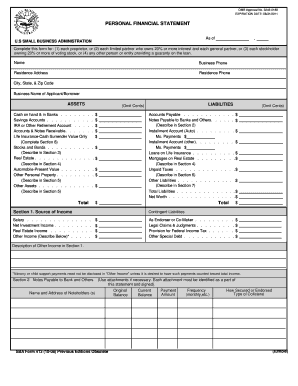

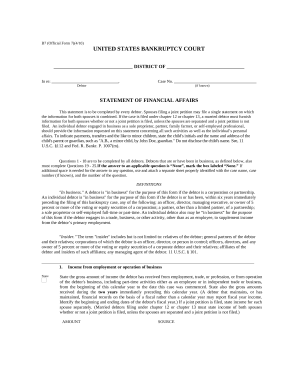

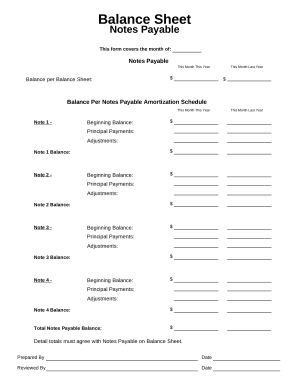

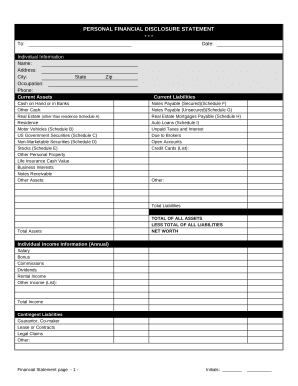

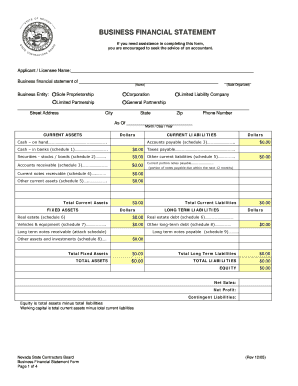

Download the best up-to-date Assistance with small business Balance Sheet Templates with DocHub online collection. Personalize and work together on your balance sheets with your team in real-time without losing important information.

Speed up your document managing with our Assistance with small business Balance Sheet Templates collection with ready-made document templates that meet your requirements. Access the document template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with your forms.

The best way to use our Assistance with small business Balance Sheet Templates:

Discover all the possibilities for your online file administration with our Assistance with small business Balance Sheet Templates. Get a free free DocHub profile right now!