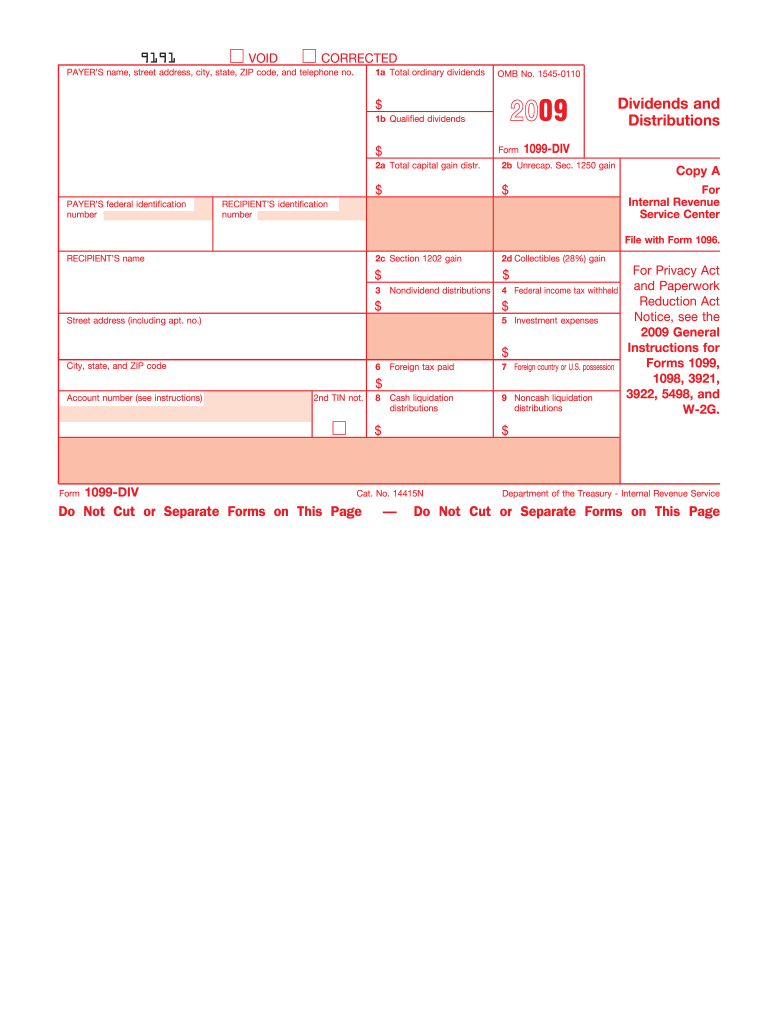

Definition & Purpose of the 2009 Form 1099-DIV

The 2009 Form 1099-DIV is a tax document used in the United States to report dividends and distributions to the Internal Revenue Service (IRS). Dividends are payments made to shareholders out of a corporation's profits. This form ensures that these earnings are reported for tax purposes, allowing the IRS to track investment income. It plays a crucial role for individuals and businesses receiving dividends, as they must include this income when filing their taxes.

How to Use the 2009 Form 1099-DIV

To use the 2009 Form 1099-DIV, follow these steps:

- Receive the Form: Typically, this form is issued by the brokerage firm or financial institution where the investments are held. Ensure you receive it early in the tax season.

- Review Your Information: Check your personal information, including your name, address, and taxpayer identification number, to ensure accuracy.

- Understand the Dividend Types: Identify ordinary dividends, qualified dividends, and total capital gain distributions from the form. Each has different tax implications.

- Report on Tax Returns: Enter the dividend information on your federal income tax return, specifically in the sections designated for investment income.

- Verify With Financial Records: Cross-check the reported amounts with your financial records to ensure consistency and accuracy.

Steps to Complete the 2009 Form 1099-DIV

When filling out the 2009 Form 1099-DIV, accuracy is crucial. Follow these detailed steps:

- Verify Payer and Payee Details: Ensure the payer’s name, address, and Taxpayer Identification Number (TIN) are correct, along with your details as the recipient.

- Fill Out Dividend Information:

- Enter ordinary dividends in Box 1a.

- Report qualified dividends under 1b.

- Include capital gains distributions in Box 2a.

- Additional Income Types:

- If applicable, fill out Boxes 2b through 2d for section 1250 gain, collectibles gain, and unrecaptured section 1250 gain.

- Federal Income Tax Withheld: Note any taxes withheld in Box 4.

- State Tax Information: Complete Boxes 10 and 11 for state tax identification and withheld amounts, if any.

Key Elements of the 2009 Form 1099-DIV

Key elements on the 2009 Form 1099-DIV include:

- Box 1a - Total Ordinary Dividends: Total amount of ordinary dividends, which are taxed at the individual’s ordinary income tax rate.

- Box 1b - Qualified Dividends: These dividends qualify for reduced tax rates.

- Box 2a - Total Capital Gain Distributions: Any distributions that are considered capital gains.

- Box 4 - Federal Income Tax Withheld: Prepaid tax, often for backup withholding.

- Box 10 and Box 11: Information regarding state-specific tax amounts.

Filing Deadlines and Important Dates

For the 2009 Form 1099-DIV, timely filing is essential. Deadlines include:

- March 15, 2010: The deadline for providing the form to the IRS and to the recipients.

- February 1, 2010: The general deadline for issuing the form to recipients if using paper formats.

- Mid-March 2010: Electronic filers may have a slightly extended deadline in alignment with IRS standards.

Adhering to these deadlines ensures compliance and avoids potential penalties.

Penalties for Non-Compliance

Non-compliance with filing requirements for the 2009 Form 1099-DIV may result in:

- Monetary Fines: Failure to file could lead to fines ranging from $50 to $270 per form, depending on the lateness and intent.

- Increased Scrutiny: Consistent non-compliance may trigger audits or further investigation by the IRS.

- Interest on Back Taxes: Late payment of required taxes due to unreported dividends can accrue interest.

To avoid these penalties, ensure forms are completed accurately and submitted on time.

Who Typically Uses the 2009 Form 1099-DIV

The 2009 Form 1099-DIV is typically used by:

- Individual Investors: Those holding stocks, mutual funds, or any security paying dividends.

- Financial Institutions: Custodian banks, brokerage firms issuing dividends to clients.

- Corporations: Entities distributing dividends to shareholders.

- Trusts and Estates: If distributing earnings generated from investments to beneficiaries.

Software Compatibility and Electronic Filing

Many taxpayers utilize software for managing and filing the 2009 Form 1099-DIV, known for:

- Compatibility with Major Software: Integration with platforms like TurboTax and QuickBooks can streamline data entry and filing.

- Electronic Filing Options: Facilitates timely submission and reduces errors compared to manual methods.

- Automated Alerts: Software often provides alerts for missing information or errors, improving accuracy.

Ensure to update software with the latest tax regulations to maintain compliance and accuracy.