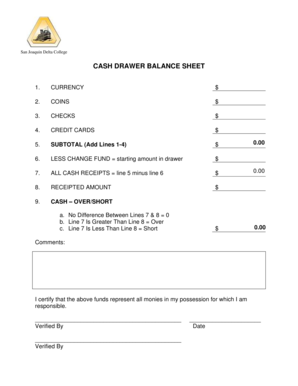

Customize Credit card Balance Sheet Templates online with DocHub versatile modification features. Generate and manage your business documents all in one location without jeopardizing your information and security.

Document managing occupies to half of your business hours. With DocHub, it is simple to reclaim your time and effort and boost your team's productivity. Access Credit card Balance Sheet Templates collection and check out all templates related to your everyday workflows.

Easily use Credit card Balance Sheet Templates:

Speed up your everyday document managing with our Credit card Balance Sheet Templates. Get your free DocHub profile right now to explore all templates.