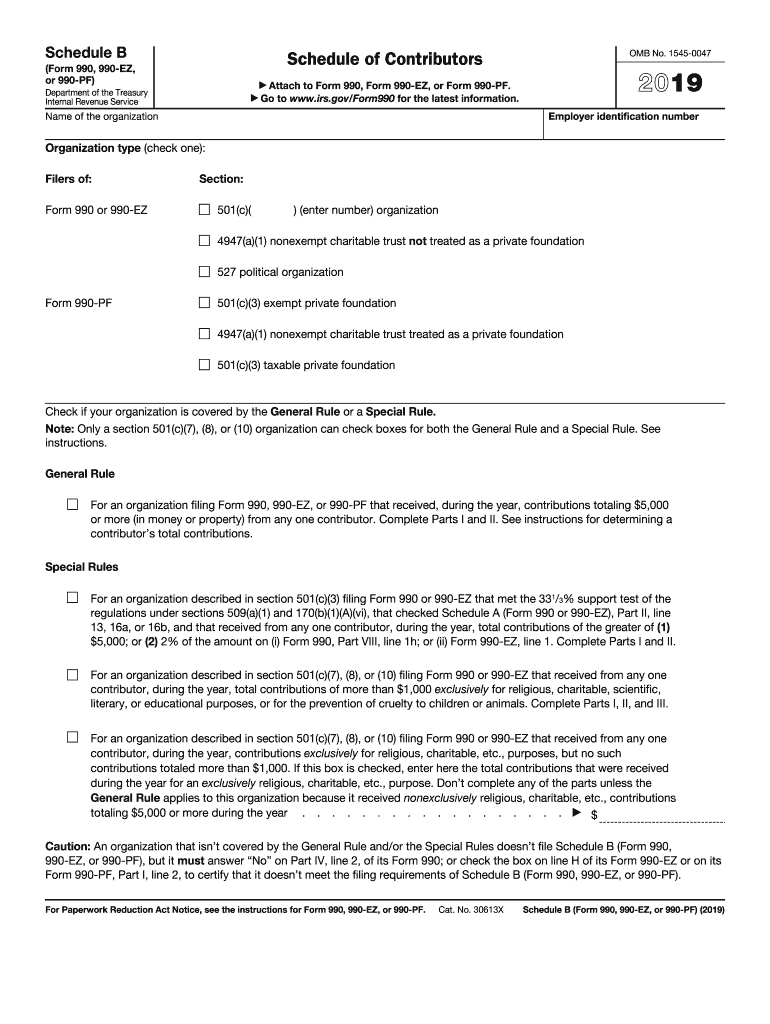

Definition & Meaning of IRS Form 990-EZ

IRS Form 990-EZ is a short form used by tax-exempt organizations to provide annual financial information. This version is simpler than the full Form 990 but requires a comprehensive reporting of finances, fundraising activities, and the organization’s mission. It allows eligible entities to describe how they use their funds and ensures compliance with federal tax regulations.

- Purpose: It helps the IRS and the public understand how organizations conduct their finances and operations.

- Eligibility: Generally for organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the year.

- Function: Serves educational, transparency, and accountability purposes for nonprofit organizations.

Steps to Complete IRS Form 990-EZ

Filling out IRS Form 990-EZ requires careful attention to detail to ensure accuracy and compliance. Here’s a step-by-step guide:

-

Prepare Necessary Information:

- Gather detailed financial records, including income, expenses, and asset data.

- Collect information on the organization’s mission and any changes in operations.

-

Fill Out Section A (Identification):

- Input the organization's name, address, and Employee Identification Number (EIN).

- Indicate the tax year and type of organization.

-

Complete Section B (Financial Overview):

- Provide data on revenues, including program service revenue and other income.

- Ensure accurate totals for expenses such as salaries, rent, and utilities.

-

Detail Fundraising Activities:

- Include specifics on events, campaigns, and donation methodologies.

- Itemize costs incurred from fundraising activities to illustrate efficiency.

