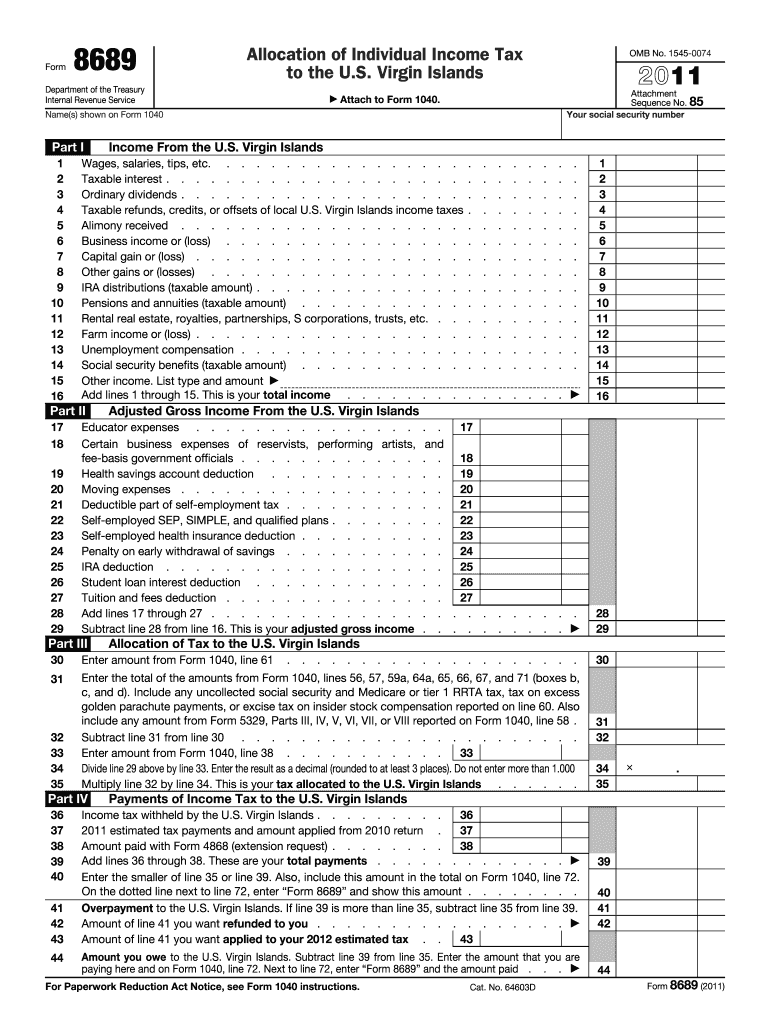

Definition & Meaning

Form 8689 is a tax document used by U.S. citizens and resident aliens to allocate U.S. income tax to the U.S. Virgin Islands (USVI). This form is specifically vital for individuals who earn income from sources within the USVI but are not considered bona fide residents of the territory. It serves as a method to accurately report and calculate the share of taxes due to the USVI, ensuring compliance with both U.S. and USVI tax obligations.

Practical Examples

- A U.S. citizen working remotely for a USVI-based company would use this form to calculate the tax owed to the territory.

- Individuals owning rental property in the USVI would also need Form 8689 to report their income correctly.

Steps to Complete the 2011 Form 8689

Completing Form 8689 involves several critical steps to ensure accurate submission:

-

Income Declaration: Begin by listing income from all USVI sources. Document amounts earned through employment, investments, or business activities within the territory.

-

Adjusted Gross Income (AGI) Calculation: Calculate AGI by including all eligible deductions related to USVI-sourced income. This step is crucial for setting the correct taxable base for USVI tax obligations.

-

Tax Allocation: Allocate tax due precisely between the U.S. and USVI based on the pro-rata share of USVI-sourced income.

-

Payment Record: Document any tax payments made to the USVI to prevent double taxation.

-

Final Review and Attachments: Cross-check entries for accuracy and attach any required supplementary documentation before submission.

Note of Importance

- Ensure all information matches corresponding U.S. tax forms to maintain coherence and avoid discrepancies.

Who Typically Uses the 2011 Form 8689

Primary Users

- Non-Resident Individuals: U.S. citizens or resident aliens earning income in the USVI, but living elsewhere, are the primary users of this form.

