Definition and Purpose of W-9 Form RIS

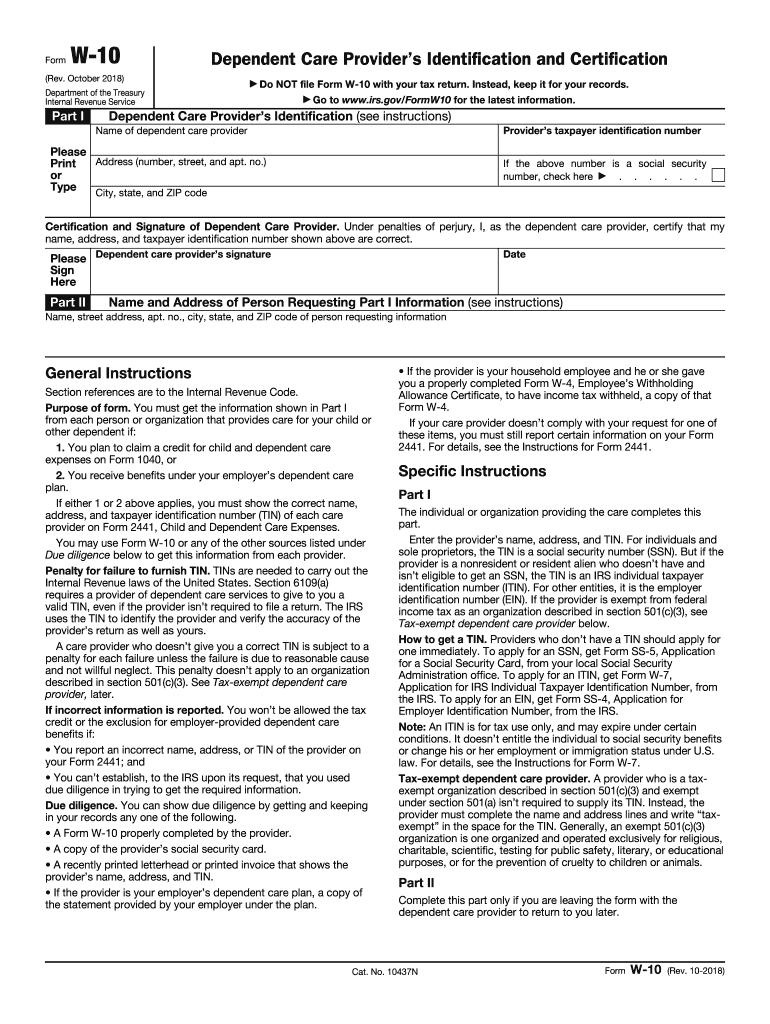

The W-9 form is an important tax document in the United States, primarily used to provide a taxpayer's identification number to entities that will report income paid to them. The acronym 'RIS' in "W-9 Form RIS" typically refers to the form's system within an organization's records management or information system process. Generally, the W-9 form is necessary for independent contractors, freelancers, and other non-employees who receive payment for services. It’s essential for ensuring that income is correctly reported to the IRS and for the accurate processing of tax filings.

Collecting Identifying Information

- Taxpayer Identification Number (TIN): The form requires the individual’s or entity’s TIN, which can be either a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

- Name and Address: Full name and address are required to ensure the form matches IRS records.

- Certification: Signatures are necessary to certify that the information is correct and that the individual is not subject to backup withholding.

How to Obtain a W-9 Form RIS

Organizations or individuals can obtain the W-9 form from the IRS website. The form can also be requested directly from the party requiring it, typically through email or another electronic means. Upon acquiring the form, the recipient must ensure all required sections are completed before submitting it back to the requester.

Steps to Complete the W-9 Form RIS

Completing a W-9 form involves several key steps:

- Personal or Business Name: Enter your legal name if filing as an individual or the business name if filing for a company.

- Business Classification: Indicate your federal tax classification, such as individual/sole proprietor, partnership, or corporation.

- Address Information: Provide your full street address, city, state, and zip code.

- Tax Identification Number: Enter your SSN or EIN.

- Certification: Sign and date the form to certify the validity of the information provided.

Importance of the W-9 Form RIS

Using the W-9 form ensures compliance with federal tax regulations. It facilitates the collection of necessary taxpayer information to report income accurately to the IRS. Without the W-9, there could be issues with incorrect data reporting, leading to potential penalties.

Key Elements of the W-9 Form RIS

The key components of the W-9 form include:

- Request for Taxpayer Identification Number: Ensures proper identification and reporting.

- Exemption Claims: Allows individuals to specify claims on their exemption from backup withholding.

- Certification Signature: Confirms the accuracy of information and legal compliance.

Legal Use

- Backup Withholding: Ensures that payers have the right information to decide if backup withholding applies.

- Tax Filings: The form is critical for tax preparation and filing for both the contractor and the payee.

Who Typically Uses the W-9 Form RIS

The W-9 form is typically used by:

- Freelancers and Independent Contractors: To report self-employment income.

- Businesses Hiring Contractors: To collect necessary taxpayer information for tax reporting.

- Financial Institutions: For certain banking and investment-related tax reporting.

IRS Guidelines and Compliance

The IRS mandates that the W-9 form be completed accurately to avoid penalties. It serves as a key document in the taxpayer's compliance toolkit, ensuring that all payments made and reported align with IRS guidelines.

- Accuracy: Ensure all data is accurate to avoid discrepancies.

- Backup Withholding Compliance: Address whether backup withholding applies.

Examples of Using the W-9 Form RIS

In practice, a freelance graphic designer providing services to a marketing company would complete a W-9 form RIS. The company would then use the information to report payments made to the designer to the IRS. Another example could include a legal consultant filling out a W-9 for each new client as part of standard onboarding documentation.

Practical Scenarios

- Example One: A self-employed web developer submits a W-9 form before receiving payment for services rendered.

- Example Two: A small business requests the W-9 from each of its contractors to stay compliant with IRS requirements.

By addressing these components, the W-9 Form RIS becomes an essential tool for taxpayers and businesses to navigate the complexities of tax collection and reporting. The form's proper use ensures smooth transactions and accurate tax filings, ultimately aligning with IRS regulations and safeguarding against legal issues.