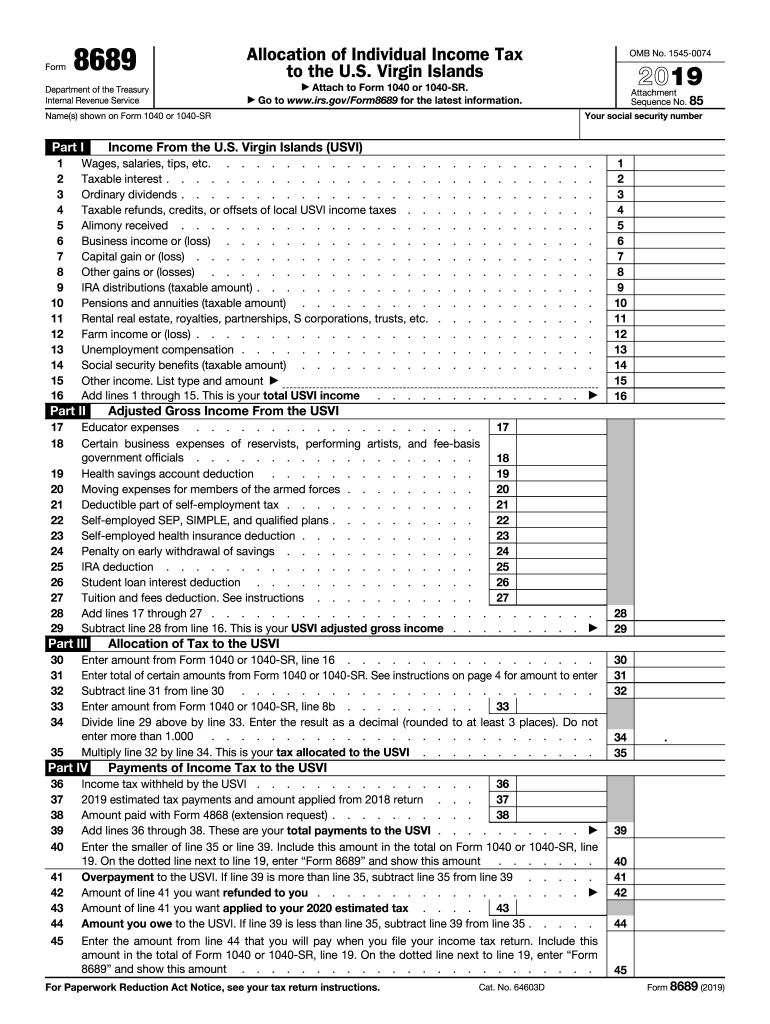

Definition and Purpose of Form 8689

Form 8689, also known as a document used to determine the allocation of a U.S. citizen’s or resident alien’s income tax liability to the U.S. Virgin Islands (USVI), is specifically designed for those who have income sourced from the USVI. This form plays a crucial role in ensuring that individuals correctly compute the portion of their U.S. income tax obligation that pertains to the USVI. By using Form 8689, taxpayers disclose their adjusted gross income, deductions, and payments specific to USVI sources. Such detailed breakdown is necessary for accurate compliance with the tax laws applicable in both jurisdictions.

How to Use Form 8689

Utilizing Form 8689 involves several steps that taxpayers need to be aware of in order to fulfill their obligations correctly. Here’s a guide on how to employ this form effectively:

- Gather Necessary Information: Collect details about all potential USVI-sourced income, including wages, dividends, and interest.

- Understand Allocation Rules: Familiarize yourself with IRS rules related to income that is considered sourced from the USVI. It is vital to accurately separate USVI income from other U.S.-based income.

- Complete the Form Carefully: Carefully fill in each section, ensuring that information about income, deductions, and previous payments relating to the USVI are correctly entered.

- Submit with Tax Return: Submit the completed Form 8689 with your annual tax return. This process should coincide with other tax preparation activities to maintain compliance.

It’s important to accurately follow each step to avoid any potential misreporting or compliance issues that could arise from errors in form submission.

