Understanding the Preparing an Individual Income Tax Return with U.S. Virgin Islands

The Preparing an Individual Income Tax Return with U.S. Virgin Islands process is crucial for U.S. citizens or resident aliens generating income from U.S. Virgin Islands sources. This form helps taxpayers allocate the appropriate tax amount to be reported, ensuring compliance with both federal and territorial tax laws.

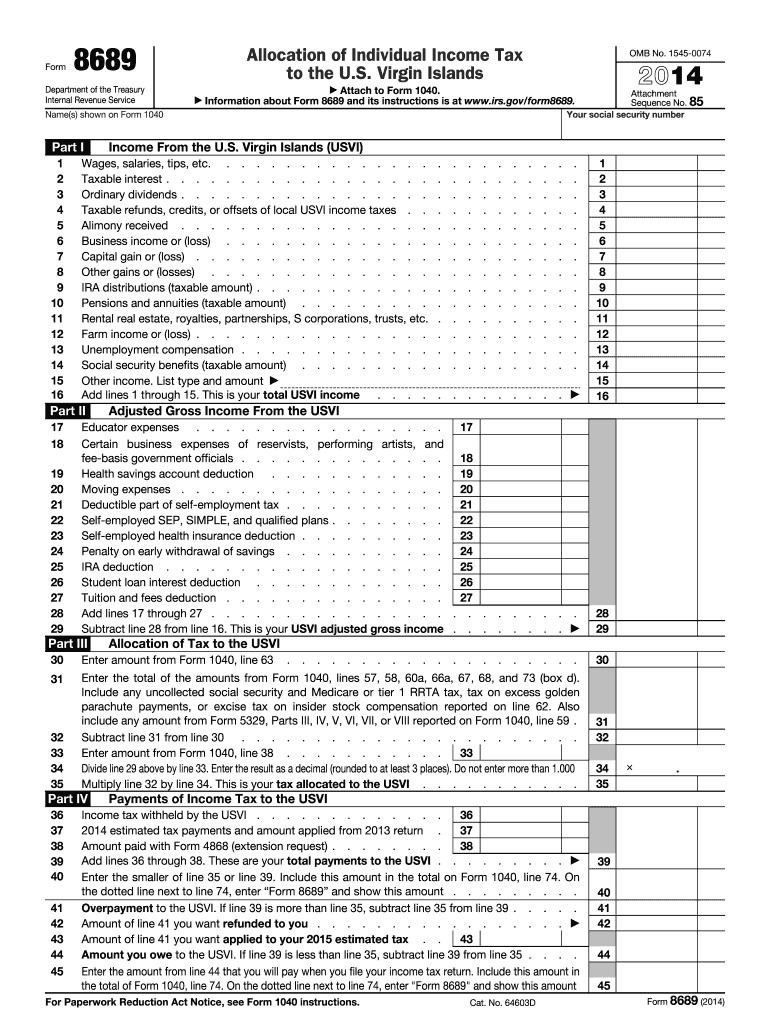

Overview of Form 8689

Form 8689 is specifically designed for taxpayers with income sourced from the U.S. Virgin Islands. It assists in calculating and reporting the proper distribution of taxes owed to both the Internal Revenue Service (IRS) and the U.S. Virgin Islands Bureau of Internal Revenue. The form details how to determine the adjusted gross income, allocate tax payments, and satisfy filing requirements. This is especially relevant for individuals earning income through various avenues in the territory, such as employment, business ventures, or other financial engagements.

Key Elements of the Form

Understanding the fundamental components of Form 8689 is essential for accurate completion. It includes several sections:

- Income Reporting: Taxpayers must include all income earned from U.S. Virgin Islands sources. This may encompass wages, interest, dividends, and capital gains.

- Calculation of Gross Income: The form guides users through calculating their adjusted gross income by allowing for deductions appropriate under U.S. Virgin Islands law.

- Allocation of Tax Payments: Taxpayers can use the form to appropriately allocate their tax liabilities between the IRS and the U.S. Virgin Islands, thus preventing double taxation.

Steps to Complete the Form

Completing Form 8689 involves several specific steps to ensure all relevant income and deductions are accurately reported and appropriately taxed:

- Gather Required Documentation: Collect all necessary income statements, including W-2s and 1099s, as well as any documents supporting deductions.

- Fill Out Personal Information: Start with your personal details, including your name, address, and Social Security Number.

- Detail Sources of Income: Clearly report all sources of income derived from U.S. Virgin Islands, ensuring consistency with other tax filings.

- Calculate Adjusted Gross Income: Use the instructions provided on the form to calculate your AGI, factoring in allowable deductions.

- Allocate Tax Payments: Determine how much tax is owed to the IRS versus the U.S. Virgin Islands based on the specific allocation guidelines highlighted in the form.

- Review for Accuracy: Before submission, double-check all figures and consult the IRS guidelines or a tax professional if uncertain.

Filing Deadlines and Important Dates

It is vital for taxpayers preparing to submit Form 8689 to be aware of specific deadlines. Typically, the due date aligns with the federal tax return deadline, which generally falls on April 15. However, those who reside in the U.S. Virgin Islands may have distinct considerations:

- Extensions: Taxpayers can apply for an extension, but it's crucial to pay any estimated taxes owed to avoid penalties.

- Penalties for Late Submission: Failure to file the form on time or accurately can result in penalties or interest on unpaid taxes.

Legal Considerations and Compliance

The legal implications of filing Form 8689 cannot be understated. Compliance ensures that taxpayers avoid potential legal repercussions, such as audits or fines. Understanding the IRS guidelines and the regulations governing the U.S. Virgin Islands' taxation is essential, as misreporting income or failing to allocate tax payments appropriately may lead to substantial penalties.

- Electronics versus Paper Submission: Taxpayers have the option to file electronically or send a paper form. Electronic filing is typically faster and may reduce errors, while paper submissions may take longer to process.

- IRS Audit Procedures: Know that the IRS reserves the right to audit returns and has specific procedures in place for reviewing forms submitted under special circumstances such as income from the U.S. Virgin Islands.

Common Taxpayer Scenarios

Different taxpayer profiles may encounter unique challenges while completing Form 8689, including:

- Self-Employed Individuals: Those running their own businesses must carefully report income and expenses to ensure accurate tax allocation.

- Retired Taxpayers: Retirees need to identify their sources of income properly, such as pensions or retirement distributions, to comply with tax obligations.

Navigating the Preparing an Individual Income Tax Return with U.S. Virgin Islands involves comprehensive understanding and attention to detail, allowing taxpayers to meet both federal and territorial tax requirements effectively.