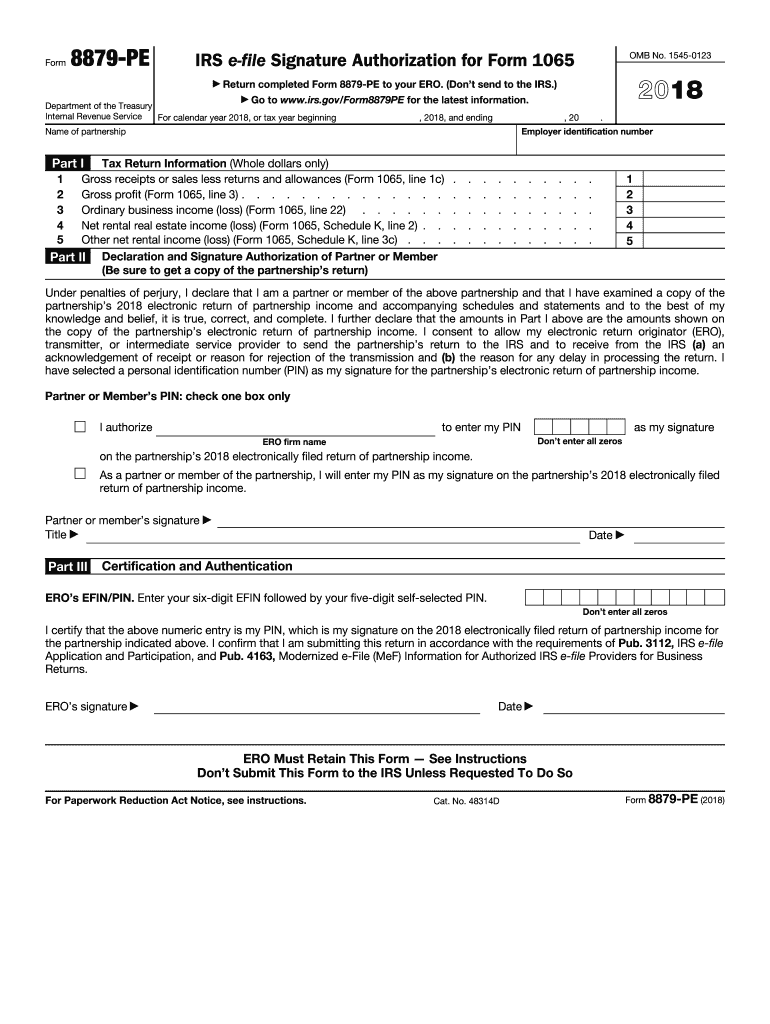

Definition and Meaning of Form 8879-PE

Form 8879-PE, known as the IRS e-file Signature Authorization for Form 1065, allows partners or members of a partnership to electronically sign their partnership's income tax return using a personal identification number (PIN). This form serves as a critical component in the e-filing process, as it authorizes the electronic submission of the partnership return. While partners sign this form to ensure the authenticity of the e-filed return, it emphasizes the importance of maintaining secured and verified data exchanges.

How to Use Form 8879-PE

To facilitate the e-filing of your partnership’s tax return, Form 8879-PE must be completed and submitted to the electronic return originator (ERO), not the IRS. It is essential for partners to carefully review the return before signing this authorization form. A thorough check guarantees accuracy, which is pivotal in avoiding potential discrepancies during the IRS review. This step in the process also involves using the PIN to affirm the legitimacy of the electronic submission.

Steps to Complete Form 8879-PE

- Obtain Form 8879-PE: Ensure you have the latest version of the form, which can be sourced from the IRS website or through your ERO.

- Verify Data Accuracy: Before completing the form, verify all information contained in the partnership’s tax return to ensure accuracy.

- Assign a PIN: Each partner responsible for signing must choose a unique five-digit PIN, which acts as their electronic signature.

- Review and Sign: Carefully read through the form, confirm the information, and sign using your designated PIN.

- Submit to ERO: Deliver the completed form to your ERO, who will use it to e-file the partnership’s tax return.

Who Typically Uses Form 8879-PE

Form 8879-PE is typically filled out by partners within a partnership who are responsible for approving the e-filing of the partnership’s tax return. This form is crucial for partnerships that opt to file their Form 1065 electronically, rather than through traditional mailing methods. Typically, business partnerships and limited liability companies (LLCs) taxed as partnerships utilize this form to facilitate a seamless filing process.

Key Elements of Form 8879-PE

- Partnership Identification: The form requires the full legal name of the partnership and its taxpayer identification number (TIN).

- Signature Authorization: Partners are required to provide their PIN, which serves as a digital signature for the submitted return.

- ERO Details: The form includes sections for the ERO’s information, including their legal name and corresponding identification numbers.

- Declaration Confirmation: Partners confirm that they have reviewed the tax return and authorize the e-file submission.

Important Terms Related to Form 8879-PE

- Electronic Return Originator (ERO): A person or entity authorized by the IRS to prepare and transmit tax returns electronically. The ERO plays a pivotal role in the submission process.

- Personal Identification Number (PIN): A secure five-digit code used by partners to electronically sign the form, ensuring the validity of the e-filing.

- Form 1065: A tax document used by partnerships to report income, deductions, gains, and other financial data to the IRS.

IRS Guidelines for Form 8879-PE

The IRS mandates the use of Form 8879-PE for partnerships opting to electronically file their tax returns. The guidelines emphasize accurate and complete data entry to minimize errors during the e-filing process. Additionally, it's essential to keep a signed copy of the form and the partnership return in the case of an audit. Keeping up with changes to IRS regulations ensures compliance and helps to avoid potential penalties.

Penalties for Non-Compliance with Form 8879-PE Criteria

Failure to adhere to the requirements set forth by the IRS for Form 8879-PE could result in significant penalties. Inaccurate or missing information, unauthorized signatures, and delays in submission are common pitfalls that may lead to such penalties. Ensuring timely compliance by reviewing IRS guidelines and consulting with tax professionals can help partnerships mitigate these risks.

Software Compatibility with Form 8879-PE

Form 8879-PE can be processed using various tax preparation software platforms, such as TurboTax and QuickBooks, which support the e-filing of partnership returns. Ensuring that your chosen software is updated to align with the most recent IRS guidelines and form changes is crucial for a smooth electronic submission. Collaboration with your ERO can also provide insights into the most efficient software solutions for your specific partnership needs.