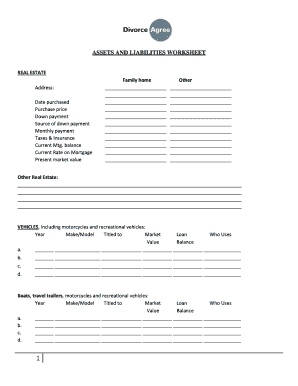

Collaborate and adjust Farm business Balance Sheet Templates in real-time. Sign up for a free DocHub and manage your financial records with precision, stay ahead your competition, and secure your records.

Document management can overpower you when you can’t locate all of the documents you require. Fortunately, with DocHub's considerable form library, you can find everything you need and promptly manage it without switching between apps. Get our Farm business Balance Sheet Templates and start utilizing them.

Using our Farm business Balance Sheet Templates using these simple steps:

Try out DocHub and browse our Farm business Balance Sheet Templates category with ease. Get your free profile today!