign it, and safely share it with your business partners and banks.

Speed up your file operations with our Personal assets liabilities Balance Sheet Templates category with ready-made document templates that meet your needs. Access the document template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the forms.

How to use our Personal assets liabilities Balance Sheet Templates:

Examine all of the possibilities for your online file management with the Personal assets liabilities Balance Sheet Templates. Get your totally free DocHub profile today!