How to Obtain Form 8689

Accessing Form 8689 is straightforward through multiple methods. The Internal Revenue Service (IRS) provides easy access to this form:

- Download from the IRS Website: The most direct and quickest method is to download Form 8689 in PDF format from the official IRS website. Make sure to download the latest version to ensure compliance with current regulations.

- Request via Mail: You can request a physical copy by contacting the IRS directly. This method may take more time, so plan accordingly if you prefer a physical form.

- Tax Preparation Software: Many tax software programs, like TurboTax or QuickBooks, include the functionality to fill out Form 8689. Utilizing such software can simplify the tax process, allowing for more accurate form completion.

These options provide various ways to easily obtain Form 8689, ensuring taxpayers have the resources needed to comply with tax obligations.

Steps to Complete Form 8689

Successfully completing Form 8689 involves detailing various aspects of your financial information. Here’s a step-by-step guide:

- Personal Information: Begin with filling in your personal details, including name and taxpayer identification number.

- Report Income from USVI Sources: Accurately list all taxable income sourced from the USVI, ensuring each category of income is identified correctly.

- Deductions and Credits: Include any applicable deductions or credits specifically related to the USVI. This may include business expenses or educational credits relevant to USVI activities.

- Calculate the Allocation: Using the guidelines available in the form’s instructions, correctly allocate the income tax to the USVI, ensuring accurate calculations.

- Attach to Federal Return: Once completed, ensure that this form is attached to your federal tax return when filing.

Following these steps closely will help ensure the form is filled out accurately and completely.

Key Elements of Form 8689

Understanding the critical components of Form 8689 is essential for accurate completion:

- Identification Information: Essential personal data that links the taxpayer to the form.

- USVI Income Details: Sections dedicated to reporting income specifically sourced from the USVI, an essential factor in tax allocation.

- Deductions Specific to USVI: These deductions reduce overall tax liability and must specifically relate to USVI-sourced income.

- Tax Allocation Calculation: Instructions and sections dedicated to calculating the accurate share of income tax attributable to USVI sources.

Each key element is designed to help accurately report and allocate income taxes, ensuring compliance with U.S. and USVI regulations.

Important Terms Related to Form 8689

When working with Form 8689, understanding specific terms ensures accurate and compliant filing:

- USVI-Sourced Income: Income originating from the U.S. Virgin Islands, including wages, dividends, and interest.

- Tax Allocation: The process of determining the appropriate share of income tax that applies to the USVI.

- Adjusted Gross Income (AGI): Total income from all sources, adjusted for specific deductions, pivotal for calculating USVI-sourced income.

- Deductions and Credits: Allowable reductions in taxable income specifically applicable to USVI activities.

Recognizing these terms helps in accurately completing the form and achieving tax compliance.

Legal Compliance Using Form 8689

Form 8689 ensures the legal compliance of taxpayers with income from the USVI by accurately reporting part of the individual’s income tax obligation allocated to the USVI. Proper use avoids legal pitfalls associated with misreporting or neglecting necessary disclosures related to USVI income. Failure to comply can lead to penalties and interest on unpaid taxes, making accurate and timely filing critical for legal adherence.

IRS Guidelines on Form 8689

The IRS provides explicit guidelines for completing and filing Form 8689, aimed at standardizing the reporting process for USVI-sourced income. These guidelines cover essential aspects like identifying USVI income, claiming related deductions, and computing the tax payable to the USVI. Adhering to these guidelines is crucial for ensuring your tax filings are error-free and compliant with both U.S. and USVI tax laws.

Filing Deadlines and Important Dates for Form 8689

Knowing the deadlines related to Form 8689 is crucial for maintaining compliance. Typically, Form 8689 should be filed together with your federal income tax return by April 15, the same general deadline for federal filings. If this date falls on a weekend or holiday, the deadline moves to the next business day. Timeliness is essential, as late submissions can result in penalties and interest charges.

By covering these topics extensively, you ensure comprehensive understanding and proper handling of Form 8689, thereby maintaining compliance with relevant tax laws applicable to taxpayers with USVI-sourced income.