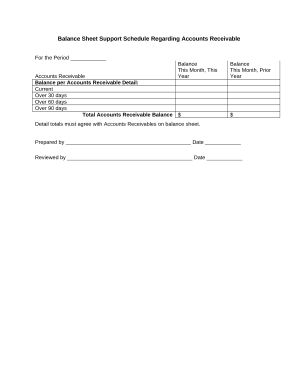

Preview and obtain One of the most common of off financing is Balance Sheet Templates to ensure the accuracy and transparency of your financial records. The DocHub web catalog offers dozens of ready-made customizable forms.

Papers management occupies to half of your business hours. With DocHub, it is possible to reclaim your time and effort and increase your team's efficiency. Access One of the most common of off financing is Balance Sheet Templates online library and discover all form templates relevant to your day-to-day workflows.

The best way to use One of the most common of off financing is Balance Sheet Templates:

Boost your day-to-day document management with the One of the most common of off financing is Balance Sheet Templates. Get your free DocHub account today to discover all templates.