-

List Officers and Key Employees:

- Provide names, titles, and average weekly hours worked for each person.

- Note their compensation to reflect the organization's internal management.

-

Review and Attach Schedules:

- Ensure necessary schedules are completed, such as Schedule A for public charity status.

- Append supporting documents to clarify financial or operational anomalies.

-

Check and File:

- Double-check all sections for accuracy and completeness.

- File on time using appropriate submission methods (paper or electronic filing).

Important Terms Related to IRS Form 990-EZ

Understanding the terminology used in IRS Form 990-EZ is crucial for correctly completing it. Here are some key terms:

- Gross Receipts: Total amount the organization receives from all sources before deductions.

- Public Charity Status: Classification affecting the organization’s tax obligations and Form 990 submission.

- Net Assets: Remaining assets after liabilities are deducted, indicating financial health.

- Disclosures: Mandatory reporting sections to provide transparency about organizational activities.

These terms help clarify official guidelines and enable precise reporting.

Filing Deadlines and Important Dates for IRS Form 990-EZ

Adhering to deadlines for Form 990-EZ submission is essential to avoid penalties. Critical dates include:

-

Annual Filing Due Date:

- Generally, the 15th day of the 5th month following the end of the organization’s fiscal year.

- For instance, if the fiscal year ends on December 31, the filing deadline is May 15.

-

Extension Requests:

- Form 8868 can be filed to request an automatic three-month extension.

- Further three-month extensions require explicit approval, with a valid reason.

-

Important Considerations:

- Late filing may result in daily penalties, emphasizing timely submission.

- Monitor IRS announcements for any changes to typical deadlines.

Digital vs. Paper Version of IRS Form 990-EZ

Organizations have options for submitting IRS Form 990-EZ, each with its advantages. Here’s an analysis:

-

Digital Filing:

- Convenient and efficient, reducing receipt times and ensuring immediate acknowledgement.

- Software support ensures forms are filled out correctly, reducing errors.

-

Paper Submission:

- Offers a traditional route that some organizations prefer for record-keeping.

- May involve additional processing time, with risks of late delivery.

-

Tips for Choosing:

- Evaluate the organization’s internal capabilities and resources.

- Consider software compatibility and workflow efficiency for digital submissions.

Penalties for Non-Compliance with IRS Form 990-EZ

Failing to comply with filing requirements for Form 990-EZ can lead to severe repercussions:

-

Financial Penalties:

- Daily charges accrue for late submissions, escalating with increased delay.

- Significant oversights can lead to more substantial fines and interest.

-

Reputation Risks:

- Non-compliance may raise questions about organizational integrity and management.

- Consistent failures can affect future donor and public trust.

-

Avoidance Strategies:

- Implement robust internal controls for timely financial reporting.

- Engage knowledgeable accountants or software solutions to ensure accuracy and timeliness.

IRS Guidelines Specific to Form 990-EZ

IRS guidelines provide comprehensive instructions for filling out Form 990-EZ precisely. Key areas include:

-

Eligibility Criteria:

- Organizations must meet revenue and asset thresholds to use the shorter form.

-

Content Requirements:

- Specific financial disclosures and narratives are necessary for each section.

- Guidelines for certain attachments to ensure transparency and compliance.

-

Completeness Checks:

- Review all filing components, such as required schedules and supplemental information.

- Use IRS resources or consult professionals for detailed compliance understanding.

Examples of Organizations Using IRS Form 990-EZ

Types of organizations typically using Form 990-EZ include:

-

Small Nonprofits:

- Arts and cultural organizations with limited assets and revenues.

- Environmental advocacy groups prioritizing direct programming over fundraising.

-

Local Charities:

- Community support initiatives with low financial thresholds.

- Special interest societies offering educational or social support services.

-

Use Case Variations:

- Dynamic organizations transitioning from grassroots to scalable operations.

- Established entities simplifying their reporting due to reduced growth phases.

By analyzing these examples, organizations can better understand their eligibility and reporting obligations for using Form 990-EZ.