- Self-Employed Individuals: Freelancers or contractors working with USVI companies.

Additional User Scenarios

- Investors and business owners with income-generating assets in the USVI.

- Employees temporarily stationed in the USVI.

Required Documents

To successfully complete Form 8689, gather the following documents:

- W-2 Forms: From USVI-based employment.

- 1099 Forms: Reflecting other income sources like dividends and interest.

- Proof of Payment: Any documentation of taxes already paid to the USVI.

- Receipts: For expenses related to USVI income that can be deducted.

Documentation Tips

- Consistently update and store copies of all relevant financial documents throughout the year to ensure readiness when filing.

IRS Guidelines

The IRS provides specific guidelines regarding the use and filing of Form 8689 to maintain compliance:

- Filing Requirements: Ensure parallel filing of identical tax returns with both U.S. and USVI authorities.

- Form Accuracy: Any inaccuracies can result in penalties, making adherence to IRS instructions vital.

- Deadlines: Similar to federal tax deadlines but verify for any unique USVI regulations.

Compliance Strategies

- Utilize IRS resources or consult with a tax professional to ensure a comprehensive understanding of obligations related to USVI income tax.

Filing Deadlines / Important Dates

Key Dates

- Standard Deadline: Coincides with the federal tax filing deadline, typically April 15.

- Extensions: Potential extensions may be requested; however, ensuring timely submission reduces stress and avoids penalties.

Consequences of Late Filing

- Late fees and accrued interest on owed taxes can significantly affect your financial standing, making punctual filing essential.

Penalties for Non-Compliance

Non-compliance with Form 8689 filing requirements can lead to several penalties:

- Monetary Fines: Failure to file can result in substantial financial penalties.

- Interest Accumulation: On unpaid tax amounts, compounded daily until full settlement.

- Legal Complications: Repeated neglect of tax obligations can escalate to serious legal repercussions.

Prevention Measures

- Maintain rigorous records, meet deadlines, and consider professional tax assistance to prevent any lapses in compliance.

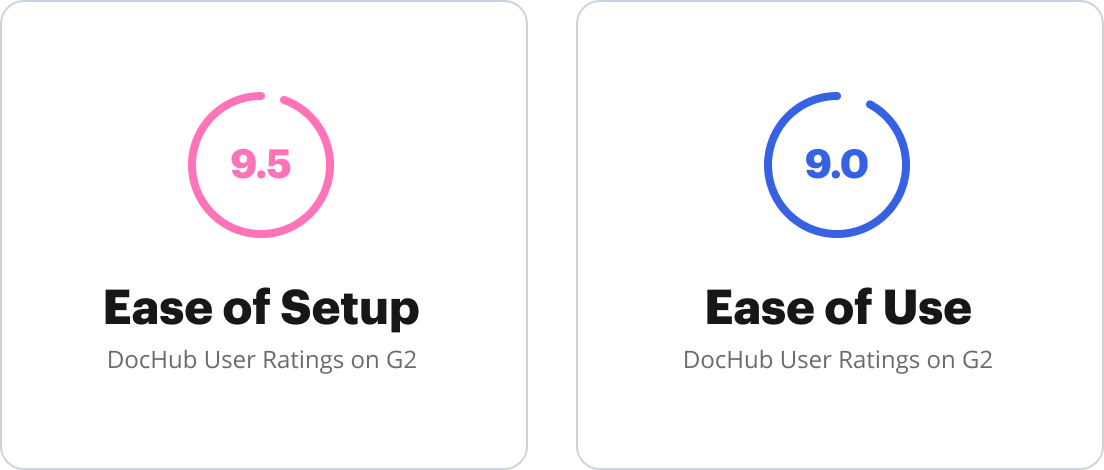

Software Compatibility with Form 8689

Supported Platforms

- TurboTax and H&R Block: These are among the tax preparation software compatible with Form 8689, streamlining e-filing processes.

- QuickBooks: Often utilized by businesses to manage records seamlessly in conjunction with Form 8689 requirements.

Benefits of Using Compatible Software

- Streamlines calculations and reduces human errors.

- Provides timely reminders of upcoming deadlines and necessary updates.

Expert Suggestion

- Opt for software that includes user support services for additional guidance specific to Form 8689 and USVI tax intricacies.