Definition and Meaning

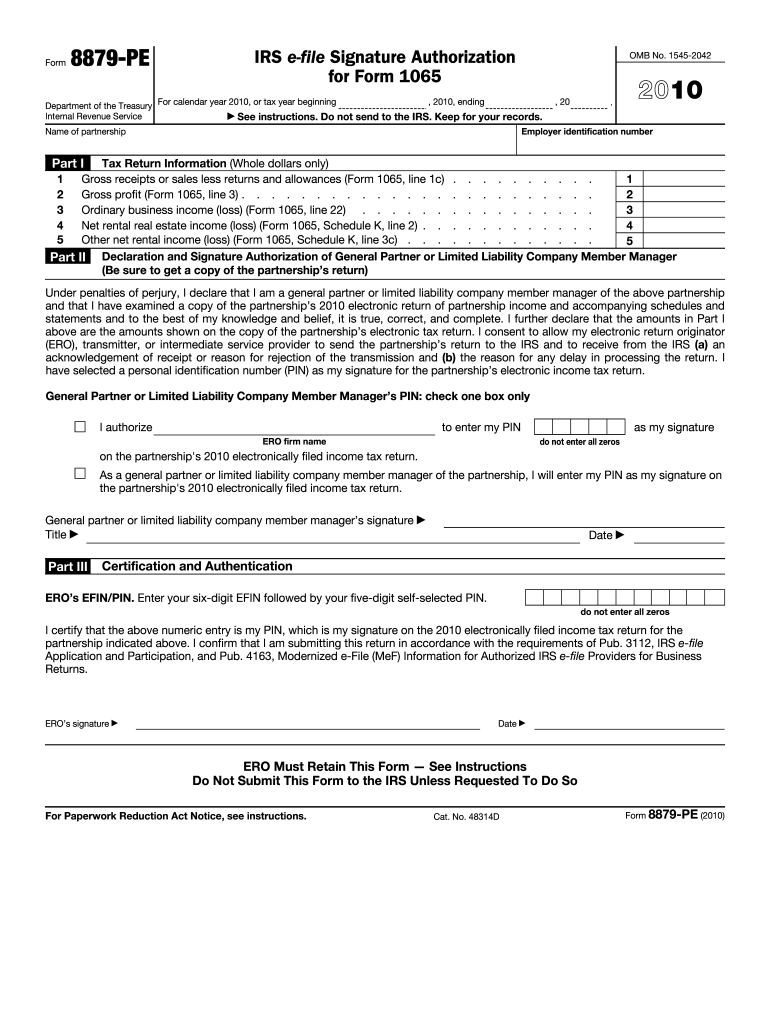

Form 8879-PE, also known as the IRS 8879-PE, is a specific document designed to facilitate the electronic signing of a partnership's income tax return by general partners or limited liability company (LLC) member managers. This form is integral in the digital submission process, utilizing a personal identification number (PIN) for signature authorization. The form comprises essential sections that outline responsibilities and ensure compliance with IRS electronic filing standards. Critically, it's intended for retention in records rather than submission to the IRS, underlining its role in verification and authorization processes in e-filing situations.

Main Sections of Form 8879-PE

- Tax Return Information: Details regarding the partnership's income tax and associated financial summaries.

- Declaration and Signature Authorization: Affirmation of the tax information's accuracy, alongside partnership representatives' electronic signatures.

Steps to Complete the 8879-PE Instructions 2010 Form

Completing the 8879-PE form necessitates a comprehensive understanding of its sections and procedural steps, ensuring accuracy and compliance.

-

Gather Necessary Information: Before completing the form, collect the partnership's financial data and previous tax details for accuracy.

-

Enter Tax Return Information: Fill out the relevant sections with data from the partnership's tax return, including financial summaries.

-

Declaration Section: The designated signatory, either a general partner or LLC member manager, must confirm the accuracy of the information provided.

-

Signature Authorization: Use a valid PIN to electronically sign the form, ensuring that all electronic filing credentials are accurate.

-

Retain for Records: Once completed, the form should be filed with other necessary documents for future reference but not sent to the IRS.

Common Errors to Avoid

- Using an incorrect personal identification number.

- Failing to confirm all entered data matches the actual tax return information.

Who Typically Uses the 8879-PE Instructions 2010 Form

The form is specifically tailored for use by general partners and managing members of LLCs operating as partnerships. These individuals are responsible for overseeing the accuracy of partnership tax returns and ensuring compliance with electronic filing requirements.

Common Users

- General Partners: Individuals with direct management responsibilities over a partnership.

- LLC Member Managers: Authorized figures in LLCs organized as partnerships.

Legal Use of the 8879-PE Instructions 2010 Form

Form 8879-PE is a critical component in the IRS's governance of electronically filed partnership returns. Proper completion and adherence to its instructions assure compliance with IRS guidelines concerning tax return accuracy and authentication.

Key Legal Implications

- Verification of Data: Ensures all reported figures on returns are validated by authorized personnel.

- Electronic Filing Compliance: Demonstrates adherence to IRS electronic submission protocols, reducing audit risks and processing delays.

Key Elements of the 8879-PE Instructions 2010 Form

The form contains several crucial elements integral to its function in partnership tax filing processes.

Essential Components

- Tax Data Section: Collects details about the partnership’s taxable financials.

- Signature Block: Allocates space for digital verification via personal identification PIN, securing legal acknowledgment of the e-file submission.

Important Terms Related to the 8879-PE Instructions 2010 Form

Understanding key terminologies associated with the 8879-PE form enhances users' ability to complete and utilize it effectively.

Definitions

- Electronic Return Originator (ERO): A person authorized and responsible for submitting electronic tax returns to the IRS.

- Personal Identification Number (PIN): A unique number used by individuals to verify their identity when signing electronically.

IRS Guidelines for the 8879-PE Instructions 2010 Form

The IRS provides explicit guidance regarding the electronic submission process utilizing Form 8879-PE.

Compliance Requirements

- Exact Data Submission: Partner information must coincide precisely with tax return details.

- Authorized Credentials: Usage of valid ERO services assures adherence to IRS electronic filing standards.

Examples of Using the 8879-PE Instructions 2010 Form

Practical scenarios can illustrate how partnerships utilize this form in real-world applications, ensuring clarity and ease in electronic filing.

Case Studies

- Multi-Partner LLCs: Large LLCs often employ the 8879-PE to streamline the multiple layers of tax return authorizations required before IRS submissions.

- Small Partnerships: Smaller entities leverage the form to simplify the accurate electronic completion of IRS filing obligations without extensive paperwork.

These sections highlight the significance of the 8879-PE Instructions 2010 form in the streamlined electronic filing processes for partnerships, focusing on detailed explanations and practical approaches to its completion and application.