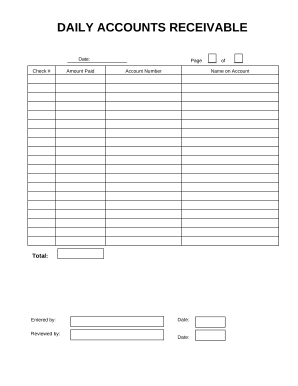

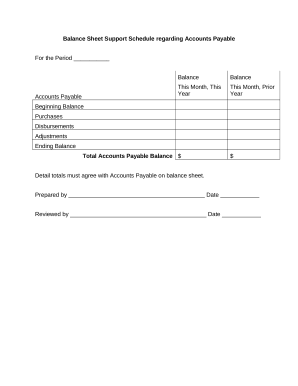

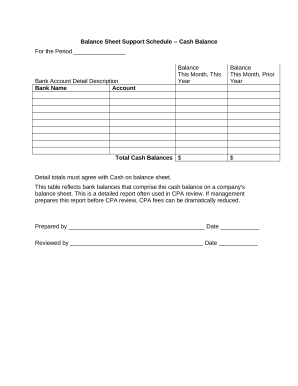

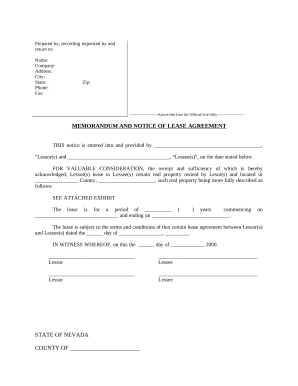

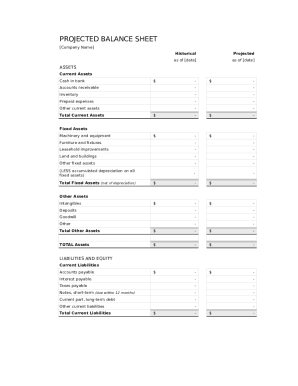

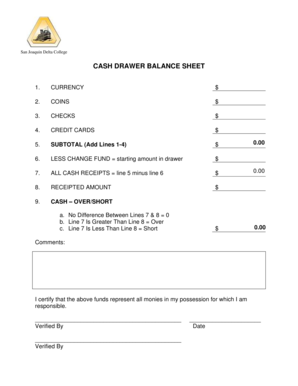

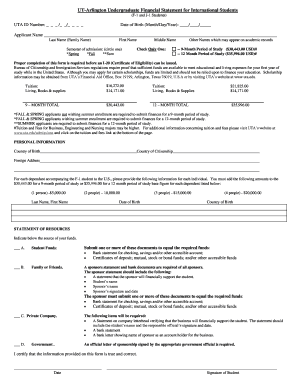

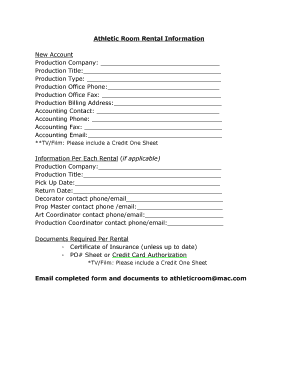

Gain access to Daily register Balance Sheet Templates and ensure that your financial statements are transparent, compliant, and accurate. Adjust, complete, or collaborate with your team on the form before sharing it.

Boost your document administration with our Daily register Balance Sheet Templates library with ready-made templates that meet your requirements. Access the document template, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your documents.

How to use our Daily register Balance Sheet Templates:

Explore all the possibilities for your online document administration using our Daily register Balance Sheet Templates. Get a totally free DocHub profile today!