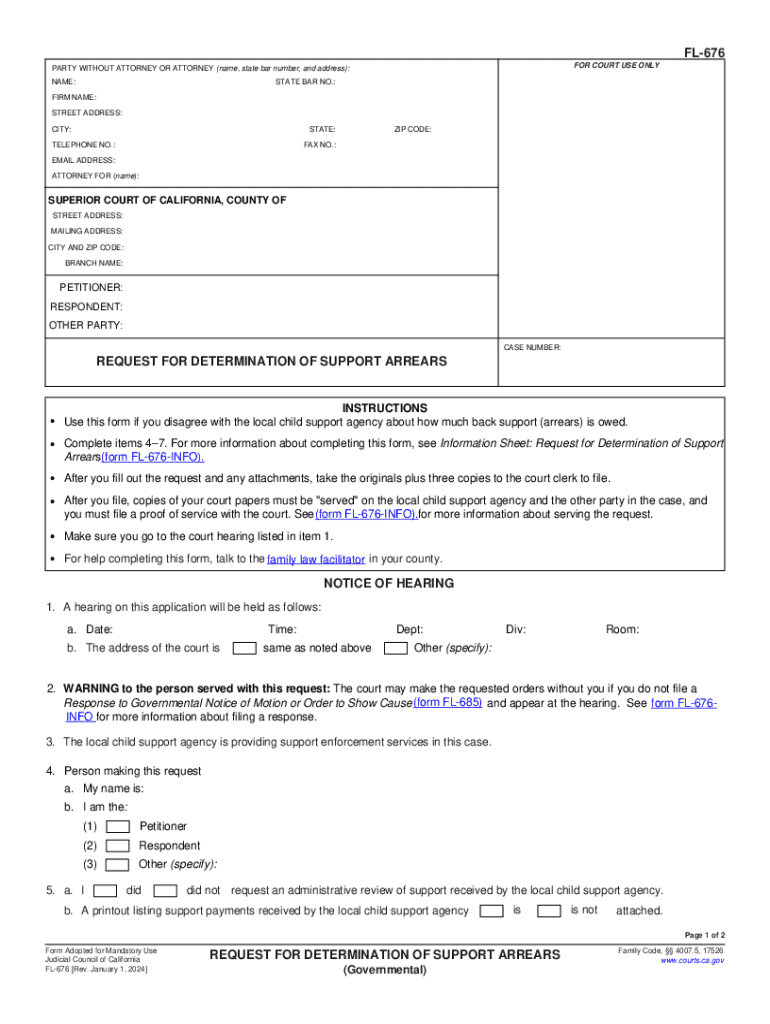

Definition and Meaning of Fl-676

The FL-676 form is a legal document used within California’s family law system. It is specifically designed for individuals who are contesting the local child support agency's calculation of child support arrears. The form serves as an official request to reassess the agency's assessment by providing the court with additional information and justification. It includes sections for personal and case details, reasons for disputing the arrearage amount, and the necessary documentation to support the claims. Understanding the form's purpose is crucial for ensuring accurate legal processes and communication with family law courts.

How to Obtain the Fl-676 Form

Obtaining the FL-676 form is a straightforward process. It can be accessed online through California’s court websites or directly from a local family court. Forms are often available in both PDF and fillable electronic formats, allowing individuals to complete them digitally or by hand. For those who prefer personalized guidance, visiting a local courthouse in person enables access to physical copies and assistance from court staff. Whether obtained online or offline, having the correct form version is essential to ensure compliance with current legal requirements.

Steps to Complete the Fl-676

-

Personal Information Section:

- Fill out full legal name, address, and contact details.

- Include case number and court jurisdiction.

-

Case Details:

- Provide information on the original child support order.

- Specify the date of the disputed determination.

-

Dispute Reasons:

- Clearly outline why the arrears determination is incorrect.

- Attach any supporting evidence or documents justifying the dispute.

-

Additional Attachments:

- Include any relevant financial documents or correspondence.

- Ensure all attachments are legibly labeled and securely fastened.

-

Filing and Service:

- File the completed form with the appropriate court.

- Serve copies to the local child support agency and all involved parties per legal requirements.

Why Should You Use the Fl-676 Form

Using the FL-676 form is crucial for individuals who believe their child support arrears have been miscalculated. It serves multiple purposes:

- Legal Recourse: Offers a formal avenue to dispute perceived inaccuracies in arrears calculation.

- Clarity and Accuracy: Enables correction of errors that might significantly impact financial obligations.

- Court Communication: Provides an official method for presenting additional evidence and explanations to the court.

- Ensures Fairness: Helps achieve a fair assessment of arrears, aligning with actual financial circumstances.

Key Elements of the Fl-676 Form

The FL-676 form contains several essential elements that must be accurately completed:

- Personal and Case Information: Ensures the form is processed correctly within the legal system.

- Dispute Justification: Key area where the claimant outlines the rationale for contesting the arrearage decision.

- Required Attachments: Detailed section covering the necessity of supporting documents, such as pay stubs, correspondence, and financial statements.

- Signature and Date: Legal affirmation of the information provided and the commitment to truthfulness.

State-Specific Rules for the Fl-676

California has unique regulations related to contesting child support arrears, making it necessary to understand state-specific guidelines:

- Filing Deadlines: Specific time frames dictate when disputes must be filed post-assessment.

- Documentation: California courts typically require comprehensive evidence to support claims.

- Potential Hearings: Cases may be reviewed by court commissioners who have specific legal authority under California law.

- Service Requirements: Detailed rules dictate how and when involved parties must be notified.

Form Submission Methods

Submitting the FL-676 can be done using multiple methods depending on personal convenience and urgency:

- Online Submission: Some jurisdictions may offer electronic filing options to expedite processing.

- Mail: Traditional mailing remains a valid choice for individuals comfortable with postal submissions.

- In-Person: Direct submission at court offices may provide assurance of immediate receipt and processing.

Penalties for Non-Compliance with Fl-676 Regulations

Failing to comply with the guidelines and deadlines stipulated for the FL-676 can lead to several serious consequences:

- Legal Penalties: Dismissal of the dispute or potential sanctions from the court.

- Missed Opportunities for Relief: Failure to contest within designated time might result in missed chances to rectify financial obligations.

- Enforcement Actions: Uncontested arrears may lead to enforcement measures like wage garnishment or tax refund interceptions.

- Limited Appeal Options: Non-compliance might prevent further legal appeals to address the disputed arrears.

Given these potential penalties, ensuring adherence to all FL-676 requirements is imperative for effective legal challenge and resolution. Each step must be undertaken with accuracy and promptness to uphold one's legal rights effectively.