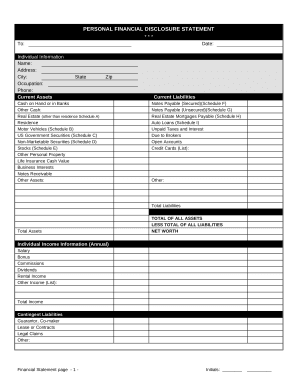

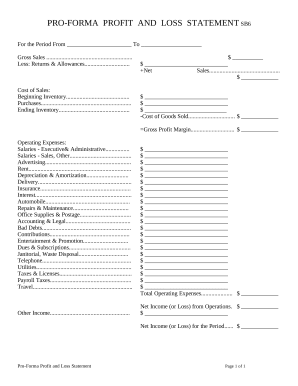

Customize Cashflow from p&l and data Balance Sheet Templates online with DocHub flexible modification features. Create and manage your financial statements all in one location without compromising your information and safety.

Document management can overpower you when you can’t locate all of the documents you require. Fortunately, with DocHub's considerable form collection, you can get all you need and swiftly deal with it without switching between apps. Get our Cashflow from p&l and data Balance Sheet Templates and begin utilizing them.

How to use our Cashflow from p&l and data Balance Sheet Templates using these basic steps:

Try out DocHub and browse our Cashflow from p&l and data Balance Sheet Templates category without trouble. Get a free profile today!