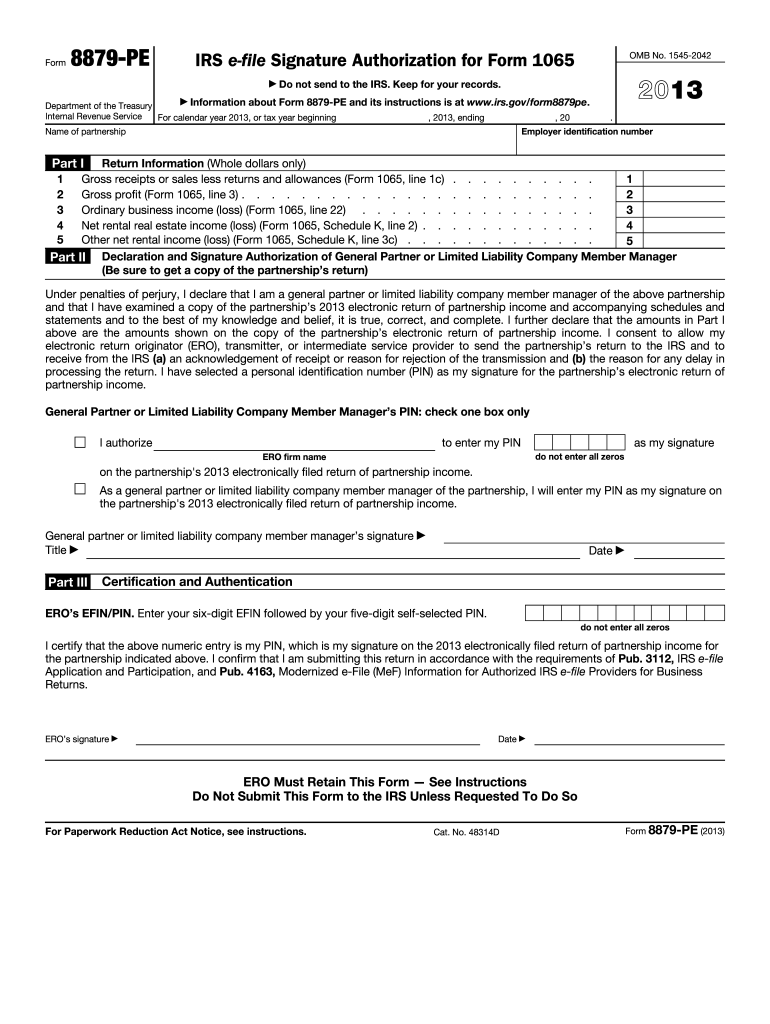

Definition and Purpose of the 2018 Form 8453-PE

2018 Form 8453-PE is known as the IRS Partnership Declaration and Signature for Electronic Filing. This form serves as a declaration for a partnership's electronic tax return. It is primarily used to confirm that the information provided in the electronically submitted tax return is true and correct.

- Partnership Declaration: This form acts as the official declaration for income tax returns filed electronically by partnerships.

- Signature Confirmation: It serves to confirm that the partners or members have authorized the electronic filing.

- Verification of Accuracy: Ensures the accuracy of information before submission to the IRS.

How to Use the 2018 Form 8453-PE

Utilizing the 2018 Form 8453-PE requires careful attention to detail to ensure accurate submission.

- Download the Form: Obtain the form from the IRS website, ensuring it is the correct version for the tax year.

- Fill in the Required Sections: Complete all sections accurately, including partnership name, address, and other identifying information.

- Review for Errors: Double-check for errors or omissions that could delay processing.

- Sign and Date the Form: Ensure proper signatures before submission, confirming the information's accuracy.

- Submit Electronically: Send the completed form to the IRS using the authorized electronic filing system.

Steps to Complete the 2018 Form 8453-PE

Completing the form involves a series of steps designed to ensure accuracy and compliance.

- Gather Information: Assemble all necessary documentation and records related to the partnership's financial activities.

- Enter Partnership Details: Fill in the partnership's name, EIN, and other required details.

- Provide Declaration: Insert the declaration of partner authority and accuracy of the information.

- Signatures: Ensure all necessary signatures from partners or members are included.

- Submit to ERO: Deliver the completed form to the electronic return originator (ERO) to finalize the electronic filing process.

Key Elements of the 2018 Form 8453-PE

Understanding the key components of the form is essential for proper completion.

Partnership Identification

- Name and EIN: Include the full legal name of the partnership and its assigned Employer Identification Number.

Declaration of Electronic Filing

- Authorization Statement: Confirms partner or member consent for electronic submission.

- accuracy Check: Verifies that the information has been reviewed and is accurate.

Signature and Date

- Partner Signatures: All relevant parties must sign and date the form to confirm the declaration.

IRS Guidelines on 2018 Form 8453-PE

Adhering to IRS rules and guidelines is critical for successful form completion.

- Compliance: Ensures that the form complies with all IRS specifications for electronic partnership returns.

- Retention Requirements: The form should be retained by the ERO and only submitted to the IRS upon request.

Filing Deadlines and Important Dates

Timeliness is crucial when dealing with tax forms.

- Deadline for Submission: Generally aligns with the partnership's tax return due date, including extensions.

- Extension Consideration: Ensure all filing extensions are properly filed if additional time is needed.

Required Documents for 2018 Form 8453-PE

Specific documentation is necessary for proper form completion.

- Partnership Details: Comprehensive financial records relating to the partnership.

- Tax Return Information: Complete information regarding the partnership’s tax return must be available.

Penalties for Non-Compliance

Understanding the consequences of non-compliance is vital to avoid negative outcomes.

- Fines and Penalties: Inaccurate or late submissions can result in financial penalties.

- Legal Consequences: Failing to comply can lead to scrutiny by the IRS and potential legal challenges.